Massachusetts to Consider Legislation to Create a Bitcoin Reserve

A Massachusetts State Assembly committee plans to hold hearings on a Bitcoin Strategic Reserve bill first introduced in February.

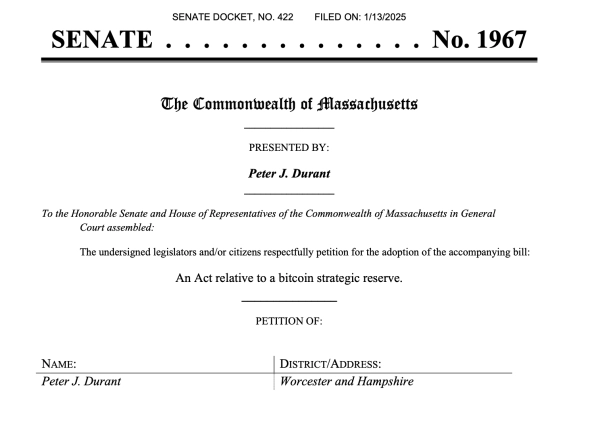

On Friday, the Massachusetts Joint Tax Committee will hold a hearing on the “Bitcoin Strategic Reserve” bill, introduced by Republican State Senator Peter Durant.

The bill, which Durant introduced in the Massachusetts Senate in February, is part of an effort by Republican lawmakers in several US states to support cryptocurrency and create bitcoin reserves.

The text of the proposed Bitcoin Reserve Act. Source: LegiScan

It's unclear what the chances are of any Republican-sponsored bill passing in the Massachusetts Legislature. Democrats currently hold a supermajority in the House and Senate, as well as control of the governor's office. All state representatives in the U.S. House and Senate are also Democrats.

Durant's proposed legislation would allow “any Bitcoin or other digital asset confiscated by the Commonwealth” to be placed in a reserve. The state Treasury would also be able to use up to 10% of the Commonwealth Stabilization Fund to invest in cryptocurrency.

Although four US states, including Massachusetts, are formally referred to as commonwealths in their constitutions, their legal relationship to the United States as a whole is essentially the same as that of all states. The terms are used interchangeably.

As of September, only a few US state governments, including New Hampshire and Texas, had passed laws allowing them to store bitcoin and other cryptocurrencies as part of a strategic reserve plan.

At the federal level, US President Donald Trump signed an executive order in March establishing a federal reserve of Bitcoin and other cryptocurrencies. The reserve will be partially funded by seized assets. Republican lawmakers are attempting to enshrine this order in Congress through the Bitcoin Act.

Proposals to create cryptocurrency reserves in other US states are still under consideration.

Massachusetts has joined several state governments currently considering legislation allowing treasuries to invest in cryptocurrencies and Bitcoin. These states are exploring the possibility of following the federal government's lead.

In 2025, Montana, North Dakota, Pennsylvania, South Dakota, and Wyoming rejected or failed to introduce similar bills. However, bills proposed in Michigan and Ohio could still pass.

Cryptocurrency firms, including Michael Saylor's Strategy, have been investing in Bitcoin and other digital assets for years as a potential inflation hedge. Many other firms reportedly followed suit in 2025 following Trump's executive order.

Source: cryptonews.net