When is The Best Time to Trade Crypto?

Active crypto traders know the US stock market opens at 9:30 AM EST on weekdays, with the closing bell at 4:00 PM EST. However, crypto markets trade 24 hours a day and never take a day off. So, when is the best time to trade crypto?

The answer depends on what type of trade you need to make. Trading volume on centralized exchanges parallels the busy times for the US trading markets. However, if you’re trading on decentralized exchanges, gas fees might be a consideration, making it wiser to avoid busy times in some cases. Lastly, price action on weekends and major holidays should be taken with a grain of salt. The price direction could change swiftly when volume returns. Let’s discover the best time to trade crypto, depending on the type of trade you need to make.

In Short: Is There a Best Time to Trade Crypto?

For trading on centralized exchanges in major markets, such as BTC and ETH, the daytime hours during the weekdays provide the most volatility and highest volume. This coincides with the hours the US stock market is open, so between 9:30 AM and 4:00 PM EST, you’ll have the strongest price signals. Trading volume on decentralized exchanges converges during US business hours as well.

After-hours trading can still offer opportunities. However, crypto trading volume typically falls off during the evenings and particularly during the weekend. This means that short-term crypto indicators may not show accurate price direction signals. The lower volume also makes it easier for crypto whales to push around prices on individual exchanges.

However, when using decentralized exchanges (DEXs), you may want to consider making your trades in the evening hours or on weekends when gas fees are lower. Bear in mind that prices on cryptocurrency markets can change significantly in a few hours, so you may have to pay the higher gas fees in some cases.

How Do Crypto Market Hours Work?

Crypto exchanges are open 24/7 to accommodate a worldwide market, including weekends and holidays. The same is true of decentralized exchanges, which are trading platforms run on blockchain computer programs called smart contracts. Although cryptocurrency markets trade around the clock, the busiest times often align with US stock market trading hours.

What Are The Best Market Conditions For Trading Crypto?

The best conditions for trading crypto often depend on your trading strategy. For example, you probably don’t want to use weekend price action to determine your next move in countertrend or breakout trades. The data may be suspect. Let’s look at some factors that may determine the best time to trade, including gas fees, liquidity, unusual market trends, and macro events.

Low Network Activity

Smart-contract blockchains like Ethereum charge “gas fees” to pay for transactions. Sending ETH becomes more expensive when there is more network activity. However, gas fees can jump considerably when you need to interact with a smart contract, such as a decentralized crypto exchange swap or deploying tokens in a decentralized finance (DeFi) protocol.

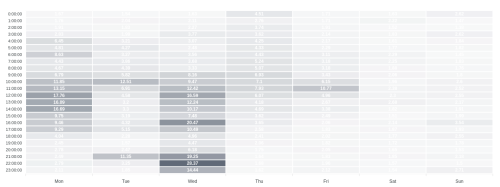

Traditionally, daytime hours brought higher gas fees due to increased network activity. However, many traders began waiting until the evening hours to make their trades. The spike in evening activity caused gas fees to rise in the evenings, negating any advantage.

What remains consistent is that weekends see reduced blockchain activity, leading to lower gas fees on weekends. If you need to make a trade that’s not time-sensitive, you can consider making weekend swaps to save money.

Trading fees become a lesser consideration when using Layer 2 Ethereum networks like Arbitrum or Base or low-cost networks like Solana. Swaps on these networks often cost pennies or less, compared to several dollars or even more, as activity picks up on Ethereum.

High Liquidity

Liquidity refers to the ability to trade in or out of a position easily. In short, high liquidity means there’s a vibrant market of buyers and sellers. You’ll find higher liquidity on crypto exchanges during peak trading hours, roughly coinciding with the trading hours for the US stock market.

When liquidity is higher, spreads between ask and bid prices shrink, and the additional orders in the order book allow trades to fill with less slippage.

Stable Macro Environment

Global events and events in other financial markets often affect crypto trades. When the yen carry trade cratered in August 2024, Bitcoin and ETH sold off, logging BTC and ETH losses of up to 20% before the US stock markets opened. These two cryptocurrencies often influence the cryptocurrency market trends as well as investor sentiment.

Check the news to help determine the best time to trade crypto. If there are potentially market-shaking events afoot, you might want to wait.

When Are The Crypto Markets Busiest?

Although crypto markets are worldwide, trading activity peaks during business hours in the US. Market activity starts to pick up around 9:00 AM and continues at higher levels until 5:00 PM EST on weekdays.

However, trading times can vary based on the type of trade. For example, you may do well with trending low-cap meme coins in the evenings or on Sunday morning EST. Be aware that lower volume can be deceiving, though, and plan an exit strategy to protect your profits.

Is The Weekend a Good Time to Trade Crypto?

Weekends can often see increased volatility and trading opportunities, which can be well-suited to short-term trades. However, when trading volume returns on Monday morning, the direction can change quickly as the market speaks with a louder voice.

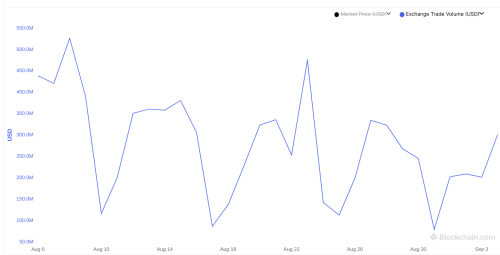

In the monthly chart above, spanning from early August to early September 2024, the dips show dramatic decreases in BTC trading volume on weekends.

Weekend trades can be good for scalping a percent or two while the larger market slumbers. In many cases, you can also use the weekend’s low-volume market volatility to pick up tokens at a discount if you plan a long-term trade. Crypto prices often fall on weekends due to lower buying activity. However, lower liquidity may make it more challenging to buy in size. Expect wider spreads and more slippage on large trades.

Weekends often see prices drift lower if buyers aren’t out in force to counter sellers. Many traders see Monday as the best trading day of the week because prices may rise after a weekend lull in the action.

Conclusion

In most cases, the best time to trade crypto is between 9:00 AM and 5:00 PM EEST. Volume usually intensifies during US stock market trading hours between 9:30 AM and 4:00 PM EST. However, the type of trade can also play a role. Memecoins, for example, dance to their own beat, and other types of DEX trades may be best saved for times when gas fees are lower.

FAQs

Is there a best time of day to trade crypto?

You’ll usually enjoy higher liquidity during business hours in the US. Traders come out in larger numbers between 9:00 and 5:00 PM EST on weekdays.

What is the best day of the week to trade crypto?

Many traders see Monday as the best trading day because the global market becomes more active following the weekend.

What time of day does most crypto peak?

Crypto prices can swing dramatically from day to day. However, cryptocurrency trading volume often continues at peak levels through 5:00 PM EST, so on an up day, prices may peak between 4:00 PM and 5:00 PM EST.

Should you trade crypto on the weekends?

Crypto markets trade 24/7 but see reduced volume on weekends. However, the weekend can be the best time to trade crypto in specific meme coins or if you’re buying dips for a long-term trade.

References

- Is There a ‘Best’ Time to Trade Crypto? Here’s What the Data Says (coindesk.com)

- The market turbulence and carry trade unwind of August 2024 (bis.org)

- Exchange Trade Volume (USD) (blockchain.com)

- Here’s why cryptocurrency crashes on weekends (cnbc.com)

Source: cryptonews.com