What is Compound Finance? DeFi Lending Protocol Explained

Compound Finance enjoys a leading position in the world of decentralized finance (DeFi). But what is the Compound protocol, and how does it work? On a high level, Compound Finance provides a well-tested crypto lending and borrowing platform. However, the platform also provides additional yield opportunities through COMP tokens.

In this guide, we’ll provide you with an overview of Compound as well as features and pros and cons. Learn how this multichain protocol can help you earn a yield or borrow against select cryptocurrencies.

What is Compound Finance in Crypto?

Compound Finance is a decentralized lending and borrowing protocol that supports several chains, including the Ethereum blockchain, Base, Arbitrum, and others. Lenders can deposit select cryptocurrencies into a lending liquidity pool to earn a proportional yield on funds borrowed from the pool. Liquidity pool assets can also act as collateral, allowing users to borrow against their deposited funds. Borrowers will pay interest on their loans through Compound.

All this happens without an intermediary. Borrowers don’t need to apply for a loan. Instead, deposits act as collateral, eliminating the need for banks or other middlemen. Transactions, interest rates, and collateral thresholds are all governed by the Compound protocol’s smart contracts, which are computer programs that run on the blockchain.

Compound Finance History

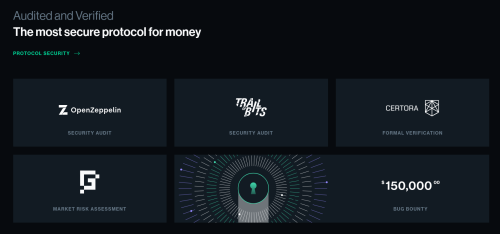

Compound launched in 2018, making it one of the first DeFi lending platforms. Now, with a series of audits from leading smart contract auditing firms, including OpenZeppelin and ChainSecurity, Compound Finance remains among the most trusted DeFi protocols today.

Robert Leshner and Geoffrey Hayes founded the project in 2017, just two years after the launch of the Ethereum blockchain. By mid-September 2018, Compound launched on the Ethereum Mainnet. Compound V2 launched in 2019, bringing support for additional cryptocurrencies.

In 2020, Compound became a community-governed protocol, with COMP token holders voting on proposals for the protocol. One such vote led to a third version of Compound, further expanding the number of supported cryptocurrencies and bringing additional features to the platform.

Compound currently supports several major Ethereum Virtual Machine (EVM) networks, including Ethereum, Optimism, Base, and Abitrum. However, each of these chain deployments operates independently, with different supported crypto assets and no cross-chain interoperability.

During 2021’s crypto bull market, Compound reached a total value locked (TVL) high of more than $12 billion. Figures through 2023 and 2024 place Compound Finance in a TVL range of $2 billion to just over $3 billion.

How Does Compound Finance Work?

As a collateral-based lending platform, Compound uses deposits to secure loans and fund lending pools for other borrowers. When you deposit a supported cryptocurrency, you receive an equivalent token called a cToken. For example, a 0.5 ETH deposit is replaced with 0.5 cETH. These tokens can be redeemed for ETH as needed but earn interest as others borrow ETH from the lending pool.

Supported assets vary by chain. For example, on Ethereum Mainnet, Compound supports five assets as collateral, including ETH and Wrapped Bitcoin (WBTC), as well as the protocol’s own token, COMP.

Let’s explore a quick walkthrough of the lending and borrowing process on Compound Finance.

How to Lend on Compound Finance

Although Compound Finance is available on several chains, the process for Compound lending on each chain is similar. In the example below, we’ll use the Arbitrum chain to save on fees. If you have ETH on Ethereum Mainnet, you can consider bridging ETH to Arbitrum. Arbitrum Layer-2 transactions are faster and much more affordable compared to Ethereum Mainnet. We’ll also use USDC to lend in this example.

1. Connect Your Crypto Wallet to Compound Finance

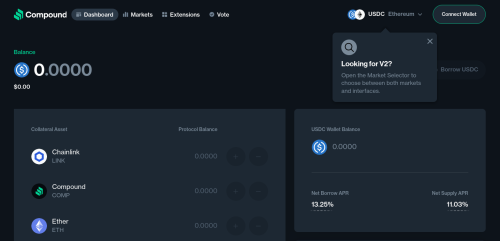

Visit Compound Finance and tap on the App button. Next, look for the Connect Wallet button. The Compound DeFi app supports several popular crypto wallets, including MetaMask, Coinbase Wallet, and Rabby, as well as Ledger hardware wallets.

Next, switch to your desired network. We’ll use Arbitrum in this walkthrough.

