10 Best DeFi Platforms to Watch Out For in 2024

2024 />

2024 />

The financial world remained relatively unchanged until decentralized finance (DeFi) emerged, sparking a significant shift. DeFi is already reshaping finance through decentralized lending and ownership, with the potential to transform various aspects of daily life.

Today, we’ll explore leading DeFi platforms like Aave, Lido, Compound, and Uniswap, examining their offerings, the fundamentals of DeFi, its safety, and how to choose the best DeFi platform for your needs.

Best DeFi Platforms in December 2024 Compared

Before we dig deeper into each platform, here’s a quick overview of the top 10 DeFi platforms we recommend:

| DeFi Platform | Services | Transaction Volume (24h) | Total Value Locked |

|---|---|---|---|

| Aave | Lending and borrowing | $377.35 million | $17.38 billion |

| Uniswap | DEX | $486.44 million | $5.69 billion |

| Lido Finance | ETH staking platform | $223.1 million | $30.82 billion |

| Compound | Lending and stablecoins | $76.35 million | $2.45 billion |

| Curve Finance | Stablecoin trading | $352.75 million | $1.84 billion |

| MakerDAO | Borrowing and stablecoins | $175.58 million | $4.93 billion |

| PancakeSwap | Multichain DEX | $118.8 million | $1.80 billion |

| Instadapp | DeFi protocol hub | $726.63 | $2.85 billion |

| Yearn Finance | Yield farming | $24.19 million | $221.97 million |

| Balancer | Portfolio management | $15.12 million | $890.51 million |

Best DeFi Platforms Reviewed – A Closer Look

Here are brief reviews of each DeFi platform to give you an idea of what they offer and excel at.

1. Aave – Best DeFi Lending Platform With One of the Longest Track Records

Aave is one of the leaders in the DeFi space, offering lending and borrowing services to crypto users. It also allows you to earn passive income by staking its AAVE native token (4.60% APR), along with GHO (5.30% APR) and ABPT (11.70% APR).

When it comes to lending and borrowing, Aave supports around 30 cryptocurrencies, including ETH, WBTC, wstETH, USDT, USDC, AAVE, DAI, and LINK.

Aave is known for being one of the most innovative platforms in the DeFi space. It has expanded significantly since its launch in 2017, becoming one of the longest-running DeFi platforms. Even though Aave’s TVL is not the highest, it comes with the biggest transaction volume in the space.

It’s fully non-custodial, open-source, and community-governed. Plus, borrowers and lenders can decide and execute their own loan terms with the help of smart contracts. In late 2024, the platform launched Aave V3 on the zkSync Era mainnet, enhancing transaction efficiency.

If you want to know more, you should read our complete guide on how to use Aave.

- DeFi Services: Lending and borrowing, staking

- Transaction Volume Last 24 hours: $377.35 million

- Total Value Locked: $17.38 billion

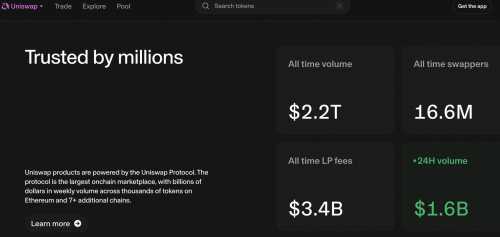

2. Uniswap – Biggest Decentralized Exchange and the Best DeFi Trading Platform

Uniswap is by far the largest decentralized exchange (DEX) on the market and one of the top trading platforms in the DeFi space, boasting over 1,500 markets.

More than that, its robust DeFi platform provides several services, including swapping coins, earning through liquidity provision, and building dApps with the Uniswap protocol. It also integrates with over 300 apps, like wallets, dApps, and aggregators.

While Uniswap may not be the largest DeFi platform overall, it’s unparalleled in the realm of DEXs. Users can trade on a fully transparent and decentralized platform without any intermediaries and through smart contracts. Recently, the platform has been focusing on enhancing liquidity provision and user experience, particularly through its V3 model, which allows for concentrated liquidity pools.

Learning to make a Uniswap trade is fairly simple for a DEX, given that the site boasts a user-friendly and minimalist design. Uniswap is known for constantly introducing new tokens, so if you’re interested in trading the latest exciting cryptos, check out the top new Uniswap listings you can buy to diversify your portfolio.

