From High Gear to Grind: Bitcoin Hashrate Drops 75 EH/s After Setting New Record

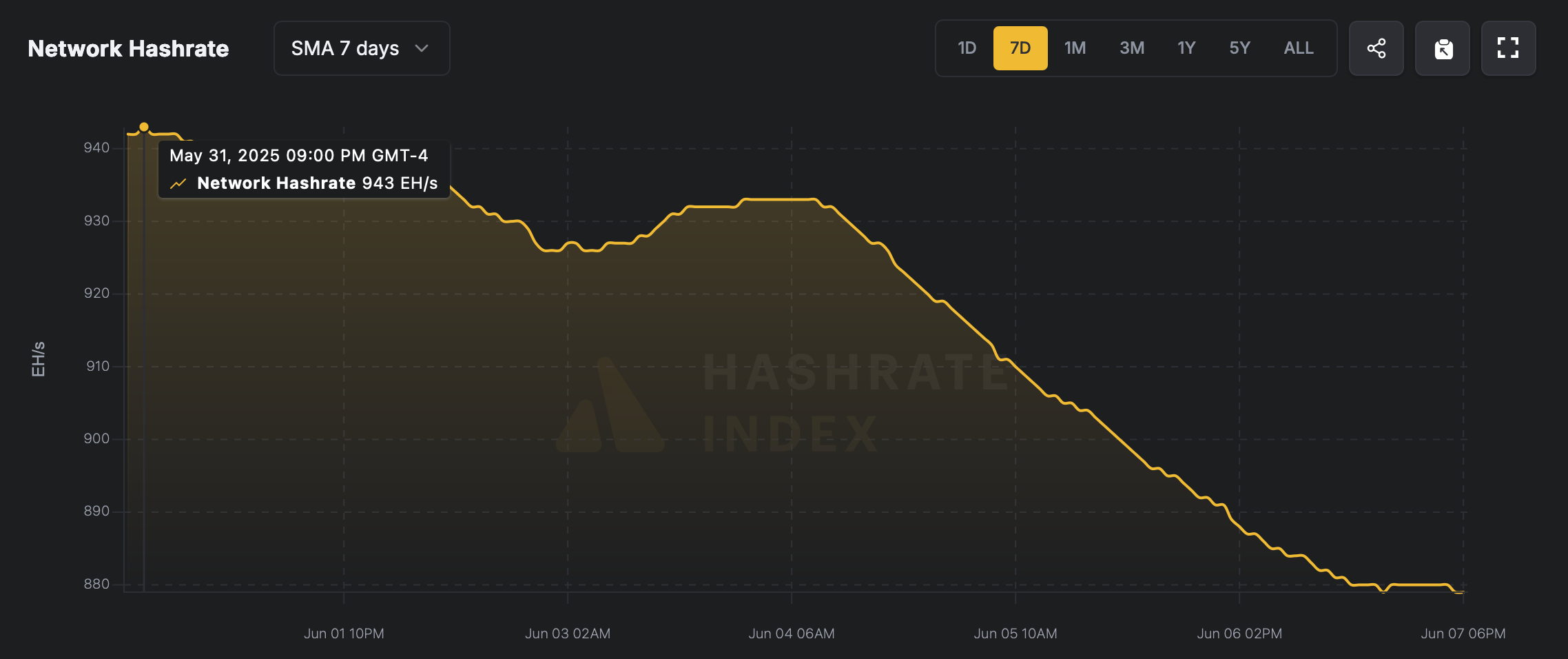

On May 31, Bitcoin's hashrate reached an all-time high of 943 exahashes per second (EH/s), but since then, the network's computing power has dropped by more than 75 EH/s in the last few days.

Bitcoin Block Time Slows Due to Difficulty Rise, Forcing Miners to Leave the Market

Bitcoin miners ended May with a bang, posting their best gains since the fourth halving in mid-April 2024. To top it all off, the network’s computing power, known as hashrate, hit a record 943 exahashes per second (EH/s) on the last day of the month. Fast-forward a week, and the seven-day simple moving average (SMA) shows the hashrate has dropped to 868 EH/s, down 75 EH/s.

Total SMA network hashrate for 7 days since May 31st according to hashrateindex.com.

Total SMA network hashrate for 7 days since May 31st according to hashrateindex.com.

