Bitcoin Mining Revenue Holds Steady at December Levels Minus $40 Million

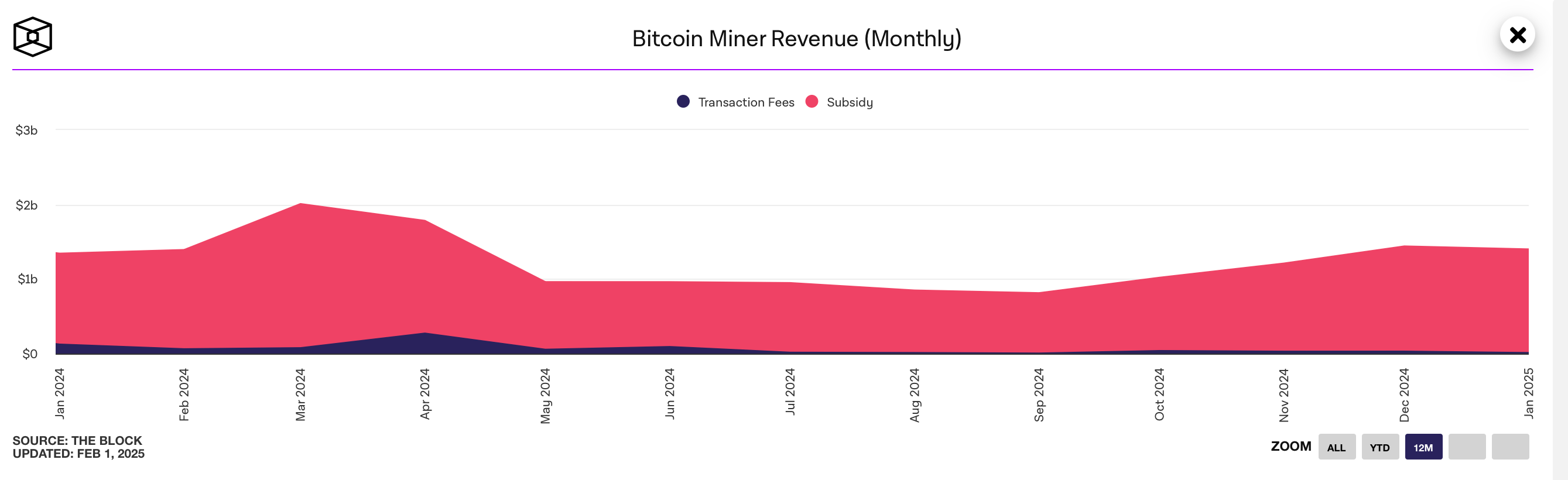

Data gathered from the first month of 2025 reveals that bitcoin mining revenue reached $1.4 billion for January, trailing last month’s figures by about $40 million.

First Month of 2025—Bitcoin Mining Revenue Mirrors December’s Figures

Statistics reveal that bitcoin miners secured about $40 million less than in December, marking the second most profitable month in the past nine months. Metrics sourced from theblock.co indicate that December generated $1.44 billion in revenue from the combined subsidy and fees.

Approximately $39.38 million of the aggregate was amassed from onchain fees. Of the $1.4 billion recorded in January 2025, fees accounted for $20.37 million. These results signal a nuanced environment for bitcoin miners.

While onchain fee revenue and bitcoin prices fluctuate, sustained earnings highlight operational viability amid evolving conditions. Miners must negotiate cost dynamics and market competition as earnings mirror adaptability.

