A recent Cambridge study confirms that the United States now dominates global Bitcoin mining, raising questions about China’s possible response. While the country has long had anti-cryptocurrency policies, Chinese mining pools have historically controlled a significant portion of the global Bitcoin hashrate.

The current competitive advantages of the US and renewed tensions over trade policy may prompt China to reconsider its position. BeInCrypto spoke with representatives from The Coin Bureau and Wanchain to find out what might prompt China to change its attitude towards digital assets.

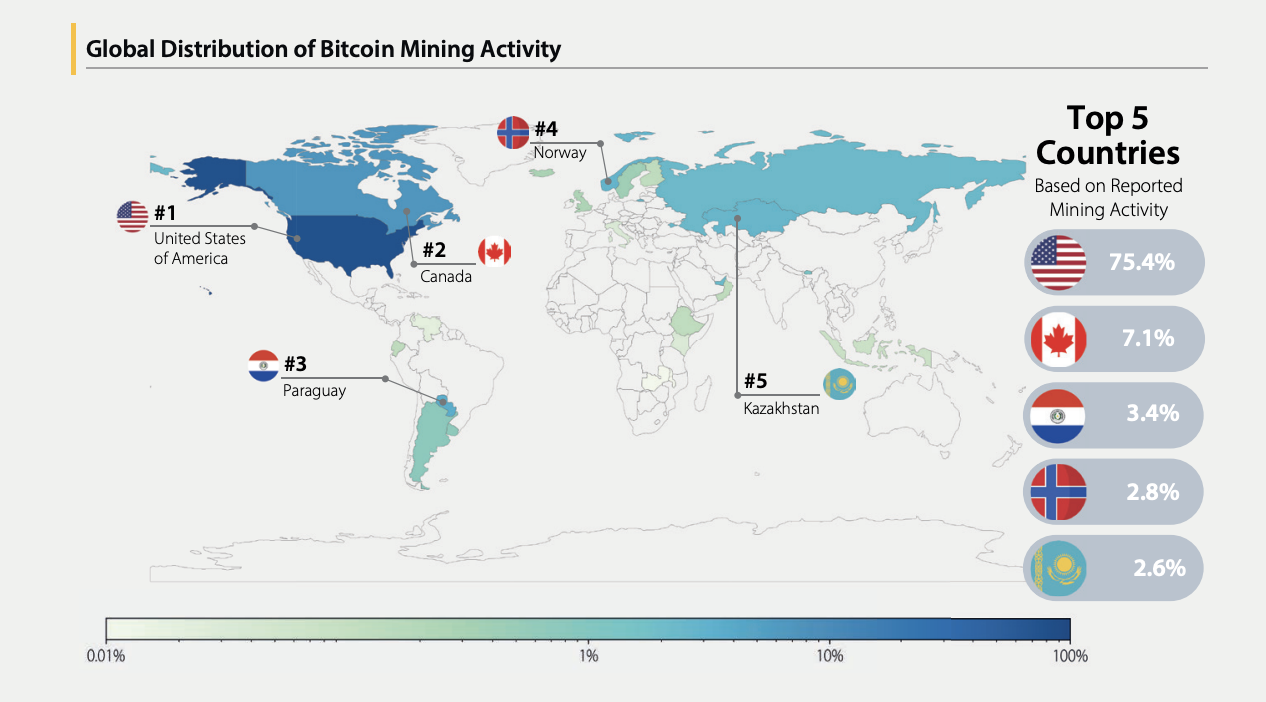

The United States has firmly established itself as the world’s leading Bitcoin mining hub. A recent report from the Cambridge Centre for Alternative Finance (CCAF) found that the US accounts for 75.4% of the total hashrate.

Global distribution of Bitcoin mining activity. Source: CCAF.

Global distribution of Bitcoin mining activity. Source: CCAF.

This latest development confirms a significant shift in the distribution of power in Bitcoin mining. China became the leading Bitcoin mining country back in 2017, using its extensive infrastructure and low energy costs to control more than 75% of the global hashrate at one point.

However, soon after, the country introduced strict measures against the industry.

In 2019, China’s National Development and Reform Commission (NDRC) announced plans to ban cryptocurrency mining, issuing a bill classifying the activity as an “undesirable industry.”

Two years later, at least four Chinese provinces have begun shutting down mining operations, a crackdown that has intensified over concerns about excessive energy consumption.

By the end of 2021, the government declared all cryptocurrency transactions illegal, further tightening the ban and prohibiting foreign exchanges from working with Chinese citizens.

However, China has a proven ability to adapt to geopolitical changes that could threaten its economic dominance, and current conditions may pose such a threat.

Even with China’s official stance on cryptocurrencies, mining activity in the region has not stopped. In July 2024, Bitcoin environmental impact analyst Daniel Batten reported that China’s hashrate currently stands at around 15% of the global total.

“Despite the official ban, the infrastructure still exists, from offshore mining to cross-border trading centers. With the rise of global adoption of cryptocurrencies and the US leading the way, China may be interested in a more strategic approach to this issue, even if it is unofficial,” Nick Pakrin, co-founder of Coin Bureau, told BeInCrypto.

China also has a geographical advantage over the United States, especially in the technology sector.

Mining cryptocurrencies, especially those that use proof-of-work like Bitcoin, relies on specialized integrated circuit (ASIC) hardware to perform the complex calculations required for verification and mining.

China’s position as the largest exporter of cryptocurrency mining equipment, especially to the US, gives it a potential advantage if it decides to relaunch its mining sector.

The unfolding tariff conflict between the two countries adds uncertainty to the long-term economic viability of the U.S. mining industry.

Pakrin believes that the combination of trade tensions and the US’s increased efforts to dominate cryptocurrencies could be enough incentive for China to reconsider its position.

“It is unlikely that China will publicly lift its ban on cryptocurrency mining and trading anytime soon. However, given that US miners now account for an increasing share of Bitcoin’s hashrate, China will likely take this into account and may quietly reconsider its position,” Pakrin added in an interview with BeInCrypto.

However, China has other strategies beyond reviving the Bitcoin mining industry to undermine US dominance.

While China is opposed to the widespread use of cryptocurrencies within the country, it may still see value in digital assets that can help balance the influence of the US dollar as a global currency.

Several countries have already adopted or are considering implementing central bank digital currencies (CBDCs) to strengthen their national currencies. China is at the forefront of these developments.

“Despite the ban on Bitcoin mining, China is actively involved in the digital asset space through initiatives such as CBDC research and the digital yuan, or e-CNY,” Wanchain CEO Temujin Lui told BeInCrypto.

In fact, the desire

Source: cryptonews.net

Your email address will not be published.

[…] January 2022, the number of cryptocurrencies existing in the market increased by 1 thousand. This implies that each new…

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective…

I would like to share my story and express my great gratitude to Maria. My husband Alexander was literally taken…