SUI vs Solana: Which is The Better Network in 2025?

BTC $98,115.88 0.41% ETH $2,831.00 2.15% SOL $202.18 -1.26% PEPE $0.000010 0.40% SHIB $0.000015 -1.68% DOGE $0.26 -1.03% XRP $2.44 -3.01% ETH Gas (gwei) 1.03

BTC $98,115.88 0.41% ETH $2,831.00 2.15% SOL $202.18 -1.26% PEPE $0.000010 0.40% SHIB $0.000015 -1.68% DOGE $0.26 -1.03% XRP $2.44 -3.01% ETH Gas (gwei) 1.03

BTC $98,115.88 0.41% ETH $2,831.00 2.15% SOL $202.18 -1.26% PEPE $0.000010 0.40% SHIB $0.000015 -1.68% DOGE $0.26 -1.03% XRP $2.44 -3.01% ETH Gas (gwei) 1.03

All EN+ English Deutsch Français Русский Türkçe 日本語 Nederlands Italiano 中文 Español Português Norsk Bokmål Suomi Indonesia Cryptonews Sui vs Solana: Which is The Better Network in 2025?

Solana is seeing a powerful resurgence following the crypto bear market’s fallout. Sui is a new network built for speed, low-cost transactions, and ease of use. Both networks share similar audiences and are growing rapidly. In this guide, we’ll compare Sui vs Solana, including which features make each a compelling investment or have room for improvement.

We examined important metrics, including tokenomics, scalability, transaction costs, and respective decentralized app (dApp) ecosystems. We also looked at the variety of meme coins and decentralized finance (DeFi) applications on each network to see what the future may hold for these chains. Let’s compare Sui vs Solana to learn which might be right for your crypto portfolio.

Solana vs Sui: Summary

| Sui | Solana | |

|---|---|---|

| Launch Date | May, 2023 | March, 2020 |

| Price | $3.61 | $205.50 |

| Market Cap | $8.44B | $99.97B |

| Total Supply | 10.00B | 533.68M |

| Active Tokens on Network | 30+ | Millions |

| Active Developers | 1,400+ | 3,300+ |

ℹ️ The prices, market caps, and total supply were last updated on February 5, 2025. The underlying content and analysis are reviewed and updated periodically and are subject to change as market conditions evolve.

Sui vs Solana: What Are They?

Both Sui and Solana are smart contract blockchains that support advanced features, including decentralized applications and decentralized exchanges. While both chains offer much higher throughput than Ethereum, the leading smart contract blockchain, each approaches the challenge of fast and affordable transactions differently.

Networks like Solana and Sui were developed to make smart contract functionality more accessible. At a small fraction of the cost of transacting on Ethereum, users can access many of the same types of applications and discover growing ecosystems.

Solana is known for its robust meme coin markets and booming DeFi marketplaces. Sui is building an audience around accessibility and safety while also offering meme coins and aggregated liquidity for trades.

What Is Sui?

Sui is a layer-1 smart contract blockchain built by Mysten Labs that launched in 2023. The project was founded by several members of the Facebook Diem project, which never launched. Sui boasts up to 297,000 transactions per second (TPS), compared to Ethereum’s current throughput of about 12 to 15 TPS.

Despite a more than 12 times increase in throughput as new users flock to the chain, transaction costs have remained stable at between $0.01 to $0.02, depending on the price of the SUI token, which acts as a fuel token for the network.

At the protocol’s core, the Move programming language aims to make safe app development faster and more intuitive. Move focuses on assets as objects with defined characteristics rather than using parameters within sometimes unwieldy code, as seen in other languages such as Solidity, which is used with Ethereum Virtual Machine (EVM) chains.

Sui’s speed and low-cost transactions invite comparisons between Sui and Solana, which is also known for its speed and affordability.

What Is Solana?

Solana Labs launched Solana, a high-performance smart contract blockchain, in 2020. However, the project’s development dates back to 2017, when founder Anatoly Yakovenko released a draft whitepaper detailing the project goals and architecture.

