Longs cut creates risks for Bitcoin to fall to $114,000

Bitcoin hit a daily low of $120,702 today, following a more than 4% drop in the past 24 hours.

According to TradingView, the BTC/USD pair is currently consolidating after a sharp 4.2% correction yesterday. This was widely expected, given the pair's consistent record highs but the lack of significant upward momentum.

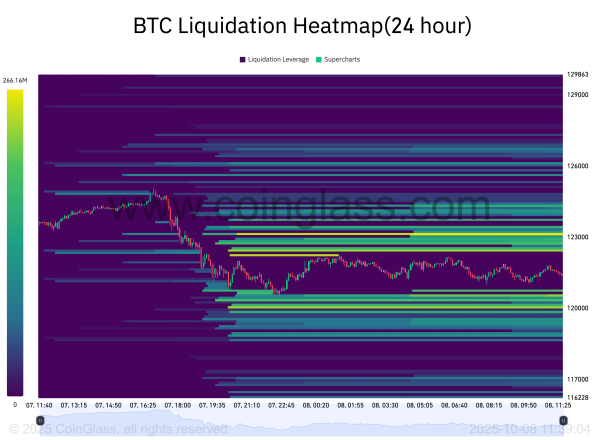

Rapidly rising open interest in derivatives markets has only fueled suspicions that Bitcoin could pull back from its recent rally.

“Very efficient price action, hence the low volatility,” wrote popular trader Skew.

However, this night liquidity began to return to the market, both on the demand and supply side.

Other experts are debating where a reliable local low for the BTC/USD pair might form, warning that it could be significantly below the current spot price.

There is weak support in the $121,000 to $120,000 range, meaning the price could fall quickly if selling picks up, said popular trader ZYN.

Experts from trading resource Material Indicators pointed to support in the $120,000 region, but noted that a more solid basis for a rebound lies at the $114,000 level near Bitcoin's 50-day simple moving average (SMA).

Meanwhile, BTC has gained 0.5% and climbed to $122,500. It's quite possible that the next resistance level will soon be under discussion.

Source: cryptonews.net