Analyst Explains Role of $117,500 Level in Bitcoin Rally

If the first cryptocurrency overcomes the key resistance at $117,500, it will open the way to updating historical maximums, said MN Capital founder Michael van de Poppe.

#Bitcoin is still nicely consolidating.

The crucial resistance remains the same, this is the $117.5K area.

If that breaks, we'll be in a great territory for a potential new ATH. pic.twitter.com/IV4PZ5EOcK

— Michael van de Poppe (@CryptoMichNL) September 16, 2025

Bitcoin has risen 9% from its local September low of $107,270. However, the rally has slowed at $118,000.

At the time of writing, digital gold is trading around $115,000.

Binance BTC/USDT Hourly Chart. Source: TradingView.

Binance BTC/USDT Hourly Chart. Source: TradingView.

According to van de Poppe, it is at the $118,000 mark that significant liquidity for long positions is concentrated. The expert believes that this level is key for further growth.

Currently, all the market's attention is focused on the Fed meeting, during which the regulator will make a decision on the key rate. The event is scheduled for September 17.

An analyst under the pseudonym AlphaBTC predicted that Bitcoin will test the $118,000 mark in the next 24 hours. After the results of the Fed meeting, he expects a correction.

📈#Bitcoin LTF game plan 📈

No change to my plan, I still think that 118K level gets taken out in the next 24-48hrs, then we see how much conviction or sell pressure comes in as the FOM Rate Decision is confirmed.

Can #Bitcoin hold 115K post the decision? Or will it sell off… https://t.co/7JleDfrKgR pic.twitter.com/x6d9EB9pTW

— AlphaBTC (@mark_cullen) September 16, 2025

What can support the uptrend?

Corporate treasuries and spot Bitcoin ETFs continue to accumulate the cryptocurrency, creating a favorable backdrop for its price. Over six trading sessions, the instruments have attracted more than $2 billion.

US Spot #Bitcoin ETFs saw net inflows of ~5.9k BTC on Sept 10th, the largest daily inflow since mid-July.

This pushed weekly net flows positive, reflecting renewed ETF demand as BTC consolidates above the $114k level.

Chart Link: https://t.co/HngTwoZ2Mv pic.twitter.com/cseoA9cxrx

— glassnode (@glassnode) September 15, 2025

“On September 10, US Bitcoin spot ETFs recorded a net inflow of ~5,900 BTC, the largest daily inflow since mid-July. Weekly inflows turned positive, reflecting renewed demand for ETFs,” Glassnode analysts noted.

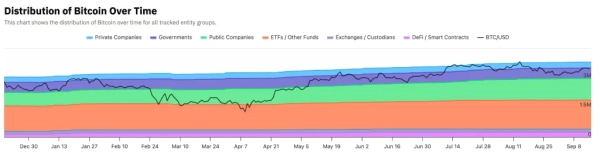

Since the beginning of 2025, the volume of Bitcoin under management by public companies and exchange-traded funds has grown by 30% – from 2.24 million BTC to 2.88 million BTC.

Source: BitcoinTreasuries.NET.

Source: BitcoinTreasuries.NET.

The high investor interest in digital gold is also confirmed by data from CoinShares. According to the latest report, $2.4 billion flowed into Bitcoin-based investment products last week.

Let us recall that the trader named the key support level for the first cryptocurrency ahead of the Fed meeting.

Source: cryptonews.net