Solana’s avid user base gravitates to the chain for its fast block times, low costs, and booming ecosystems, including some of the biggest meme coins on the crypto market, like BONK.

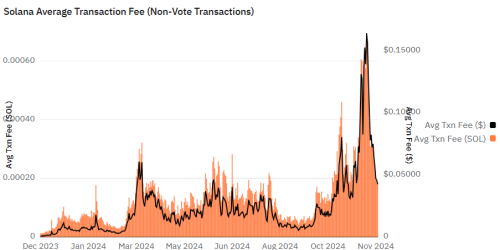

Similar to Sui, Solana offers fast and affordable transactions, with a theoretical maximum TPS of 65,000. However, transaction costs occasionally spike during network congestion. The network has also experienced several outages, including one in 2024.

Like Sui, Solana uses its native token, SOL, for gas fees, which can add to transaction cost volatility. However, average gas fees on the network often come in below a penny. SOL price volatility and competition for network resources can cause fees to jump higher.

Tokenomics: What Are the Main Differences?

The differences in tokenomics between Sui vs Solana center on a fixed maximum supply for Sui versus an inflationary supply for Solana. We’ll explore each in more detail in the following sections. However, a fixed maximum supply means no more tokens will be minted, which may prove bullish for the Sui’s price. Only 10 billion SUI tokens will ever exist.

Conversely, Solana uses an inflationary strategy, although the inflation rate decreases over time and will eventually be capped at 1.5%, making the supply disinflationary until reaching that level.

Despite the higher initial inflation, SOL has recovered well since its bear-market lows when it fell to $8. By mid-year 2024, SOL set a new all-time high of more than $260, which has subsequently been topped — SOL’s ATH now stands at $295.40.

Sui Tokenomics Explained

SUI’s fixed supply of 10 billion tokens creates competition for the tokens as network demand grows. SUI tokens power transactions on the Sui blockchain, with transactions paid in MIST, each of which equals one billionth of a SUI token.

Initial allocations fund staking rewards and other initiatives well into the future, with tokens also set aside for key groups, including Mysten Labs, early contributors, and early investors.

➡️ Here’s a breakdown of Sui’s tokenomics:

- Community Reserve (50%): Sui’s community reserve funds validator subsidies, research and development initiatives, and grant programs to foster platform development.

- Early Contributors (20%): This allocation is held for key developers for the Sui project.

- Investors (14%): Early investors were allocated 14% of the supply or 1.4 billion SUI. Early investors include blockchain giants like Coinbase Ventures, a16z, and Samsung Next.

- Mysten Labs Treasury (10%): One billion SUI are allocated for Mysten Labs’ treasury, which also holds bonds and other assets.

- Community Access Program and App Testers (6%): Early users who helped ensure a trouble-free experience were collectively allocated 6% of SUI’s supply.

Notably, the Sui project did not offer an airdrop. A project spokesman stated that an airdrop may have provided tokens to users with no real financial interest or time-based stake in the project.

How will Sui incentivize validators in the future?

With a fixed supply, how can Sui provide staking rewards once all the allocated tokens have been used? Bitcoin faces a similar question, with mining rewards slowly falling with each Bitcoin Halving. In both cases, network transaction fees, which are awarded to miners for Bitcoin or validators for Sui, are expected to provide adequate incentives for these entities to secure their respective networks.

Solana Tokenomics Explained

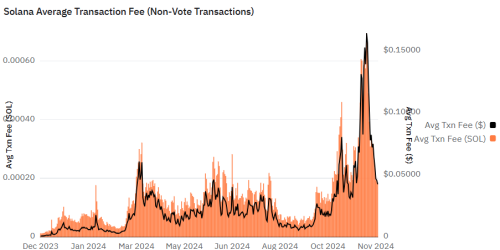

Unlike Sui, Solana does not have a fixed supply. The current circulating supply of 486.49M tokens will continue to grow. However, the inflation rate decreases by 15% annually until it reaches a floor of 1.5% annually. Currently, the inflation rate is below 5%, with these newly minted tokens used to incentivize validators to secure network transactions.