2. Deposit Crypto to Lend

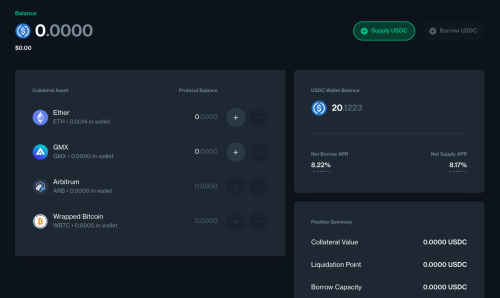

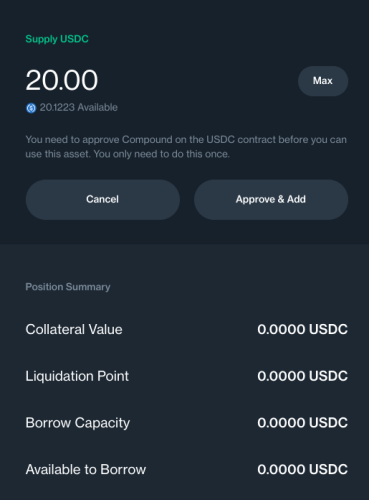

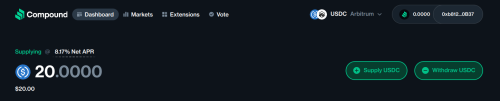

Compound Finance supports borrowing for USDC on the Arbitrum network, so that’s what we’ll deposit. Tap on the Supply USDC button.

Now, choose an amount to supply. In this example, we’ll deposit $20 of USDC. Click Approve & Add to authorize the transaction with your crypto wallet.

That’s it. Now, the lending balance is updated, and you’ll begin earning interest on the supplied USDC. The interest rate is calculated algorithmically.

How to Borrow on Compound Finance

Borrowing on Compound follows a similar process to Compound lending. However, we won’t be able to borrow USDC using USDC as collateral. Instead, we’ll need to deposit a supported collateral crypto asset.

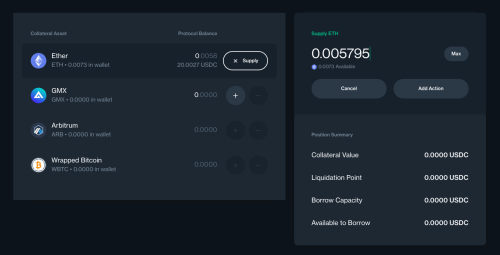

Compound supports ETH, GMX, ARB, and WBTC as collateral when borrowing USDC on the Arbitrum chain.

Connect your wallet and switch to the desired chain, like in the previous example.

1. Supply a Supported Collateral Asset

Let’s supply $20 worth of ETH so we can borrow. Choose the desired collateral and amount, and then click on Add Action. Then, confirm the transaction using your crypto wallet.

2. Choose an Amount to Borrow

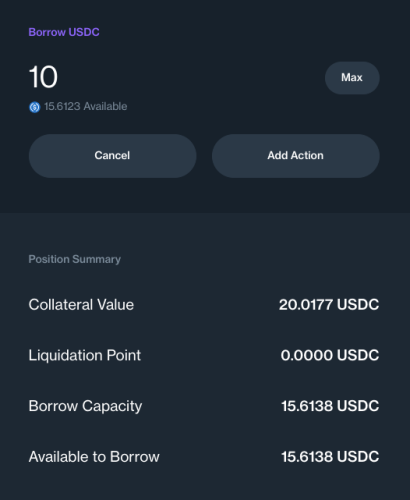

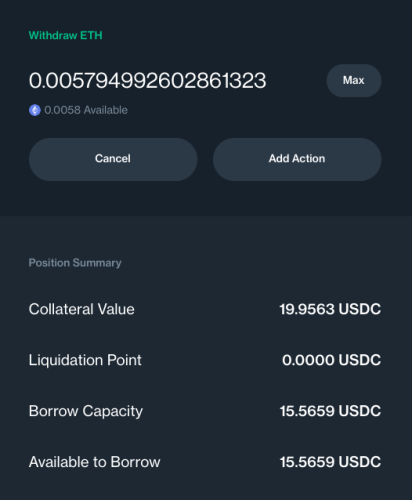

Based on the $20 worth of ETH deposited as collateral, we can borrow about $15.60. However, we don’t want to borrow that much. If the price of ETH falls, we may get liquidated because we no longer have enough ETH to cover the collateral requirement value.

Tap on Borrow USDC and choose a safer amount. We’ll use $10 in this example.

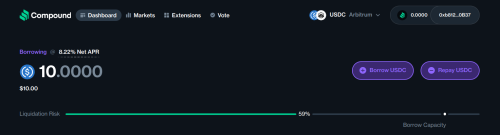

Tap the Add Action button to approve the transaction with your crypto wallet. Once the transaction is complete, your balances will be updated in your Compound dashboard.

As you can see, we’ve borrowed 59% of our borrowing capacity.

This figure will change based on accrued interest and the value of the supplied collateral. If ETH increases in value fast enough to outrun the interest on the loan, the borrowing capacity will increase without adding more collateral. However, if ETH falls in value, we may need to add more collateral or pay down the loan to avoid liquidation.

Like most lending protocols, Compound can sell your collateral to cover the outstanding loan balance if your collateral value falls below a certain threshold. However, in this event, you keep the loan proceeds, sacrificing the collateral instead.

