Bitcoin falls to 4-week low amid signs of bullish cycle exhaustion

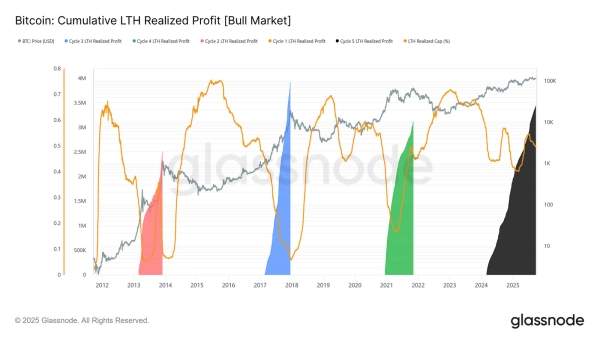

According to on-chain analysis, Bitcoin may be in for a deeper correction as the total realized profits of long-term holders have reached levels seen during the peaks of previous market cycles.

Long-term holders made a $3.4 billion profit, while inflows into exchange-traded funds slowed, a sign of “exhaustion” after the Federal Reserve's rate cut last week, according to Glassnode.

Bitcoin fell below key support levels at $112,000, hitting a four-week low of $108,700 on Coinbase late Thursday, according to TradingView.

The price has not yet dropped to $107,500, as it did on September 1, but analysts say a move in that direction could be just that.

“The rebound from that decline quickly lost momentum, and now that prices are hovering around that level again, there could be a fresh wave of stop-loss selling,” said Marcus Thielen, head of research at 10x.

“This comes at a time when many are expecting a rally in the fourth quarter, so the big surprise is not the sharp jump higher, but the correction.”

BTC retreats from lower highs. Source: Tradingview

Bitcoin is heading for a cooling phase, Glassnode says.

This week, Glassnode reported that the realized profit-to-loss ratio shows that profit-taking has exceeded 90% of the coins that moved three times in this cycle, with the market just recovering from the third such extreme.

Historically, these peaks have marked the tops of major cycles, and “the likelihood points to a cooling phase ahead,” the statement said.

Total realized profits coincide with cycle peaks. Source: Glassnode

Some Bitcoin holders are selling at a loss

Thielen also stated that the Spent Output Profit Ratio (SOPR) is showing alarming behavior as some Bitcoin holders are starting to sell at a loss, which historically indicates significant market stress.

In bull markets, a drop in the SOPR below 1 can signal sellers' exhaustion and precede a rebound, while in bear markets, a rebound of 1 or above often signals renewed downward pressure. According to Glassnode, the ratio currently stands at 1.01.

More importantly, short-term holders' net unrealized profit/loss (NUPL) is approaching zero, threatening to trigger a liquidation as new holders “quickly cut their losses,” he said.

What's next for Bitcoin?

Glassnode analysts concluded that unless demand from institutional investors and holders aligns again, “the risk of a deeper cooldown remains high, highlighting a macrostructure that increasingly resembles exhaustion.”

Meanwhile, Thielen said the company remains neutral “unless Bitcoin can get back to $115,000.”

Chairman of the Strategy Division Michael Saylor was more optimistic, saying earlier this week that Bitcoin would rise in the fourth quarter after macroeconomic headwinds subside.

At the time of writing, the asset was trading at $109,645, down 6.5% over the past week.

Source: cryptonews.net