Similar to Ethereum, Solana burns a portion of transaction fees generated on the network, helping to offset the inflation caused by minting new tokens for staking rewards. Like Ethereum’s approach, token burning as part of the protocol is limited to base fees, with priority fees given to validators in their entirety following a successful governance proposal.

A significant percentage of tokens (38%) were allocated to the Solana Community Reserve Fund, which is managed by the Solana Foundation, with the tokens meant to foster growth in the Solana ecosystem through grants, community development, and similar initiatives. The Solana Foundation itself was allocated an additional 12.5% of the SOL supply.

About 80% of Solana’s supply is in circulation and available for trading, whereas the remaining 20% is either locked in staking accounts or held by the Solana Labs or the Solana Foundation. SOL tokens held by these two entities are not locked but are used to delegate to validators and aid in decentralization.

Wider Ecosystem: DeFi and DApps

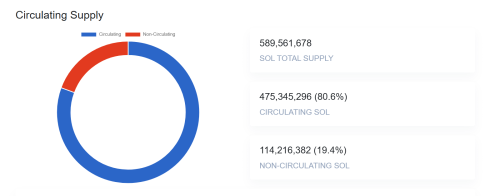

Solana holds a clear advantage regarding ecosystem size and maturity. However, things change quickly in the crypto world, and Sui has already outpaced well-established chains like Cardano in terms of total value locked (TVL). Of the non-EVM chains, Solana boasts the highest TVL at 8.67%, with Sui holding the eighth largest TVL at nearly 1.4% of total value locked.

According to DefiLlama, Solana hosts 197 protocols compared to 52 on Sui. Solana’s largest protocol by TVL focuses on liquid staking, with the second-largest being a decentralized exchange (DEX). By comparison, Sui’s top two protocols both focus on lending markets, with its leading DEX ranking third in TVL.

However, later in this article, we will see that both platforms offer a wide range of decentralized applications. In the following sections, we’ll discuss some of the leading protocols on these smart contract chains to better understand the user base and the opportunities available through each.

Sui Ecosystem: What Projects Are There?

Although Sui currently has fewer live projects running on-chain, it boasts some of the more advanced solutions to challenges like liquidity. For example, DeepBook leverages Sui’s parallel transactions to provide a decentralized order book for trades and exchanges.

Let’s examine some of Sui’s leading protocols:

- NAVI Protocol: NAVI provides a vibrant lending marketplace for stablecoins and blue-chip assets, such as Sui, USDC, USDT, wETH, and wBTC.

- Suilend Protocol: Suilend expands its lending market with wrapped assets such as wSOL and suiETH, as well as Sui ecosystem tokens like DEEP.

- Cetus AMM: Sui’s leading DEX offers swaps and advanced tools for creating concentrated liquidity positions to earn trading fees.

- Haedal Protocol: Haedal provides a liquid staking token for Sui staking that pays a yield while allowing users to use their tokens as collateral or in other DeFi activities.

- Scallop Lend: Scallop provides an easy-to-use lending platform paired with a pro dashboard that unlocks advanced tools for power users.

- Aftermath Finance: Aftermath offers a well-featured DEX, allowing up to eight assets per pool. It also offers liquid staking support and farming rewards for LP stakes.

Other notable protocols on the platform include Ondo Finance, a leader in real-world asset (RWA) tokenization, and two growing prediction markets. Sui also supports non-fungible tokens (NFTs) and Web3 gaming.

USDC on Sui aids Sui’s growth and appeal by providing a safe haven for traders in between trades and through DeFi yield opportunities. By comparison, some other chains, like Cardano, do not have a major stablecoin, such as USDC or USDT.

Solana Ecosystem: What Projects Are There?

The number of protocols running on-chain shows Solana’s long head start over Sui. However, many of Solana’s leading protocols, including liquid staking, DEXs, and lending markets, mirror those of Sui in functionality.

