Bitcoin's Hidden Threat: DAT Company Collapse Threatens Forced BTC Sales

Shares of Digital Asset Treasury (DAT) companies, which have chosen Bitcoin as a strategic asset, are falling sharply, which may create new headwinds for the BTC price.

According to a new report from on-chain analytics platform CryptoQuant, the ongoing decline in Bitcoin's price could exacerbate negative trends.

What is PIPE?

A CryptoQuant report analyzes Bitcoin-holding companies that raised capital through private investment programs (PIPEs). The study found a significant decline in these companies' stock prices.

Many DAT companies have raised capital this year. The main drawback of this method—dilution of existing shareholders and downward pressure on the share price—was often overlooked due to Bitcoin's strong rise. However, CryptoQuant notes that companies that used PIPE programs have since seen their share prices plummet.

The vicious circle of decline

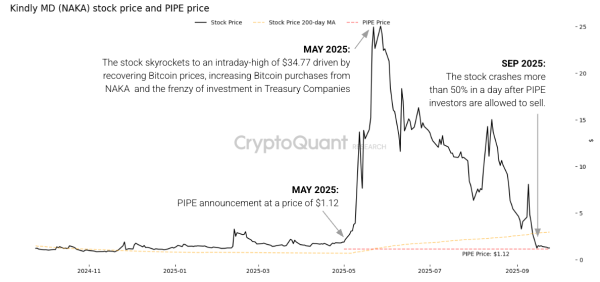

For example, shares of Kindly MD (NAKA) soared from $1.88 at the end of April to $34.77 in less than a month—an 18.5-fold increase. However, since then, the stock has fallen 97% to $1.16 and is trading around $1.12 at the time of writing.

NAKA stock price and PIPE price. Source: CryptoQuant

NAKA stock price and PIPE price. Source: CryptoQuant

CryptoQuant noted that Bitcoin companies such as Strive (ASST), Cantor Equity Partners (CEP), and Empery Digital (EMPD) have seen their stock prices fall between 42% and 97%. Some stocks still trading above their PIPE prices could decline by another 50%.

Although these DAT companies may have accumulated significant cryptocurrency holdings, their market valuations are declining even faster. This is evident in the rapid decline of their market value to net asset value (mNAV).

Domino effect

As Bitcoin remains weak, DAT company shares continue to fall. This is leading to selling by PIPE investors. If the situation continues, companies may lose their main source of capital and be forced to sell their Bitcoin for cash.

This will increase pressure on Bitcoin's price, creating a vicious cycle in which BTC and DAT stocks fall simultaneously. CryptoQuant believes that only sustained Bitcoin growth can halt the further decline of these stocks. Without such growth, analysts predict that many crypto stocks will continue to decline to or below their PIPE prices.

Source: cryptonews.net