Bitcoin's Sharpe Ratio Drops Near Zero, a Rare Risk-Reward Signal

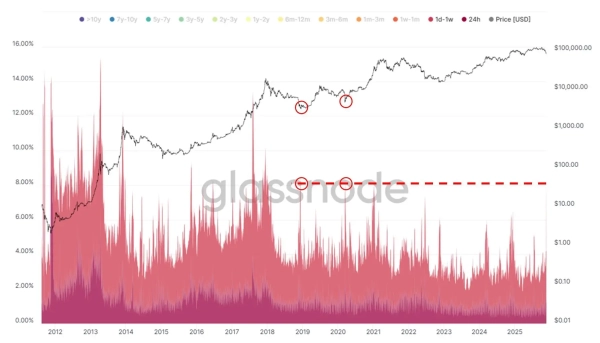

Bitcoin's Sharpe ratio has fallen to near zero, reaching levels seen during the market bottoms of 2019, 2020, and 2022. Meanwhile, 8% of all Bitcoin was moved in a single week. And all this against a backdrop of historical volatility.

Bitcoin's technical indicator, known as the Sharpe ratio, has fallen to near zero, reaching levels typical of periods preceding a market bottom.

CryptoQuant analyst I. Moreno noted on Monday that Bitcoin's Sharpe ratio is at a level that has historically corresponded to periods of maximum uncertainty and the initial stages of risk reassessment.

The expert noted that Bitcoin is now entering the same zone observed in 2019, 2020, and 2022. Back then, the ratio remained at depressed levels for a long time—before the emergence of new multi-month trends.

“This doesn't guarantee a bottom, but it does indicate that the quality of future returns is starting to improve, provided the market stabilizes and volatility normalizes,” he explained.

The Sharpe Ratio as a Signal for Smart Money

The Sharpe ratio reflects the balance of return and risk. When it's close to zero, it means Bitcoin exhibits low returns relative to its volatility. This creates a more attractive investment environment.

Historically, periods of low Sharpe ratios often precede new long-term uptrends—this is when smart money enters the market, as the risk-return balance improves. This is the opposite of buying at the peak of euphoria, when the Sharpe ratio is high.

In early 2024, the ratio jumped sharply to 50, amid rising markets that saw Bitcoin surpass $73,000 for the first time.

At the same time, the analyst warned that the trend recovery has not yet taken shape.

“Bitcoin is not yet signaling a trend rebound, but it does indicate that the risk-adjusted picture is becoming more attractive for future returns,” he emphasized.

Bitcoin's Sharpe ratio has fallen to zero. Source: CryptoQuant.

Unusually Large Bitcoin Transfers: A Historic Week in Blockchain

Over the past week, more than 8% of all bitcoins have moved, according to data from analytics company Glassnode.

This has only happened twice in the past seven years: during the bear markets of December 2018 and March 2020.

“This makes the latest decline one of the most significant blockchain events in Bitcoin's history,” commented Joe Burnett, director of Bitcoin strategy at Semler Scientific.

In just 10 days, Bitcoin's price plummeted by a massive 23%, or more than $24,000, reaching a low of around $82,000 on Friday. The price subsequently recovered slightly, reaching $89,000 by the end of trading on Monday.

Significant volumes of Bitcoin have only moved twice in the last seven years. Source: Glassnode.

Source: cryptonews.net