Let’s explore some of Solana’s leading projects:

- Jito: The Jito platform has quickly grown to become Solana’s leading protocol due to its enhanced yields for liquid staking. Combined yields from staking rewards and MEV (maximum extractable value) earnings reach nearly 9%.

- Jupiter: The Jupiter DEX provides basic swaps in addition to support for limit orders, dollar-cost averaging (DCA), and perpetual futures trading.

- Raydium: The popular Raydium decentralized exchange offers simple swaps with an intuitive interface and limit orders using a central limit order book (CLOB) for advanced users.

- Kamino: Kamino provides a powerful lending and borrowing platform with support for dozens of tokens. The platform also offers high-yield liquidity vaults, leverage tools to boost yields, and automated long/short contracts that utilize lending markets and leverage to let you bet long or short on key ecosystem assets.

- Marinade: The Marinade liquid staking platform automatically rebalances stake delegations to earn higher staking rewards based on performance, location, and other factors. Staking yields as of this writing exceed 12% APY.

- Sanctum: The sanctum protocol provides liquidity pools for SOL and popular liquid staking tokens within the Solana ecosystem, letting users quickly change strategy with an easy-to-use interface.

Like Sui, Solana also supports USDC and USDT. However, as a more established chain, Solana also supports newer stablecoins like PayPal USD and battle-tested, asset-backed coins like DAI.

Performance and Scalability

Sui and Solana both use proof of stake (PoS) to reach a consensus to secure on-chain transactions. Essentially, PoS uses collateral to ensure the honest operation of validators who confirm transactions on the blockchain.

Validators that break the rules are subject to slashing on both Sui and Solana, meaning the validator and users who delegate to the validator can lose their staked tokens. This structure, which uses validators and third-party stakers to secure the chain, is called delegated proof of stake (DPoS).

Proof of stake has proven to be more energy efficient (and often faster) than alternatives like proof of work (PoW). However, each of these chains also employs some other innovations to outperform chains like Ethereum in TPS. Let’s look at how Sui vs Solana approach scalability to push through more transactions per second.

Sui: Mysticeti Consensus Mechanism

Under the hood, Sui uses DPoS. However, Sui has deployed the Mysticeti engine, which significantly reduces validator CPU requirements. This strategy optimizes resource utilization and reduces latency. In plain English, Sui is much faster and can easily process tens of thousands of transactions per second.

In addition, Sui supports parallel processing due to its object-oriented architecture. These innovations place Sui well ahead of Solana and other established blockchains in transaction speed and scalability.

Solana: Proof of History

Solana also uses PoS, although adding another element called proof of history (PoH), which acts as a timestamp for transactions. This innovation allows validator nodes to quickly agree on the chronology of transactions.

PoH acts as a timestamp, leading to faster block times because the network can process transactions in parallel. By comparison, networks like Ethereum must undergo a lengthier validation process, reducing scalability.

Sui TPS vs Solana

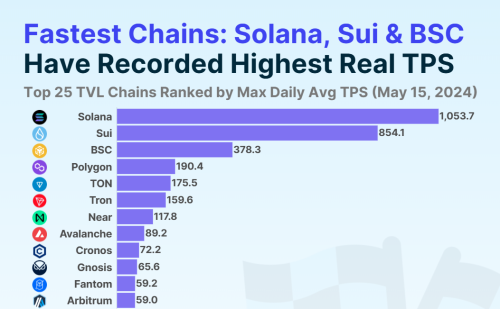

While impressive, Sui’s TPS of 297,000 and Solana’s 65,000 TPS remain theoretical or limited to testing. In real-world use, both chains see significantly less throughput. Using their own research in combination with data from Dune Analytics, CoinGecko ranked the fastest chains based on daily averages.

Solana came out on top, showing a 23% faster rate for processing transactions. However, with Sui still in its early stages of adoption and with the implemented Mysticeti consensus mechanism, these rankings could change.

Network Costs and Transaction Fees

Both Sui and Solana use their respective native token as a gas token on the network. In short, these tokens (SUI and SOL) pay for transactions made on the blockchain.