- DeFi Services: Trading and lending

- Transaction Volume Last 24 hours: $486.44 million

- Total Value Locked: $5.69 billion

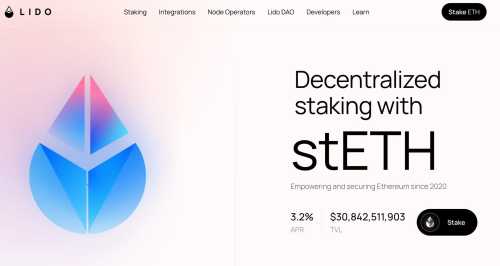

3. Lido Finance – Best DeFi Staking Platform Connecting to 100+ Apps

Lido Finance is a decentralized finance platform focused on staking. It’s run by a mission-driven decentralized autonomous organization (DAO), with decisions made entirely by public votes from holders of LDO (the platform’s native token).

The platform is known for its high security and use of cutting-edge technologies. Lido focuses on Ether staking, or more specifically, stETH (its own version of ETH), which is used to pay rewards to users who are staking ETH. You can unstake any stETH you have at any moment and exchange it for ETH at a 1:1 ratio.

Lido now also allows users to stake MATIC under the same system through stMATIC. ETH or MATIC staking is done without locking assets, and the whole service is completely non-custodial.

If you want to hold onto your stETH, bear in mind that Lido connects with over 100 apps, so you can use it for lending, as collateral, and much more. Recently, Lido has been expanding its offerings beyond ETH staking, potentially including other assets in its staking ecosystem to attract more users.

- DeFi Services: Staking

- Transaction Volume Last 24 hours: $223.1 million

- Total Value Locked: $30.82 billion

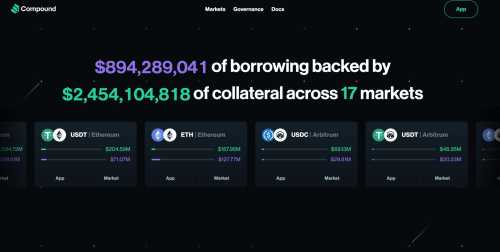

4. Compound – Lending and Borrowing Platform With Strong Stablecoin Support

Compound.finance is a decentralized marketplace for borrowing and lending cryptocurrency. By the latest count, it covers 16 markets, including cryptos like ETH, USDT, USDC, OP, and MATIC.

With both USDT and USDC in the mix, it’s clear that the platform has excellent support for borrowing and lending stablecoins.

Compound is Ethereum-based and fully supports borrowing or lending against collateral. The interest rates tend to be very good, but they are still affected by supply and demand. The platform might not be as large as Curve or Maker, but it offers plenty of value for most crypto users.

Compound has a native token (COMP) you can hold and take part in the governance of this decentralized protocol. Change proposals are posted on the Compound website, and you can vote on each.

- DeFi Services: Lending and borrowing

- Transaction Volume Last 24 hours: $76.35 million

- Total Value Locked: $2.45 billion

5. Curve Finance – DEX With a Unique Focus on Stablecoin Trading

Curve Finance is a decentralized finance platform for trading, borrowing, and lending. This DEX quickly became one of the leaders in the DeFi space, focusing on stablecoin trading, thus setting itself apart from the competition. Curve is the place to be if you’re looking for low fees and low slippage.

Curve uses automated market makers (AMM) to help it maintain stablecoin pegs. In turn, you can trade with little effect on the price. Curve maintains market liquidity by automatically buying and selling digital assets and profiting from the ask and bid price spreads.

With over $1.78 billion in total deposits and a daily volume usually above $100 million, Curve is still maintaining its position as a leading platform for stablecoin trading with significant TVL. For a platform that launched in 2020, this is no small feat.

Another unique selling point of this DeFi platform is its standout design, resembling an old-school website, all the while boasting cutting-edge web3 functionalities.

- DeFi Services: Lending and borrowing, trading

- Transaction Volume Last 24 hours: $352.75 million

- Total Value Locked: $1.84 billion

6. MakerDAO – Borrowing and Lending Platform With the DAI Stablecoin

MakerDAO is a large Ethereum-based decentralized collateralized debt position platform (CDP platform). In other words, it allows users to borrow and lend crypto. They can initiate a CDP by securing ETH or some other Ethereum-based asset as collateral.

The main objective of MakerDAO is to ensure its stablecoin DAI, one of the most popular and widely used stablecoins in the world, keeps its value tied to the US dollar.

MKR is Maker’s native token, and it’s used to facilitate users’ interest payments. Whenever a CPD is closed out on the platform, both the paid-out DAI and MKR are burned. The community actively discusses governance changes to improve risk management and collateralization strategies.

Aside from its secure and transparent practices, MakerDAO deserves the spot on this list because of its ties to DAI and its longevity on the market. It has survived all market fluctuations without faltering.