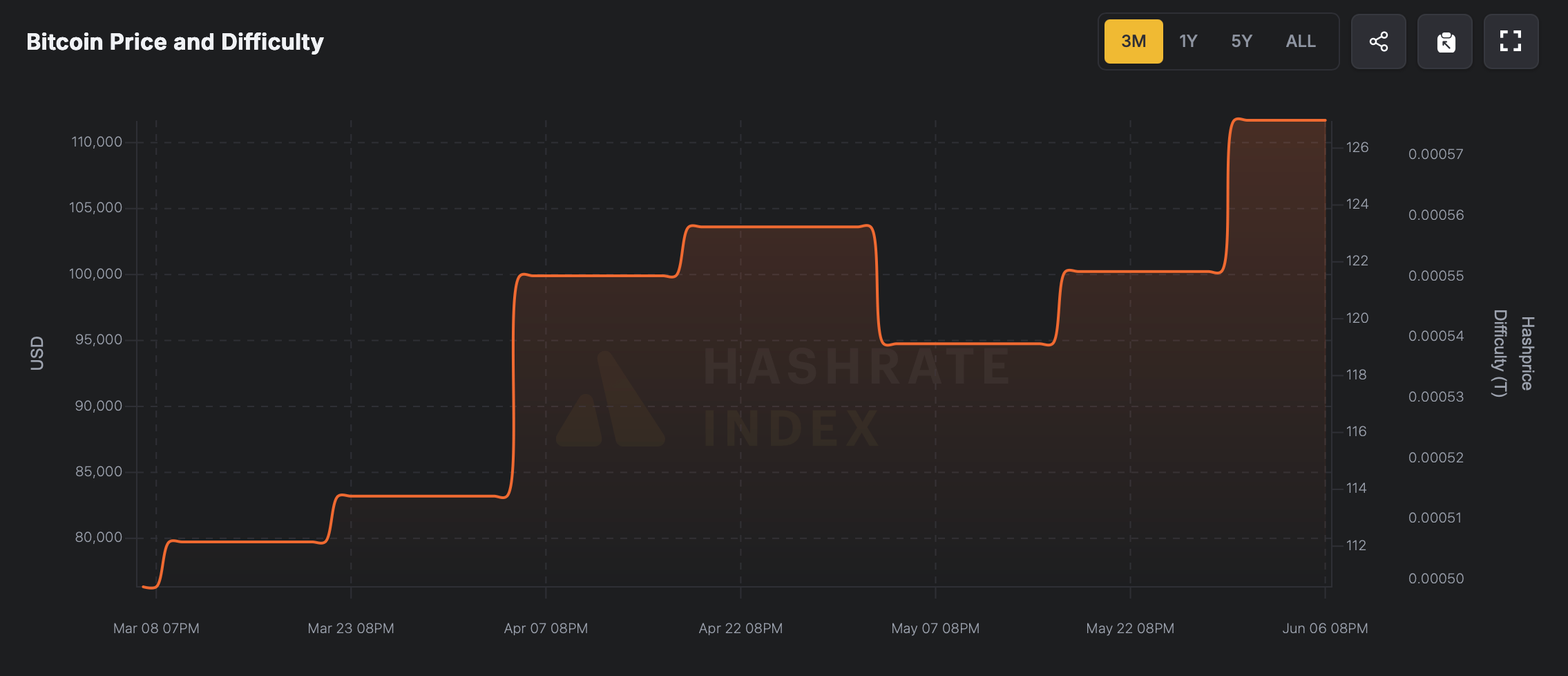

The hashprice — effectively the daily price of one petahash per second (PH/s) — is still higher than it was a month ago, though it has fallen significantly since late May. It was hovering around $57.12 per PH/s on May 29, but has since fallen 7.53% to $52.82, according to hashrateindex.com. One likely culprit? The difficulty adjustment that began on May 30, which pushed the mining difficulty to a record high of 126.98 trillion.

Bitcoin difficulty according to hashrateindex.com.

Bitcoin difficulty according to hashrateindex.com.

A difficulty level of 126.98 trillion means that Bitcoin miners must create a hash that is lower than 1 in 126.98 trillion possible values. As this number increases, so does the effort — mining a block requires more energy and computing power. Bitcoin's built-in adjustment system keeps the rate of block production stable by adjusting the difficulty every 2016 blocks based on changes in the network's hashing power.

As revenue per petahash (PH/s) declines and mining difficulty increases, Bitcoin miners feel pressure from both sides. A decline in PH/s means that each unit of computing power is worth less Bitcoin — or cash — which reduces overall revenue. At the same time, higher difficulty levels force miners to expend more energy and resources to mine a single block. This combination reduces profitability, especially for those working at the limit or facing high electricity bills.

In simple terms, they are getting less, but the costs are rising to maintain their position. This is likely putting pressure on the hashrate. At the moment, the average time between blocks is around 10 minutes and 23 seconds, indicating that the 2016 block cycle is moving slower than usual. If this slow pace continues, it could lead to a decrease in difficulty – and current forecasts suggest a potential drop of 3.72% ahead.

Source: cryptonews.net