For example, if you wanted to send SUI to a non-custodial wallet from a custodial wallet on an exchange, you would pay a network transaction fee in SUI. This relatively simple transaction would be very affordable.

Sui and Solana use a system similar to other smart contract chains, such as Ethereum, pricing transactions based on complexity and network traffic. However, some subtleties separate Sui vs Solana in how each network assigns a cost to a given transaction.

Notably, transaction fees, when measured in dollars (or cents), can also vary as the value of the base token fluctuates. Let’s compare Solana vs Sui in terms of average transaction costs.

Sui Network Fees

For most transactions, Sui proves more affordable than Solana, although Sui also charges a storage fee for each transaction. Sui’s formula for calculating gas fees is as follows:

total_gas_fees = computation_units * reference_gas_price + storage_units * storage_price

However, Sui also allows data to be deleted from the network, in which case 99% of storage fees are refunded to the user. On average, Sui transactions cost less than $0.02, which puts it on par with low-cost Ethereum Layer-2 networks.

Solana Network Fees

Similar to Sui, Solana considers computational complexity when setting fees. However, Solana also considers network congestion, which leads to occasional spikes in gas fees. Solana charges “rent” to store transactions. However, this is now handled with a “rent-exempt” minimum balance requirement.

On average, Solana transactions cost less than $0.05 and are often closer to $0.03. However, due to the congestion calculation used by Solana, prices can spike, reaching more than $0.18 in the second quarter of 2024, for instance.

Developer Ecosystem and Programming Languages

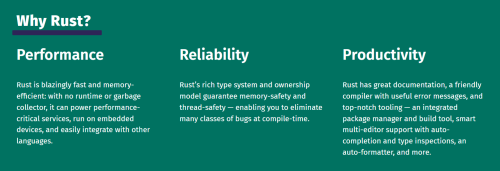

The programming languages used by Sui vs Solana share similarities and common roots. Solana uses Rust, which has become popular with operating systems such as Linux, game engines, and embedded systems.

The Move programming language, used by Sui and Aptos, was influenced by Rust but designed specifically for blockchain use. Move delivers some features that make Sui (and Aptos) more efficient while sidestepping some key security issues common to smart contract chains.

Specifically, Move’s architecture mitigates reentrancy attacks, one of the most common exploits used against smart contracts. However, Solana’s architecture also limits this risk.

Let’s look at Move and Rust and the developer community each attracts.

Sui Developer Ecosystem – MOVE

Move was initially developed to support Facebook’s Diem cryptocurrency project. Although Diem never launched, many of the team members went on to form Sui, and another group went on to launch Aptos, a crypto project similar to Sui in many ways, including the use of the Move programming language.

Sui’s developers used Move to create Sui Move, a programming language for smart contracts that uses an object-oriented approach, treating assets as objects. Other smart contract languages, including Move itself, build around an account-based structure.

This approach allows Sui to process transactions in parallel, helping Sui achieve its maximum speeds. For developers, this brings the ability to write secure code quickly. For users, it helps ensure a safer Web3 experience, mitigating some of the risks common to other smart contract languages, such as Solidity.

More than 1,100 developers currently work on Sui projects. The language’s object-oriented approach, simple syntax, and host of tools to onboard developers help keep the development community growing.

Solana Developer Ecosystem – RUST

Originally developed in 2018, Rust’s release coincided with the planned release of Solana, which launched in 2020 after a period of development. Rust is fast and reliable and runs some of today’s most used web apps, including Dropbox and Cloudflare, as well as the Firefox browser itself.

Clear syntax and strong tooling allow Rust developers to build quickly using a language with a booming community of support. Rust is fast and memory efficient while also offering safeguards that help enhance security for both projects and users.

More than 2,800 developers work on Solana projects using the Rust programming language. However, due to Rust’s popularity outside of Solana, armies of skilled developers experienced with Rust are available as Solana continues to grow.

Meme Coins: Are They Better on Sui or Solana?