- DeFi Services: Lending and borrowing

- Transaction Volume Last 24 hours: $175.58 million

- Total Value Locked: $4.93 billion

7. PancakeSwap – All-in-One DEX With DeFi Services Like Staking

PancakeSwap is one of the most cheerful DEXs you’ll find, thanks to its quirky design and bright colors. But don’t let the upbeat aspect fool you; it’s still one of the leading multichain decentralized exchanges around the world.

It’s an all-in-one DEX that offers services, including trading, staking, yield farming, and even gaming through its Game Marketplace, which launched in late 2023.

The popularity of PancakeSwap can be attributed to its operation on the BNB Chain, which has led to quick confirmation times and lower user fees.

Earning potentials are substantial and versatile, as you get to trade, stake CAKE (the platform’s native token) with up to 25.63% APR, join liquidity pools and farms, and much more, including gaming options through Game Marketplace and NFTs.

PancakeSwap hasn’t been on the market for long, but it’s dominating the BSC DEX landscape throughout the year. Moreover, it’s ideal for Binance users due to the exchange’s connection to its BNB chain.

- DeFi Services: Trading, yield farming, and staking

- Transaction Volume Last 24 hours: $118.8 million

- Total Value Locked: $1.80 billion

8. Instadapp – Easy Engagement With DeFi Protocols

Instadapp is an Ethereum-based decentralized finance application that strives to provide users with a convenient way to engage with other DeFi protocols.

Their DeFi Smart Layer gives you a chance to use various DeFi platforms all in one place. In other words, with the help of Instadapp, you won’t need separate apps for staking, lending, or any other activity.

You get an all-in-one DeFi suite that covers Instadapp Lite and Instadapp Pro, along with the Web3 Avocado Smart Wallet and the Fluid lending platform. And even though it might not sound like it, Instadapp Pro is completely free.

Despite all this, the platform still hasn’t been attractive enough to the wider masses in the DeFi space yet it’s working on enhancing its user interface and functionality to simplify multi-protocol interactions for users. Its lack of popularity most likely explains why it doesn’t have the biggest TVL.

- DeFi Services: Lending and borrowing, staking

- Transaction Volume Last 24 hours: $726.63

- Total Value Locked: $2.85 billion

9. Yearn Finance – Yield Farming Platform With Automated Strategies

Yearn Finance is a suite of products focusing on helping individuals and DAOs earn yield from their digital assets. This yield aggregator offers services geared toward making yield farming easier, giving you a chance to optimize your returns.

You can maximize your interest rates by taking advantage of the many options Yearn offers. Moreover, you can even take part in its development and network governance by holding the native YFI token.

The protocol can shift your assets automatically and move them between various high-yield options in an effort to give you the best returns from your assets. In other words, you won’t have to do much with your portfolio since the platform handles most of it. Moreover, the developers’ team is working on creating new vaults and strategies to optimize user yield generation.

- DeFi Services: Yield aggregator

- Transaction Volume Last 24 hours: $24.19 million

- Total Value Locked: $221.97 million

10. Balancer – DeFi and DEX Offering Automated Portfolio Management

Balancer is an automated market maker (AMM) product suite, which is a type of DEX that uses algorithms to facilitate token trading. Instead of dealing with other traders, you get to handle it all through the AMM.

More than that, Balancer enables you to earn passive income through the platform’s yield-bearing pools. It currently has more than 240,000 liquidity providers, which isn’t much, but the DeFi platform is still growing rapidly.

Balancer goes one step further by offering you automated portfolio management services. It creates and manages various liquidity pools, each consisting of several tokens, effectively leading to portfolio management. Recently, the platform has been focusing on improving its automated market-making capabilities and expanding its liquidity incentives.

Like most other DeFi platforms on this list, Balancer also lets you buy and hold the native BAL token to participate in the protocol’s governance.

- DeFi Services: Automated portfolio manager, trading, yield farming

- Transaction Volume Last 24 hours: $15.12m

- Total Value Locked: $890.51 million

What Is a DeFi Platform?

A DeFi platform utilizes blockchain technology and cryptocurrencies to facilitate financial services. The definition may be broad, but DeFi itself is comprehensive, as it effectively encompasses all aspects of decentralized finance.

DeFi platforms are typically decentralized crypto exchanges, liquidity providers, lending platforms, yield farming apps, prediction markets, or NFT marketplaces.

One of the premises of DeFi platforms is peer-to-peer financial transactions. They typically aim to provide:

- Accessibility to broader masses

- High interest rates

- Low fees

- Robust security

- Near or full transparency

- Complete autonomy from centralized institutions

Despite having many advantages, DeFi is not without its flaws. The ecosystem is unregulated, which has led to some bad apples entering the market. Meanwhile, faulty programming of DeFi apps can easily give rise to hacks and scams.

