Bitcoin whales have moved over $3 billion into BlackRock ETFs after SEC easing.

Bitcoin whales have begun transferring their assets en masse to exchange-traded funds (ETFs). BlackRock, which is actively working with early investors, is leading the way.

In an interview with Bloomberg, BlackRock's head of digital assets, Robbie Mitchnick, said the company has already helped clients convert more than $3 billion into shares of its iShares spot Bitcoin ETF (IBIT).

According to Mitchnick, many investors who have held assets independently for years are realizing the convenience of storing Bitcoin (BTC) with their financial advisors or private banks.

This shift allows them to maintain exposure to digital gold while integrating the assets into the traditional financial system and gaining access to lending and a wider range of investments.

Mitchnick noted that the increase in interest is linked to recent changes in regulations by the US Securities and Exchange Commission (SEC), which allowed so-called direct exchange of ETF shares for bitcoin instead of fiat.

On the topic: The SEC has approved the creation and redemption of a crypto ETF in kind.

This structure makes large conversions more efficient and tax-efficient for institutional investors.

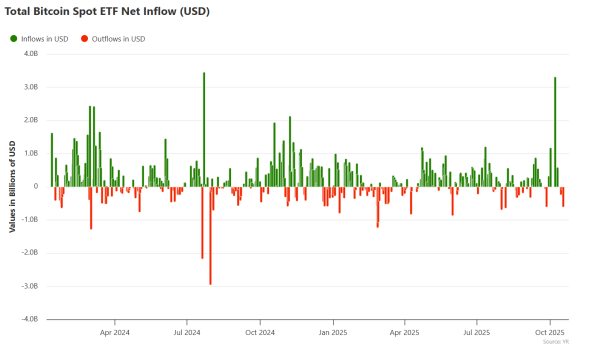

Source: Eric Balchunas.

Source: Eric Balchunas.

According to Bitbo, IBIT has become the most successful spot Bitcoin ETF approved in the US. In June, it became the fastest-growing ETF in history, exceeding $70 billion in assets under management, and that figure has now reached $88 billion.

A sharp influx of funds amid growing investor interest in the current bullish cycle. Source: Bitbo.

A sharp influx of funds amid growing investor interest in the current bullish cycle. Source: Bitbo.

Since the start of the current bull cycle, US spot ETFs have seen steady capital inflows as investors increase their exposure to the leading cryptocurrency.

Related: Crypto ETP investors ignored new salvos in the US-China trade war

“Not your keys, not your coins”

The rise of ETFs underscores the institutionalization of Bitcoin, 15 years after the first block was mined by Satoshi Nakamoto, who envisioned digital gold as a self-storage asset.

Early Bitcoin proponents traditionally believed that self-custody was the only reliable way to protect funds, as expressed in the famous phrase: “not your keys, not your coins.”

However, the rise of Bitcoin ETFs and corporate custody has called this principle into question. The new ownership model is increasingly converging with traditional custodial systems.

On the topic: Bitcoin has nothing to do with cryptocurrencies – Jack Dorsey

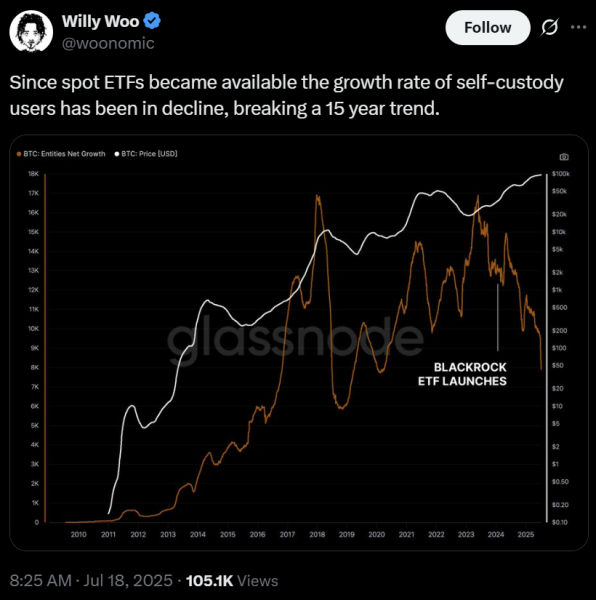

While spot ETFs and direct ownership don't directly compete, they appeal to different types of investors. Analyst Willy Woo noted back in July that demand for ETFs could have dampened interest in self-custody of cryptocurrencies.

He noted that the volume of Bitcoin in personal wallets has begun to decline for the first time in 15 years, which could indicate a change in investor behavior.

Source: Willy Woo.

Source: Willy Woo.

Nevertheless, analysts say ETFs have opened a new level of institutional participation in Bitcoin, previously unavailable to large funds and private banks. This shift has also affected early whales who previously influenced the market through direct buying and selling.

Source: cryptonews.net