Experts Discuss Why Bitcoin Hashrate Plummeted in June

In June, Bitcoin's hash rate fell sharply to its lowest level in a year. The decline came as political tensions between the United States and Iran escalated, sparking speculation about a possible geopolitical connection.

However, experts disagree. What are the arguments on both sides of this debate? Here is a more detailed analysis.

Bitcoin Hashrate Drops After ATH – Is Iran to Blame?

Hashrate is an important indicator that measures the computing power that secures the Bitcoin network and reflects the scale and state of mining activity.

A high hash rate indicates a larger number of miners participating, which increases the security of the network. When this rate decreases, it usually indicates that many miners have temporarily suspended their activities for some reason.

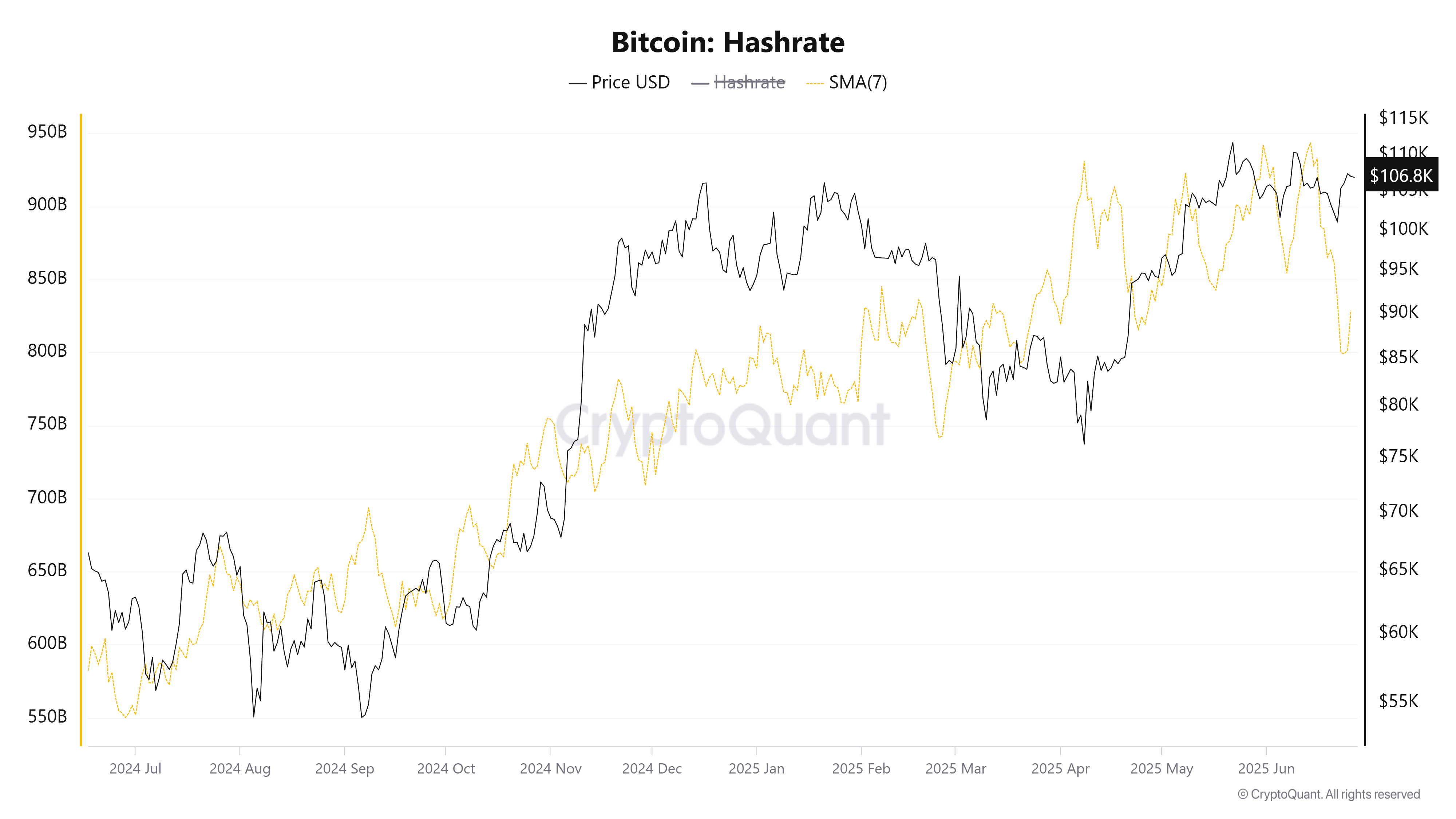

According to CryptoQuant data, the average Bitcoin hashrate has fallen to 800 EH/s over the past 7 days, the lowest level since March 2025.