DeFi platforms haven’t been around for long, but their popularity has been on the increase. The number of DeFi users has been growing steadily in the last few years. Statista research tells us that the market is expected to have around 22.09 million users by 2028, which is a massive jump from the latest peak of 7.5 million in late 2021.

Types of DeFi Platforms

As you’ve seen, DeFi platforms come in many shapes and forms. Let’s explain the most common ones you’ve seen among our recommendations.

Decentralized Exchanges (DEXs)

Decentralized exchanges are peer-to-peer marketplaces for trading crypto. Unlike centralized exchanges, where the exchange itself is the middleman, DEXs are only there to facilitate exchanges between traders, who make the trades independently and are free to determine the terms. The whole process is usually done with the help of smart contracts.

DEXs facilitate crypto trades, so there’s no option to purchase a coin for fiat or exchange your crypto assets and cash in. In order to use a DEX, you’ll need to have a crypto wallet with digital assets.

Examples: Uniswap and Pancake Swap

Pros:

- Decentralized trading

- No intermediary

- Added DeFi services

- Full anonymity

Cons:

- Steeper learning curve

- No fiat-crypto trading

- Risky coins and tokens

Lending and Borrowing Platforms

As their name suggests, these platforms allow you to lend or borrow crypto. Those interested in lending can deposit their cryptocurrencies and earn interest by keeping their assets on the platform and allowing others to take crypto loans. Borrowers have to pledge collateral and pay certain interest rates to borrow crypto.

In a way, the system is similar to banks, but it’s completely decentralized and peer-to-peer. On top of that, there are no regulations, and everything is handled by smart contracts, facilitating security and transparency.

Examples: Aave, MakerDAO, Curve Finance, Compound

Pros:

- Fully transparent processes

- Simple lending and borrowing

- Peer-to-peer, no third-party interference

- High interest rates

Cons:

- Potentially large collateral

- Price fluctuations can eliminate collateral

Yield Farming Platforms

These types of platforms make it simple for crypto holders to profit from holding their digital assets through yield farming. They let you lend crypto assets to various dApps to provide liquidity and get yield in return. These returns usually come in the shape of an annual percentage yield that’s based on the borrowers’ rates.

Yield farming is what makes DeFi possible. It’s different from staking, as you get rewards for lending assets, not taking part in the governance of a network. Many DEXs provide yield farming services, but there are also dedicated platforms like yield aggregators.

Examples: Yearn Finance

Pros:

- Added passive income

- High percentage yields

- Passively helping the DeFi ecosystem

Cons:

- Market volatility can cause losses

- Small chance of fraud

Stablecoins and Synthetic Assets

This is not effectively a type of DeFi platform, but rather the services they can provide. Stablecoins are a big part of DeFi since they are widely used in DEXs, lending and borrowing platforms, and yield farming platforms. You’ve already learned about MakerDAO in this guide, a platform that focuses heavily on stablecoin trading.

As for synthetic assets, they are effectively crypto derivatives, meaning their value comes from the value of other assets. The top DeFi platforms offer synthetic products like options, swaps, and futures. As a result, investors benefit from exposure, configurable risk, and cash flow patterns.

Example: Compound and MakerDAO

Pros:

- Access to various crypto derivatives

- Allows for liquidity in the DeFi ecosystem

- Stablecoin lending less volatile than other cryptos

Cons:

- Synthetic products can be complex for beginners

Asset Management Platforms

The DeFi space has become incredibly diverse, and traditional web3 wallets can no longer keep track of various digital assets, be they tokens, coins, NFTs, or DeFi positions. This is where DeFi asset management platforms like Yearn Finance, Zerion, and Zapper come in.

These platforms have multi-chain compatibility, can detect DeFi positions, not just assets in crypto wallets, and are largely automated. Using them, you can keep track of all of your assets and positions through a single dashboard.

Examples: Zerion and Zapper

Pros:

- Track both assets and positions in one place

- Various automated capabilities

- Built-in DeFi tools

Cons:

- Many of these platforms are still new

How to Select a DeFi Platform to Use – Our Criteria

Choosing the right DeFi platforms, whether DeFi staking platforms or some other type, requires careful consideration of a few important criteria. Let’s take a look at what these are.

1. Define Your Goals

First, determine your goals for DeFi platforms (e.g., the amount you’re looking to earn through it). Then, it is important to assess whether a platform can meet those goals. In this case, you should check the platform’s APYs.