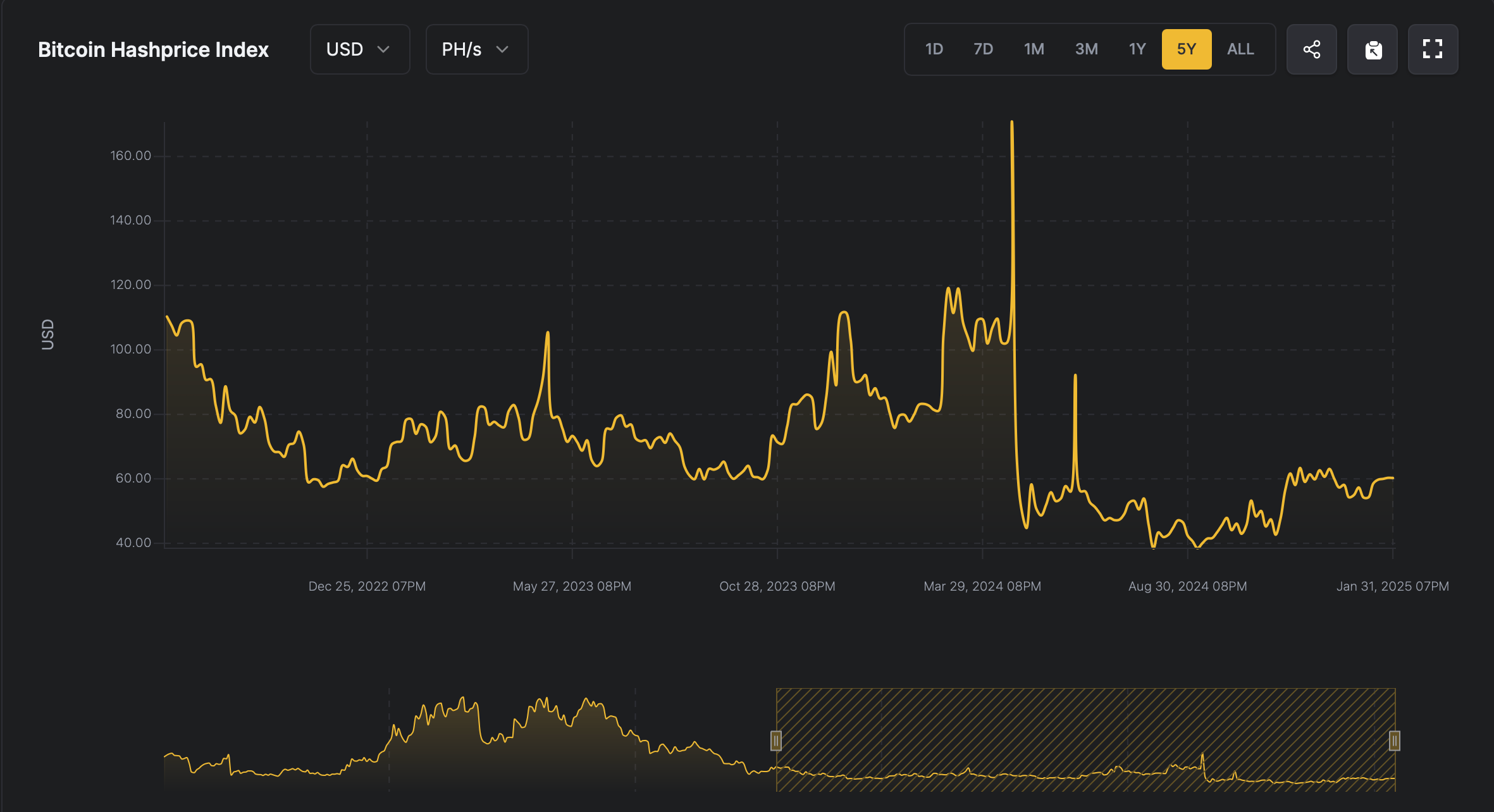

Recently, Bitcoin.com News reported that miners are encountering a lack of transfer activity on the blockchain, a factor that may be behind the lower fee revenue. Despite this trend, the hashprice—estimated value of 1 petahash per second (PH/s) of computational power—is now higher than it was a few months back.

Bitcoin’s hashprice between August 2022 until present.

Bitcoin’s hashprice between August 2022 until present.

For example, on Nov. 4, 2024, 1 petahash was just above $42, and today it stands at $59.94 per PH/s. The network’s total hashrate has dropped but remains around 782.98 exahash per second (EH/s), a modest loss of 39 EH/s since the 822 EH/s peak on Jan. 6.

The latest data implies that bitcoin mining remains at a crucial juncture, calling for strategic flexibility amid changing economic forces. Both investors and operators might discover that adaptability is essential to prospering in an environment defined by gradual operational recalibration.

Others are embracing artificial intelligence (AI) vehicles and bitcoin (BTC) treasury adoption as a means to mitigate losses. As market parameters shift, innovative participants will likely modify their methodologies to sustain profitability and seize emerging opportunities with firm conviction.

Source: cryptonews.net