‘US tariffs on mining rigs are rising sharply’ as CleanSpark, IREN report massive liabilities

Escalating U.S.-led trade policies are significantly impacting the Bitcoin mining sector, as conflicts with Customs and Border Protection (CBP) threaten to impose substantial financial risks on domestic firms.

This insight emerged from The Miner Mag’s recent analysis, exploring how industry players are managing shifting import duties influenced by prolonged economic friction between Washington and Beijing.

Following adjustments to tariff rates by federal authorities, equipment from China now faces a 57.6% levy, while devices imported from Indonesia, Malaysia, and Thailand carry a 21.6% duty, as detailed in the publication.

The report further disclosed that IREN and CleanSpark, two U.S.-based publicly traded miners, received CBP notifications questioning the provenance of their machinery, allegedly linked to Chinese suppliers.

CleanSpark stated liabilities could reach $185 million, while IREN is challenging a $100 million claim from the agency.

Beyond tariffs, mining profitability continues to struggle, with network hash rates stagnating below $60 petahashes per second and transaction fees falling under 1% of block rewards.

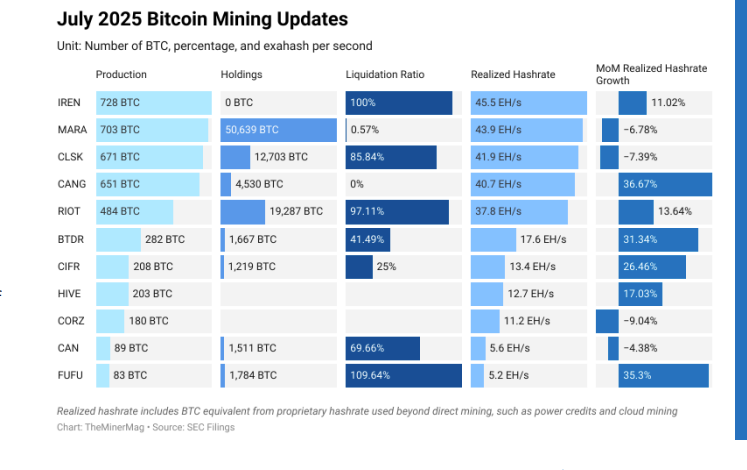

IREN and MARA Holdings each mined over 700 BTC in July. Source: The Miner Mag

IREN and MARA Holdings each mined over 700 BTC in July. Source: The Miner Mag

Amid these tensions, Trump-affiliated firm American Bitcoin recently secured rights to purchase 16,000+ mining units from China’s Bitmain, as reported by Cointelegraph. The deal reportedly shields buyers from tariff-related cost fluctuations.

Related: Jack Dorsey’s Block aims to extend Bitcoin mining equipment lifespan to decade

Hardware providers confront evolving challenges

The sector continues facing adaptation demands, balancing operational expenses, thinning profits, and regulatory uncertainties. Trade disputes have hastened these transformations, compelling miners to refine import strategies and broaden supplier networks.

Industry observers note that U.S. import taxes might reduce domestic hardware demand, possibly benefiting international competitors. Final outcomes will depend on forthcoming tariff decisions from policymakers.

Major Chinese producers like Bitmain, Canaan, and MicroBT have initiated U.S. manufacturing operations to reduce tariff exposure.

Canaan’s approach proves distinctive: After establishing Singapore headquarters, the firm announced American investment plans designed to bypass protectionist measures.

Magazine: Bitcoin’s hidden power struggle: Institutional investors versus crypto idealists

Source: cryptonews.net