2. Assess Security Measures

With the DeFi space being unregulated, it’s crucial to look at the security measures the platform offers. If they are not up to current standards, you could be opening yourself to potential cyberattacks. Check for things like multi-signature wallets, end-to-end encryption, and regular audits.

3. Check Platform Reputation

Besides the security aspect, you also need to look into the platform’s reputation. The security features won’t mean much if the platform itself cannot be trusted. The DeFi space is filled with scammers due to its lack of regulation, which is why it’s crucial to go for verifiably safe and trustworthy platforms.

4. Explore Platform Features and Functionality

Once you’ve checked that the platform is safe, you should focus on what matters the most – its features. If you’re there for yield farming, it should have diverse liquidity pools. If you’re looking to earn from staking, it should offer good APYs and a diverse range of tokens. What’s more, it needs to be interoperable with other DeFi protocols, as you’ll likely want to use other dApps and DeFi platforms.

Are DeFi Platforms Safe for Beginners?

If you’re using a reputable platform with excellent security measures, then yes, it’s safe for beginners and advanced users alike.

However, novices need to understand what they’re getting into and how DeFi services work. The DeFi space can be incredibly risky for beginner investors, largely because crypto is volatile and, consequently, the surrounding products.

Profits from DeFi options like staking and lending can be incredibly high. However, you can also lose everything if you make a few bad moves or acquire tokens and enter projects that fall through.

Most of all, you must keep control of your private keys throughout this experience. Finally, you must never let the crowd dictate how you act.

DeFi vs. CeFi Platforms: Which Are Better?

As you can probably guess, decentralized finance and centralized finance are two opposing terms.

DeFi works on decentralized networks, focusing on innovative but fully transparent financial services that rely on smart contracts. CeFi operates with the help of traditional intermediaries and is highly user-friendly, with platforms in the sphere respecting all regulations.

To fully understand the differences and determine which financial platform is better, let’s look at the pros and cons of each:

| DeFi Platforms | CeFi Platforms |

| Peer-to-peer services | Services go through an intermediary |

| Not always user-friendly | Very user-friendly |

| No regulations to worry about | KYC and anti-money laundering requirements are met |

| Some bad apples due to a lack of regulation | All platforms have to be licensed and regulated |

| Highly transparent | Less transparent |

| You can stay completely anonymous | You have to share personal data |

| You hold your crypto assets | Crypto assets held by the CeFi platform |

| You’re responsible for the security of your assets | The platform handles the security of users’ assets |

| Most new projects start here | New projects need to meet many requirements |

| Potential for bigger earnings, but more risk involved | Lower earning potential but less risk |

| Fees are sometimes higher | Fees are typically low |

Conclusion

The DeFi space is incredibly dynamic and moves continuously, which is why you’ll come across a vast number of incredibly diverse platforms that offer one or more DeFi products.

Finding the best platform for your needs can be challenging, considering the sheer volume of the market. However, by following this guide and taking our recommendations into account, the whole ordeal should be easier.

FAQs

Which DeFi platform is the best?

There’s no single best DeFi platform, as many types of decentralized finance platforms often offer completely different services. However, if we look at the main types of platforms, our recommendations are some of the best and most reliable ones in their respective fields.

Is DeFi a threat to banks?

Since its creation, the DeFi industry has been considered a major threat to traditional banking. However, it’s still in the early stages and cannot come close to banking. For example, the revenue of the entire DeFi market in 2024 is $26.17 billion, while the total revenue of just one US bank, JPMorgan Chase, was $158.1 billion in 2023.

What is the best use case of DeFi?

It’s impossible to determine the best use case for DeFi, as it’s implemented in a wide range of services. Some of the most popular ones are decentralized exchanges, DeFi lending platforms, digital asset staking, and various other traditional financial activities facilitated in a decentralized manner.

What is the difference between DeFi and crypto?

DeFi, or decentralized finance, is just an umbrella term for all financial services and platforms built around decentralization. Meanwhile, cryptocurrencies are decentralized digital currencies. Although different, the two are still part of the same industry, focusing on decentralization and blockchain technology.

How safe is it to use DeFi platforms?

As with everything, it depends entirely on the specific DeFi platform you’re looking into. DeFi, due to its nature, can be a great place for scammers, so we recommend using reputable and well-established platforms like the ones on this page.

References

- Beyond banks and brokers: All about decentralized finance (DeFi) (Britannica)

- What is DeFi? (Coinbase)

- Defining DeFi (Decentralized Finance) (Fool)

- DeFi vs. Crypto: What’s the Difference and Why You Should Get Involved? (Litslink)

- DeFi Vs. CeFi In Crypto, With Change Invest (Finimize)

- What are the main types of DeFi platforms? (1inch)

Source: cryptonews.com