The cryptocurrency market surged at the start of the year, with Bitcoin ($BTC) reaching new all-time highs and the total altcoin market surpassing $1.5 trillion for the first time.

The launch of spot Bitcoin exchange-traded funds (ETFs) in the United States further integrated the asset within traditional finance.

Additionally, discussions around a potential U.S. strategic Bitcoin reserve have added legitimacy to the asset class.

Despite these market milestones, a new Chainalysis report highlights a concerning rise in market manipulation across select blockchain networks.

The findings raise serious concerns about the scale of market manipulation within the crypto industry.

Diane Seo, a data scientist at Chainalysis, told Cryptonews that the firm estimates wash trades involving ERC20 and BEP20 tokens account for up to $2.57 billion in trading volume on decentralized exchanges (DEXs).

In our latest preview chapter for the 2025 Crypto Crime Report, we look at our methodologies for uncovering suspected wash trading and pump-and-dump schemes, providing a clearer view of how market manipulation manifests in the crypto space: https://t.co/dg7RZZBpsz

— Chainalysis (@chainalysis) January 29, 2025

“We suspect that ERC20 and BEP20 wash trades on select blockchains account for up to $2.57 Billion in trading volume,” Seo said.

Seo explained that Chainalysis created two distinct heuristics to demonstrate this illicit activity.

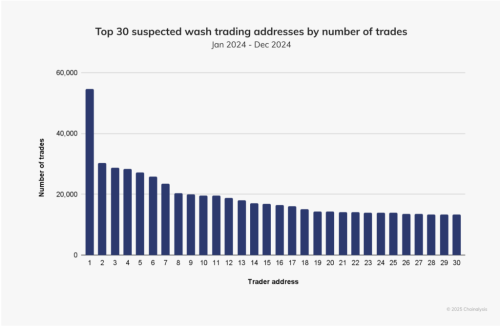

Interestingly, both methods revealed a long-tail distribution, indicating that a limited number of actors are responsible for the majority of these trades.

Source: Chainalysis

“For example, the first heuristic reveals that 10% of the addresses accounted for 43% of the total wash trades, and one single address executed more than 54,000 buy-and-sell transactions of almost identical amounts,” Seo said.

Source: Chainalysis

“The second wash trading heuristic shows that one bad actor accounted for 16.7% of the total wash trades,” she added.

Market manipulators employ wash trading for various reasons, including artificially inflating token activity in pump-and-dump schemes.

“This is where individuals inflate the activity of a token they’ve launched to attract investors, and then dump the token to realize a profit,” Seo said. “Another type involves bad actors providing wash trades as a service to token creators, helping them inflate the token’s activity and get paid for the service they provide.”

A recent example involved social media influencer Hailey Welch, also known as “Hawk Tuah,” whose meme coin, $HAWK, sparked concerns over a pump-and-dump scheme.

🚨 The Hawk Tuah controversy deepens! @HalieyWelchX, the “Hawk Tuah Girl,” vows to cooperate amid the $HAWK lawsuit following a shocking 90% crash and $151K in losses.#HawkTuah #Lawsuithttps://t.co/YXXv9DSLtB

— Cryptonews.com (@cryptonews) December 20, 2024

Welch came under legal scrutiny after $HAWK plummeted 90%, erasing over $151,000 in investor funds.

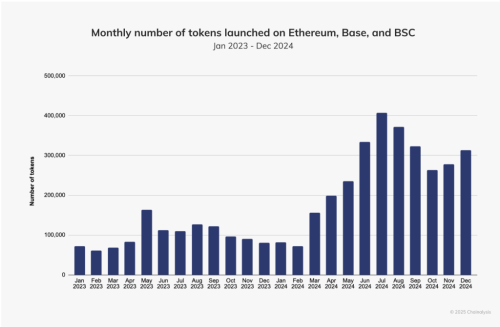

Chainalysis found that pump-and-dump schemes accounted for 4.52% of market activity in 2024, up from 3.59% in 2023. The increase is partly attributed to lower transaction fees, driven by the rise of new Layer 2 solutions and growing interest in cheaper Layer 1 chains.

The Chainalysis findings raise serious concerns about the integrity of crypto market activity.

Blake Benthall, Founder and CEO of blockchain analytics firm Fathom(x), told Cryptonews that wash trading is becoming more widespread across exchanges and decentralized finance (DeFi).

“This is inflating volumes and making it difficult to assess real market activity,” Benthall said.

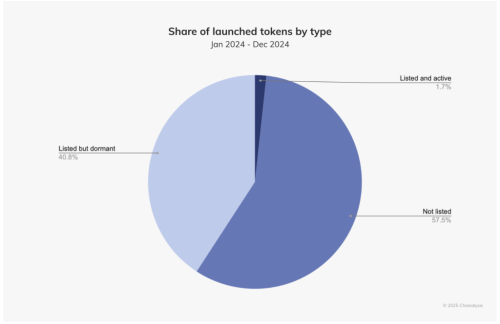

The Chainalysis report puts this issue into perspective, revealing that more than 3 million tokens were launched in the blockchain ecosystem last year. Approximately 1.29 million of these (42.54%) were listed on a DEX.

Source: Chainalysis

However, despite the high number of new tokens, only 1.7% remained actively traded in the past 30 days, largely due to market manipulation tactics such as wash trades, pump-and-dump schemes, and rug pulls.

Source: Chainalysis

Benthall noted that industry insiders often leverage unannounced software, advanced market-making tools, and prebuilt mining capabilities to gain an advantage, even in open-source projects.

He also pointed out that personality-driven hype can lead to extreme volatility.

“Meanwhile, personality cults drive volatility – one tweet from a prominent figure can send a token crashing, revealing just how centralized these markets really are,” he added.

Unfortunately, market manipulation is expected to persist in the crypto sector.

“As the industry matures, it inherits bad actors from traditional finance, just as the internet inherited scammers and fraudsters from the real world,” Benthall remarked. “Crypto has also entered the political mainstream and manipulation is evolving.”

While this challenge persists, certain actions can be taken to help combat market manipulation.

Seo explained that Chainalysis has found that most market manipulation is concentrated in the activities of a few sophisticated bad actors who repeatedly execute the same patterns over time.

“This suggests that if the bad actor had been identified early on and proactively banned from trading, that could have prevented the subsequent wash trades,” she said.

Given this, Seo believes that clear regulations and market surveillance are increasingly necessary for the crypto industry.

“This would help to quickly detect patterns, take action, and prevent larger-scale misconduct,” she said.

Benthall added that the transparency of public blockchains means insider trading and shady dealings can sometimes be exposed.

“While crypto can be used to bypass traditional oversight, every transaction remains on-chain, creating a digital breadcrumb trail that could be scrutinized for years to come,” he said.

Several initiatives are already in place to combat illicit activity in the crypto sector. The T3 Financial Crime Unit (FCU), for example, was launched in September last year to monitor illegal USDT transactions on the TRON blockchain.

Ari Redbord, Vice President and Global Head of Policy and Government Affairs at TRM Labs, told Cryptonews that blockchain technology inherently provides transparency, but when combined with analytics, it enables real-time detection of market manipulation.

“Collaboration between the private sector, regulators, and law enforcement will be key to addressing these challenges and creating a safer environment for investors,” Redbord said.

Source: cryptonews.com

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…