ETH Treasury: Are companies at risk of falling into a debt trap?

- Bit Digital CEO Sam Tabar warns that secured loans can become a strain on treasury firms in a bear market. Long-term treasury strategies could be jeopardized if companies are forced to sell their crypto reserves during price declines.

- “All these secured bonds will ruin many ETH treasury companies in a bear market. And that will be a real problem. The wrong kind of leverage can very easily ruin a company,” Tabar said.

- While secured debt is considered a cheap financing option with lower interest rates, it ties borrowers tightly to their collateral. In practice, this works by a company pledging assets—usually Bitcoin or Ethereum in the crypto sector—as collateral.

- If their market value falls, in extreme cases, the position may even be liquidated. In this way, payment defaults can quickly result in the loss of important crypto assets.

- Unsecured debt works differently: Here, a company doesn't have to pledge any assets as collateral. This model is riskier for lenders, as they can't directly utilize collateral in the event of a default. Therefore, interest rates are typically higher, and loans are only granted after a rigorous credit check. However, for crypto companies, it means higher ongoing costs.

- For treasury companies, the choice between secured and unsecured debt becomes a strategic trade-off: While unsecured loans appear attractive in boom phases, they can become a threat to their existence in times of crisis.

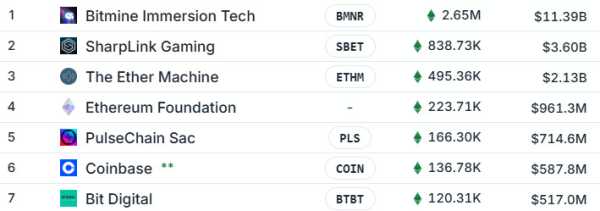

- Bit Digital, the former Bitcoin mining company, is currently one of the largest Ethereum treasuries: With 120,310 ETH, valued at approximately $517 million, the company ranks seventh in the global rankings. The company's stock is trading at approximately $3.15, having gained 21.32 percent in one month.

- “Currently, our average cost for ETH is around $2,400, which is very low. And we've been buying Ethereum since 2023,” Tabar said.

- The second-largest cryptocurrency is currently at $4,300 and has performed particularly well in the second half of the year.

Recommended Video Bitcoin before Uptober: What the data really reveals

Sources

- The Block article