Meme coins can offer spectacular returns if you choose well and time trades effectively. They also often lead the way regarding capital moving on-chain in a meaningful way. Let’s look at the meme coin scene for Sui and Solana to compare the opportunities for each chain.

Sui Meme Coins

Although many of Sui’s leading dApps focus on decentralized finance, meme coins bring new traders and capital to the chain. The good news is that, due to the network’s newness, Sui meme coins have much lower market caps compared to more established chains.

At press time, only one Sui meme coin, LOFI, had a market cap of more than $70 million. By comparison, the market caps for top meme coins on Solana, Base, and other leading chains reach into the billions. These lower values suggest more room to grow as Sui attracts more users.

Top Sui Meme Coins by Market Cap

| Coin | Symbol | Price | Market Cap | YTD Return |

|---|---|---|---|---|

| LOFI | LOFI | $0.077 | $77.07M | +689.48% |

| sudeng | HIPPO | $0.0051 | $51.01M | -7.15% |

| AXOL | AXOL | $0.028 | $28.84M | +422.45% |

| MemeFi | MEMEFI | $0.0014 | $0.00 | -94.85% |

| BLUB | BLUB | $0.000000041 | $13.29M | +3760.01% |

ℹ️ The data in this table was last updated on February 4, 2025.

Solana Meme Coins

Solana is home to some of the largest meme coins by market cap, including tickers like BONK and WIF. Many of these offer well-established communities and the type of viral marketing that makes crypto a fun space.

However, Solana also has its share of rug pulls and high volatility. Buyer beware, but if you choose well, some of the best Solana meme coins have reached billions in value.

Top Solana Meme Coins by Market Cap

| Coin | Symbol | Price | Market Cap | YTD Return |

|---|---|---|---|---|

| Official Trump | TRUMP | $17.77 | $3.55B | +314.25% |

| Bonk | BONK | $0.000018 | $1.41B | +83.36% |

| dogwifhat | WIF | $0.83 | $834.84M | +307.91% |

| Pudgy Penguins | PENGU | $0.013 | $835.94M | -74.79% |

| Fartcoin | FARTCOIN | $0.75 | $755.45M | +2952.08% |

ℹ️ The data in this table was last updated on February 5, 2025.

Sui vs Solana: Which Is the Better Network?

When considering speed, transaction cost, and smart contract security, Sui seems to be the better choice. However, choosing between Sui vs Solana also requires an analysis of your goals. Arguably, Solana offers more DeFi platforms and a more robust meme coin community.

As an established network, liquidity is also higher, meaning you can move in and out of positions more efficiently. Additionally, DeFi earning opportunities may be higher on Solana vs Sui due to increased demand.

Let’s compare the pros and cons of each network to help determine which is best and for which use cases.

Sui Pros and Cons

Although relatively new, Sui’s rapid growth invites comparisons against Solana and other well-established networks. Pros include Sui’s faster speed and stable yet low transaction costs. However, scalability remains untested under high real-world usage. Let’s investigate Sui’s pros and cons compared to other networks.

Pros

- Faster speed through parallel transactions

- Sui’s object-centric model improves scalability

- Developer-friendly programming language

- Low-cost transactions without large variances

Cons

- Newer chain with low liquidity

- Scalability is untested in real-world conditions

- Limited bridging tools to bring assets from other chains

Solana Pros and Cons

Although well-established, Solana has seen some growing pains over the years, including several network outages and times at which transaction fees spike. However, Solana has also proven itself as the comeback king of the crypto world, rising from the depths of the crypto bear market to become one of the most used chains.

Pros

- High-performance network built for speed

- PoH consensus mechanism to allow parallel transactions

- Solana uses the popular Rust language, bringing a worldwide army of experienced developers

- Booming meme coin, NFT, and DeFi ecosystems

Cons

- Network congestion causes transaction cost spikes

- Occasional outages call reliability into question

- Solana’s popularity attracts scammers and rug pulls

Is Sui or Solana a Better Investment?