Bitcoin Hashrate. Source: CryptoQuant

Bitcoin Hashrate. Source: CryptoQuant

The sharp decline occurred between June 14 and 24, coinciding with increased military tensions between Israel, the United States and Iran.

Nick, the founder of CoinBureau, has put forward a provocative hypothesis. He suggests that Iran could use bitcoins earned from oil sales to circumvent sanctions and finance government needs.

In his post on X, Nick estimated that around 3.1% of the world's Bitcoin hashrate could be coming from Iran.

He argued that the drop in hashrate following the US airstrikes may not have been a coincidence. Bitcoin mining facilities controlled by Iran's Islamic Revolutionary Guard Corps (IRGC) may have been targeted.

This theory has found support from the analytics company Elliptic, which pointed out that Iran is using Bitcoin mining as a financial tool to resist international sanctions.

Another analyst, Mike Alfred, went further, claiming that Iran is not only evading sanctions with bitcoin, but is also selling bitcoin obtained through cyberattacks to buy missiles and upgrade its uranium enrichment infrastructure.

“We may have entered an era where countries bomb each other’s Bitcoin mining facilities in the global hash war I predicted in 2017,” Max Keiser told BeInCrypto.

Could the US be the real reason?

Rob Warren, author of The Bitcoin Miner's Almanac, offered an alternative view. He suggested that the decline may be due to domestic circumstances in the US rather than geopolitical conflict.

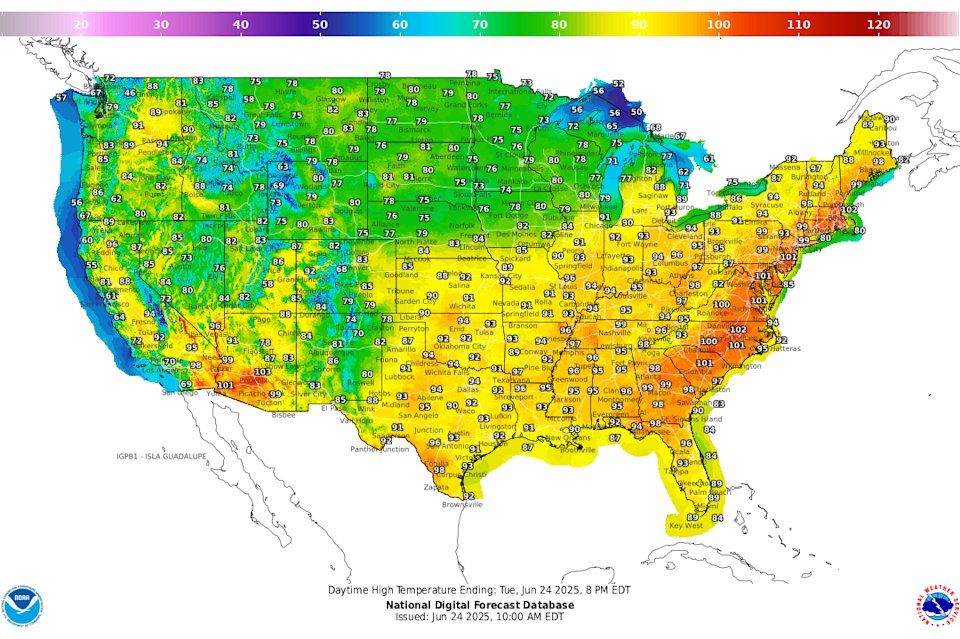

Rather than blaming the airstrikes in Iran, Warren pointed to the heat wave in the United States as a more likely factor.

US Daytime High Temperatures. Source: National Digital Forecast Database (NDFD)

US Daytime High Temperatures. Source: National Digital Forecast Database (NDFD)

“It's impossible to know exactly how many miners are running at any given time. Block time is the only indicator we have for the current hashrate. I'm guessing the decline is due to the US heat dome, coupled with a host of other unknown factors. I don't think Iran is the only explanation,” Warren said.

Tech investor Daniel Batten agreed, citing Occam's razor – the idea that the simplest explanation is usually the true one.

He noted that record temperatures in Texas have increased demand for power on ERCOT's grid, forcing mining companies to cut back on operations to avoid overload.

Data from the U.S. Energy Information Administration (EIA) shows that electricity consumption in Texas has increased significantly, in part due to the growth of data centers and mining operations. Natural gas-fired electricity generation is projected to increase 8% in 2025.

The crypto community is watching closely for definitive answers as geopolitical instability and climate change continue to mount. Regardless of the cause, this hash rate drop is likely to have a long-term impact on Bitcoin’s price and mining strategies.

Source: cryptonews.net