Jefferies says Galaxy is positioning itself for growth in a favorable regulatory environment and is starting with an acquisition

In a new research report, Jefferies noted that Galaxy Digital (GLXY) is well-positioned to benefit from the favorable regulatory environment for cryptocurrencies.

Jefferies initiated coverage on the crypto investment bank with a “buy” rating, pointing to the passage of the GENIUS Act in the U.S. as “creating a positive market structure” for Galaxy's business.

The research, published Tuesday, also highlighted Galaxy’s potential to profit from increased demand for artificial intelligence (AI) data centers. Jefferies described Galaxy’s lease of CoreWeave’s 393-megawatt facility in Helios, West Texas, as a “transformative deal.”

Jefferies rates Galaxy shares a buy rating and sets a $35 price target. GLXY shares closed up more than 6% on Tuesday, to $29.11. They were up another 3% in premarket trading Wednesday, to $30.

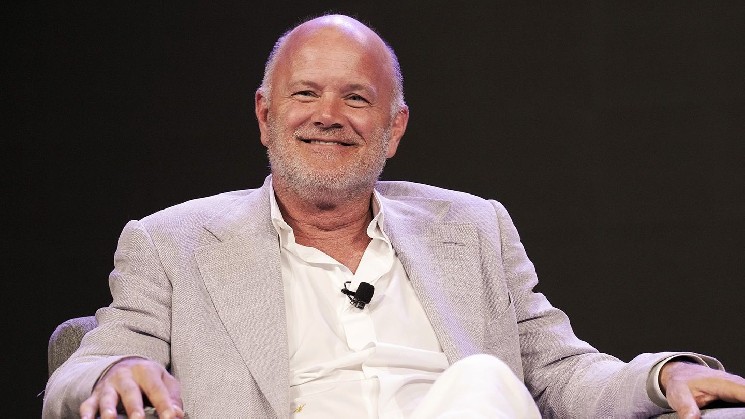

The company, founded by Mike Novogratz, provides financial services in the digital asset space, including trading, asset management and investment banking. However, Jefferies believes that about two-thirds of its value comes from its data center business.

Bitcoin

The $118,193.21 BTC mining industry has adapted to AI data to capitalize on the sector's growth and diversify its revenue streams amid an increasingly challenging BTC mining environment.

AI data centers and Bitcoin mining facilities have a lot in common in terms of the required hardware and high-performance computing (HPC) expertise, so they could be a natural extension for miners.

Source: cryptonews.net