By the end of February, Bitcoin miners' income had fallen by $190 million

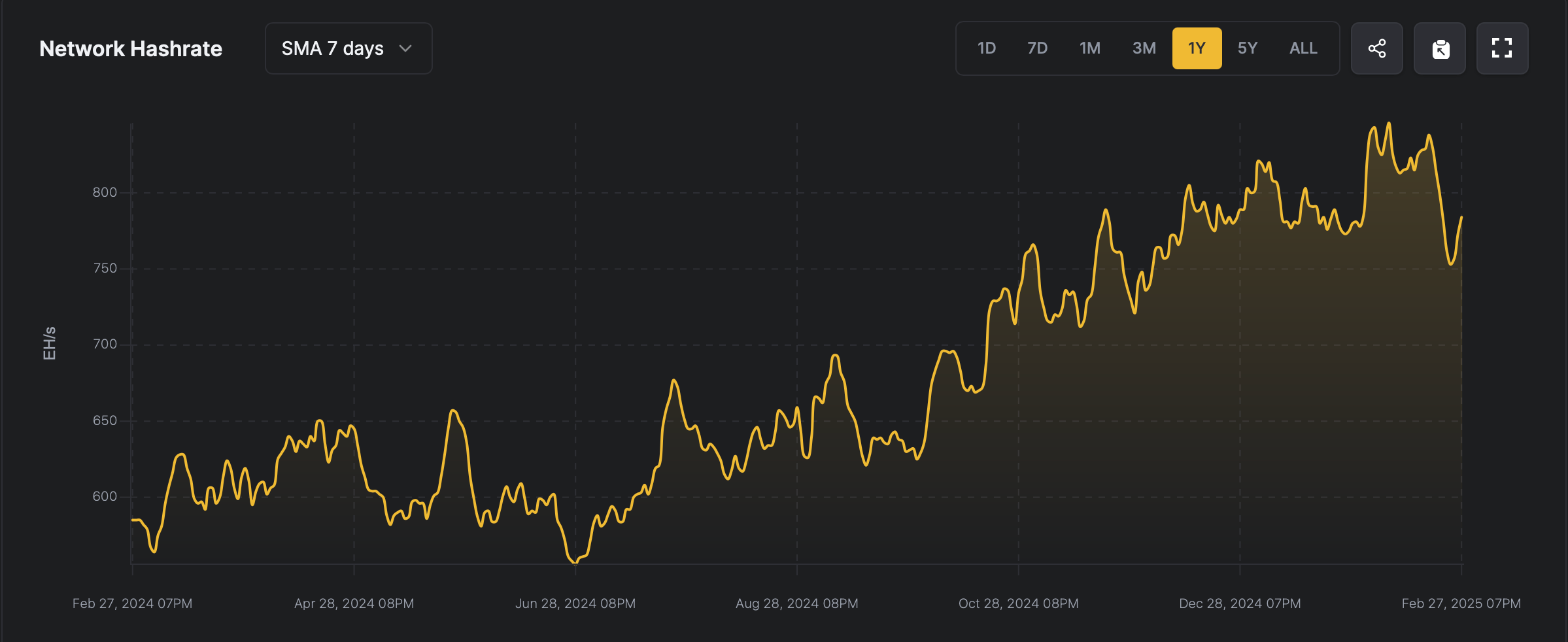

The latest data shows that Bitcoin's hashrate has dropped below 800 exahashes per second (EH/s), which coincides with a 30-day low in mining revenue, commonly referred to as hashprice. As of Friday, hashprice is just below $50 per petahash per second (PH/s), indicating a significant drop in profitability for miners.

Bitcoin Miners Are Struggling

Bitcoin's slide below $80,000 on Thursday was not the best for miners, as their revenues took a hit. Now that Bitcoin (BTC) has climbed back above $83,000, the hash rate — or the implied value of 1 PH/s — has recovered slightly, but remains at its lowest level since January 28.

Bitcoin hashrate via hashrateindex.com

Bitcoin hashrate via hashrateindex.com

On Thursday, the hash rate fell to $45.41 per petahash, and as of 3:30 PM ET on Friday, it had increased to $48.65 per petahash. Just 30 days ago, the hash rate was more bullish at $60.19 per PH/s, highlighting the recent difficulties faced by BTC miners. Bitcoin's hash rate also saw a significant increase in February, reaching 852 EH/s on February 7, 2025.

However, with the current rate of 799 EH/s, the network has lost over 50 EH/s of its computing power, indicating a significant shift in computing resources. The decrease in hash power coincided with a 3.15% drop in Bitcoin difficulty, which occurred five days ago on February 23 at block level 885,024. The network difficulty currently stands at 110.57 trillion, with the next adjustment expected on March 9.

While the official numbers are not yet complete as February 28 has not yet ended, it appears that Bitcoin miners have made less money this month compared to January. According to data compiled by theblock.co, miners earned $1.4 billion from block subsidies and fees last month. However, their revenue this month is $1.21 billion, and there are only three hours and 20 minutes left in February.

Source: cryptonews.net