3. Monitor or Repay Your Loan

To repay your loan or add additional collateral, visit your Dashboard on Compound Finance. After you repay your loan, you can remove your collateral from Compound.

Choose an amount to withdraw and Tap Add Action to approve the transaction with your wallet. Withdrawing converts your cTokens back to the base cryptocurrency. In this example, we’ll redeem cTokens for .00579 ETH, matching our initial collateral deposit.

Can You Yield Farm on Compound Finance?

Compound was among the first protocols to introduce yield farming in 2020. You’ll earn COMP tokens when you supply tokens or borrow from the platform. Some users use a looping technique to accrue more COMP. The process entails supplying, borrowing, and then using the borrowed funds to repeat the supply and borrowing process.

To collect your accrued COMP tokens, interact with the Compound Finance protocol again by withdrawing the supplied tokens. Even a small withdrawal triggers the COMP token release to your wallet.

COMP tokens can be used for voting but also boast a solid market value. As of this writing, COMP tokens are valued at ~$51.30, with a market capitalization of $429,137,267. Compound’s fully diluted market cap is $513,395,115 based on a maximum supply of 10 million tokens.

What is The COMP Token For?

The COMP token serves as a governance token used to vote on proposals for the protocol. However, you can also use COMP tokens as collateral for borrowing through Compound on Ethereum Mainnet.

While the token’s price can be volatile, prices have risen over the past year. Users who supplied COMP as collateral would have seen their borrowing cap increase during this period.

The Pros and Cons of Compound Finance

Compound Finance was among the first DeFi protocols to reach a broad audience and remains popular today. However, today’s market brings additional competitors, making it essential to weigh the pros and cons versus other lending and borrowing protocols as well as traditional finance options.

Advantages of Compound Finance

Although Compound Finance has more competitors now, the platform still brings several advantages for lenders and borrowers alike.

- Verified smart contract audits: Few protocols can rival the number of independent audits that have been completed for Compound Finance. Both OpenZeppelin and ChainSecurity have completed audits of Compound V3. In addition, Compound offers a $150,000 bug bounty to help ensure user safety.

- Fully decentralized protocol: Compound’s community votes on changes to the protocol using the COMP token. This decentralized approach builds trust and loyalty within the community.

- No intermediary for lending and borrowing: Compound’s fully automated lending and borrowing protocol makes it easy to get a loan without selling your crypto to raise funds. Anyone can connect to the protocol and borrow or lend without third-party permission.

- Yield farming opportunities: Users can earn COMP tokens by supplying tokens to the platform or by borrowing, creating another way to earn crypto as passive income.

Drawbacks of Compound Finance

While Compound is generally regarded as a safe lending and borrowing platform, its structure brings some disadvantages compared to competitors.

- Less intuitive interface: Compared to Aave, another popular lending protocol, Compound may not be as easy to use. Newer crypto investors may struggle to find their way.

- Limited yield on supplied collateral: Unlike Aave, which pays an in-kind yield for most deposits, Compound only pays an in-kind yield on select cryptocurrencies. Other supplied collateral deposits earn COMP tokens.

- Limited token support: Collateral and borrowing options on Compound pale in comparison to those on many competitors, such as Aave. By comparison, Aave supports 15 collateral assets on Abitrum versus four on Compound Finance.

- 2021 exploit: A smart contract exploit in 2021 led to the loss of 490,000 COMP tokens, many of which were later returned.

Conclusion

The Compound lending and borrowing app lets users earn a yield by supplying cryptocurrency to the platform as well as for borrowing. The popular decentralized application has become a staple in the DeFi world, allowing anyone to lend or borrow cryptocurrency without an intermediary. The platform also remains popular for DeFi farmers who can earn COMP tokens by using the platform. With a limited supply of just 10 million tokens, many expect the value of COMP tokens to continue climbing.

FAQs

What is Compound Finance?

Compound Finance is a decentralized lending platform that allows users to lend cryptocurrencies to earn yields. The platform also rewards collateral suppliers and borrowers with COMP tokens. The platform allows lending markets to function without an intermediary and without identity verification.

How does a Compound loan work?

Borrowing on Compound is made possible by depositing crypto collateral on the platform. Borrowing caps vary depending on the type of cryptocurrency used for collateral. Compound Finance supports several chains, with lending markets also varying by chain.

What is the main benefit of using Compound Finance?

Compound Finance provides two key benefits. First, users can lend and borrow cryptocurrency without an intermediary. However, a second popular feature of Compound is the ability to earn COMP tokens for using the platform. These valuable tokens have a capped supply of just 10 million.

How do you earn interest on Compound Finance?

You can earn interest for lending supported digital assets on Compound. For example, users currently earn more than 8% APR for lending USDC on Compound on the Arbitrum blockchain. Users who supply collateral tokens can also earn COMP tokens.

References

- Yield Farming: The Truth About This Crypto Investment Strategy (investopedia.com)

- Bug puts $162 million up for grabs, says founder of DeFi platform Compound (cnbc.com)

- wBTC: What is Wrapped Bitcoin? (gemini.com)

Source: cryptonews.com