Many Solana investors enjoyed spectacular gains from the bottom of the bear market to reaching new all-time highs in late 2024. However, those gains also invite questions about how much further Solana can run and whether there may be better opportunities with newer projects like Sui.

Both projects compare well regarding transaction costs and available protocols, although Solana’s ecosystem is much larger, bringing greater liquidity and more mature applications. Still, Sui’s Move programming language promises to bring greater security and faster app development to Web3.

Solana may represent a safer investment, particularly with the possibility of Solana ETFs coming to market under a new administration. Greater name recognition and the potential for mainstream investors to buy through ETFs bode well for top-tier cryptos like Solana. Our Solana price prediction puts forward much higher prices for SOL in the coming years.

However, Sui could be a more profitable investment in the short term. Although its growth as a newer chain remains uncertain, Sui has already captured an impressive share of the market and piqued the interest of the crypto community. More secure smart contracts powered by a developer-friendly language and easy onboarding through Web2 logins make Sui a compelling proposition.

How to Buy Sui or Solana in 2025

Both SUI and SOL are available through several major exchanges. Check out our reviews of the best cryptocurrency exchanges for February 2025 to select the one that better fits your preferences and needs.

For this example, we’ll look at how to buy Sui or Solana using MEXC. The MEXC exchange offers some of the lowest trading fees and supports withdrawals to a non-custodial wallet for secure storage or use on the Sui or Solana blockchains.

Here’s the step-by-step process for purchasing SOL or SUI:

Buy Sui or Solana on MEXC

Conclusion

Solana and Sui both offer high-performance blockchain solutions, but their differences in scalability, tokenomics, and ecosystem maturity shape their investment potential.

Solana’s larger developer community, deeper liquidity, and established DeFi and meme coin markets make it a strong contender for mainstream adoption. However, network congestion, occasional outages, and inflationary tokenomics present risks.

Sui’s innovative Move programming language, object-based architecture, and parallel transaction processing provide a more secure, scalable framework for Web3 applications. Yet, its early-stage adoption, lower liquidity, and untested real-world scalability introduce uncertainty.

Both networks offer compelling opportunities, but investors should carefully consider risk factors, adoption trends, and long-term sustainability before making any decisions. Always do your own research — crypto markets remain highly volatile.

👉 Don’t Miss: Best Crypto to Buy Now in February 2025

FAQs

Is Sui the next Solana?

Many see Sui as viable competition for Solana. The Sui network has seen fast adoption, although its user base remains much smaller than Solana. An object-oriented programming language developed specifically for blockchains promises to help Sui grow through safer and faster development.

Could Sui be a Solana killer?

Sui brings several advantages over Solana, including a newer and more secure programming language as well as cheaper and more predictable transaction fees. Adoption rates remain much lower than those of Solana, which creates risk for those who invest in the chain. In time, Sui may make Solana and similar chains redundant, but higher adoption and greater liquidity are key.

Does Sui have a bigger market cap than Solana?

No. Sui’s market cap is a fraction of Solana’s. Currently, Solana has a market cap of $99.97B, compared to Sui’s $8.44B.

What is the difference between Sui and Solana?

While both networks boast fast transactions and low fees, Sui has a higher maximum TPS due in part to efficiencies in the way the network validates transactions. Sui also uses an object-oriented approach to smart contract programming that allows more secure code while also boosting network speeds.

References

- Solana: A new architecture for a high performance blockchain v0.8.13 (solana.com)

- Solana outage caused by a previously identified bug, devs say (blockworks.co)

- Proposal for Enabling the Reward Full Priority Fee to Validator on Solana Mainnet-beta (solana.com)

- Total Value Locked All Chains (defillama.com)

- The Backbone of Sui DeFi Liquidity (deepbook.tech)

- Experience the Power of USDC on Sui (sui.io)

- The Fastest Blockchain Processed 91M Transactions in a Day (coingecko.com)

- Gas in Sui (sui.io)

- All About Objects (sui.io)

Source: cryptonews.com