What Is a Blockchain Reorg and Why It Matters

Blockchain reorganizations, which occur when networks abandon recent blocks to adopt lengthier chains, have revealed vulnerabilities in proof-of-work (PoW) frameworks, exemplified by Monero’s challenges in August 2025 and prior disruptions on other platforms.

Understanding Chain Reorganizations

A blockchain reorganization, often termed a reorg, unfolds when a sequence of blocks is replaced by an alternative chain demonstrating higher total proof-of-work (PoW), effectively altering sections of the ledger. These events reverse transactions in orphaned blocks, returning them to the mempool for potential re-inclusion—or exclusion—in subsequent blocks.

This vulnerability enables double-spending attacks, where malicious actors exploit discarded chains to spend coins while retaining ownership post-reorg. During August 2025, Monero faced multiple reorgs linked to the Qubic mining pool, which achieved overwhelming hashrate control. Qubic characterized its actions as experimental, utilizing its PoW configuration to mine Monero blocks and secure rewards.

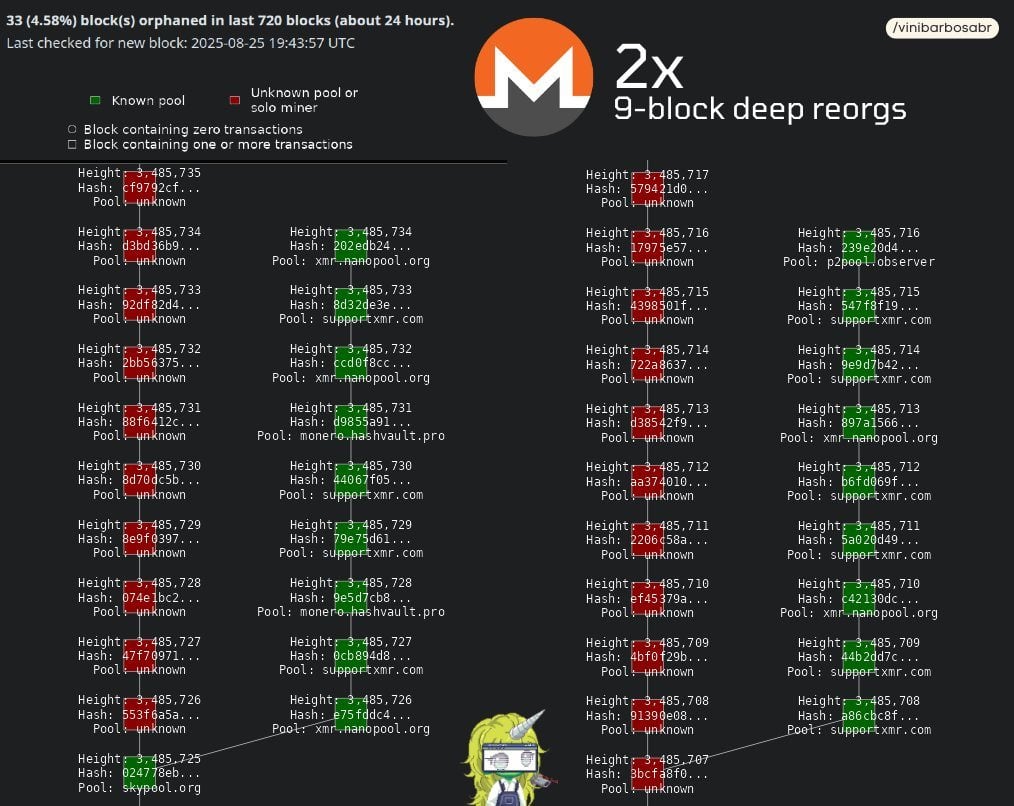

Image source: Vini Barbosa. The X account Vini Barbosa disclosed that Monero experienced two nine-block reorgs within an hour, spanning blocks 3485726 → 3485734 to 3485708 → 3485716.

Image source: Vini Barbosa. The X account Vini Barbosa disclosed that Monero experienced two nine-block reorgs within an hour, spanning blocks 3485726 → 3485734 to 3485708 → 3485716.

Qubic’s dominance initially facilitated a six-block reorganization, demonstrating ledger manipulation capabilities. Subsequent incidents included a documented nine-block reorg occurring twice. Monero’s instability arose from Qubic’s hashrate superiority, enabling covert mining of extended chains before public release, compelling nodes to adopt the new version. Risks encompassed double-spending, transaction suppression, and operational disruptions from erased blocks.

Platforms such as Kraken halted deposits, later imposing a 720-confirmation threshold—significantly exceeding the standard 10—to mitigate exposure. The crisis ignited discussions about overhauling Monero’s consensus model, with suggestions including Bitcoin merge mining, geographically dispersed hardware to dilute pool influence, and Dash-inspired Chainlocks employing masternodes to freeze blocks against reorgs.

In August 2021, Bitcoin SV encountered comparable issues when an unidentified miner commanded majority hashrate, executing an alleged 100-block reorganization. This fractured the chain into three iterations, undermining trust. Investigators attributed the incident to covert miners constructing hidden chains, reintroducing risks like double-spends, network instability, and eroded confidence.

Reorgs underscore PoW’s probabilistic security model: transaction irreversibility strengthens with confirmations, but 51% dominance can negate this. Both cases demonstrate how routine chain corrections can be weaponized, spurring demands for enhanced decentralization and hybrid security measures.

Monero and BSV’s experiences illustrate reorgs’ dual nature—routine maintenance tools versus destabilizing weapons—emphasizing the critical role of hashrate distribution in maintaining blockchain reliability.

Bitcoin (BTC) remains prohibitively costly to attack due to its unparalleled hashrate supremacy among PoW chains. The network operates at hundreds of exahashes per second (EH/s), sustained by globally dispersed ASIC-powered mining facilities.

Attempting a Bitcoin chain reorganization would necessitate covert control over most hashrate—a venture requiring billions in mining equipment, industrial infrastructure, and energy resources. Such expenditure renders attacks economically impractical.

Monero (XMR) and Bitcoin SV (BSV) present lower attack costs due to their substantially smaller hashrate footprints and reduced mining barriers compared to Bitcoin.

Source: cryptonews.net