Hashrate Price Below $40? Mining Report Paints Grim Picture for Bitcoin Miners

Bitcoin miners will face the lowest margins since 2023 as the cost of hashrate approaches critical breakeven levels, according to Wolfie Zhao, head of research at theminermag.com.

The study found that Trump's tariffs are increasing uncertainty among miners already struggling due to rising complexity

According to data compiled by Wolfie Zhao and presented on theminermag.com, the hashrate price temporarily dropped below $40 per petahash per second in early April, down from the $45–$50 range seen in March. Zhao points out that the $40 level is the breakeven point even for public giants, adding to the pressure for consolidation in the industry.

The report notes that two consecutive 1.43% difficulty increases in March and another 6.81% increase this month have coincided with falling fees, which now represent less than 1.2% of the block reward. Zhao estimates that the decline in transaction revenue is exacerbating energy costs, leaving the median fleet hashing cost at around $34 per petahash for public miners.

Source: report published by theminermag.com.

Source: report published by theminermag.com.

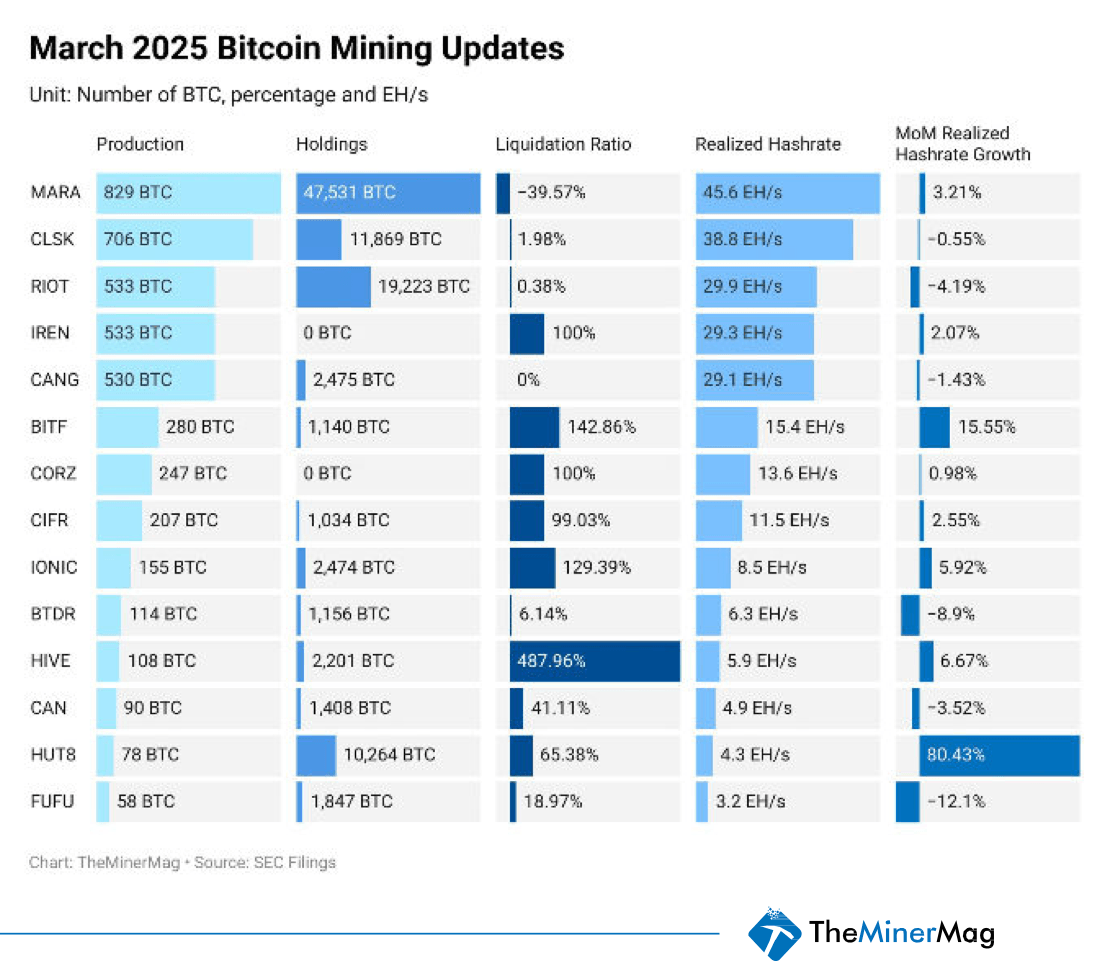

Bitfarms and Hut 8 bucked the trend by increasing their realized hashrate by about 16% and 80% respectively, Zhao reports, while MARA remains the only miner to exceed 40 exahash. However, research from theminermag.com shows that registered Bitcoin miners sold off 42% of their output in March, the highest since October, as companies like Cleanspark shifted strategy from a full hodl to selling assets.

Market sentiment reflects operational challenges. Investor anxiety has been heightened by Trump’s tariff proposals, which threaten the ASIC supply chain. The price-to-hash ratio on Theminermag.com, as described by Zhao, has fallen to $50 per terahash (TH/s), half of its post-election peak, pushing the sector’s market cap below $20 billion.

Zhao concludes that further increases in hashrate by efficient operators in the face of tariff-induced uncertainty could accelerate capitulation among small private miners if the cost of hashrate does not recover.

Source: cryptonews.net