Bitcoin rises after the US Federal Reserve cut interest rates by 0.25%.

The Federal Reserve cut interest rates by 25 basis points today, citing labor market instability and rising inflation.

For the average American, this means lower borrowing costs and could be a positive factor for the crypto market. However, the decision also increases inflation risks and raises questions about the Fed's independence.

The Fed cut rates for the first time in 9 months.

Bitcoin's price immediately surged after the US Federal Reserve cut interest rates by 25 basis points on Wednesday.

The Federal Open Market Committee (FOMC) did what many economists and traders expected: it cut the federal funds rate to a range of 4.00%–4.25%. This is the first cut in nine months, following a similar cut in December 2024.

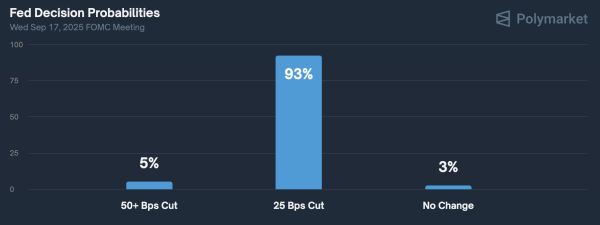

93% of Polymarket participants predicted a 25 basis point rate cut at today's FOMC meeting. Source: Polymarket.

93% of Polymarket participants predicted a 25 basis point rate cut at today's FOMC meeting. Source: Polymarket.

“The Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4% to 4.25%,” the Federal Reserve said in a statement. “Recent data show economic growth slowing in the first half of the year. Job growth declined, and unemployment rose slightly but remains low. Inflation increased and remains slightly elevated.”

The possibility of further rate reductions was mentioned:

“In considering the extent and timing of additional adjustments to the federal funds rate, the Committee will carefully evaluate incoming data, the evolving outlook, and the balance of risks.”

This decision could have a positive impact on Bitcoin and the rest of the crypto market in the coming days.

A Positive Catalyst for Crypto?

The crypto market was cautiously optimistic ahead of the Fed's interest rate decision. Now that the rate cut is a reality, traders can expect good news. According to CryptoQuant, investors are preparing to buy.

“Overall, the Fed's rate cut is a positive catalyst for risk assets like cryptocurrencies,” said Julio Moreno, head of research at CryptoQuant.

Investors are holding onto their most valuable crypto assets, including Bitcoin and Ethereum. This suggests that large holders are not panicking and likely expect prices to rise after the rate cut.

“For BTC and ETH, investors seem to be expecting a rally as inflows into exchanges are low, meaning they are not planning to sell,” Moreno noted.

Meanwhile, funds are flowing into stablecoins. Moreno explained that these assets often serve as cash on exchanges, indicating investor readiness to buy.

“Higher deposits in stablecoins are a 'dry powder' for investors before buying,” he said.

On-chain data also shows that some investors are cashing out of less valuable assets, such as altcoins. This could be a sign of caution or strategic preparation for important events.

Most data confirms how crypto markets typically react to lower interest rates. Lower borrowing costs traditionally encourage investors to seek higher returns in riskier assets.

The 2020-2021 rate cuts following the COVID-19 pandemic were a prime example of how financial easing fueled the historic crypto bull market. At that time, capital inflows directly increased risk appetite among retail investors.

However, the link between falling interest rates and the crypto market is not always direct.

A politically charged decision

Powell's statement comes amid heightened tensions between the Federal Reserve and the Trump administration. Since taking office, Trump has repeatedly pressured the FOMC to lower interest rates, even attempting to fire Fed Governor Lisa Cook.

Yesterday, the Senate confirmed Stephen Miran, Trump's former chief economic adviser, to the Federal Reserve Board.

The constant pressure has raised doubts about the Fed's independence in decision-making. It's unclear whether Powell cut rates because of the economic situation or because of government pressure. Experts disagree on the necessity of these cuts.

If today's decision was made under political pressure, it could lead to higher inflation, which would reduce Americans' purchasing power and overheat the economy. Such instability would also reduce risk appetite, diverting trading volumes away from the cryptocurrency market.

Meanwhile, the American economy has been experiencing significant turmoil in recent months.

What's next for the American consumer?

The latest data shows a weak labor market, with employment growth slower than expected. Inflation also remains a significant concern.

The Fed's preferred measure of inflation, the personal consumption expenditure (PCE) price index, is likely to remain above its 2% target. This is partly due to import taxes imposed by Trump, which economists believe could further increase prices in the coming months.

The coming months will reveal whether the Fed's new interest rate cuts will help it achieve maximum employment and price stability. It will also be interesting to see whether the cryptocurrency market can benefit from them this time around.

The post Bitcoin rises after the US Federal Reserve's 0.25% rate cut appeared first on BeInCrypto.

Source: cryptonews.net