Bitcoin Miners Face Growing Pressure From Hardware Tariffs, ETF Demand: Bitwise

With import duties reaching 46% and capital being funneled into low-risk Bitcoin assets via ETFs, miners are facing increasing constraints on both costs and funding.

Bitcoin (BTC) miners in the US face two significant challenges: rising hardware prices due to import duties and increasing competition from financial instruments such as ETFs, according to a new report from Bitwise.

In the report, Bitwise’s head of research Andre Dragos and analyst Ayush Tripathi highlight that an estimated 40% of the global hashrate is controlled by US-based mining companies, and the industry is “subject to taxes ranging from 24% to 46% on imported equipment from Vietnam, Thailand, and Malaysia.” These duties come at a time when the cost of hashrate, a key metric for miners’ profitability, is “at an all-time low,” the report notes.

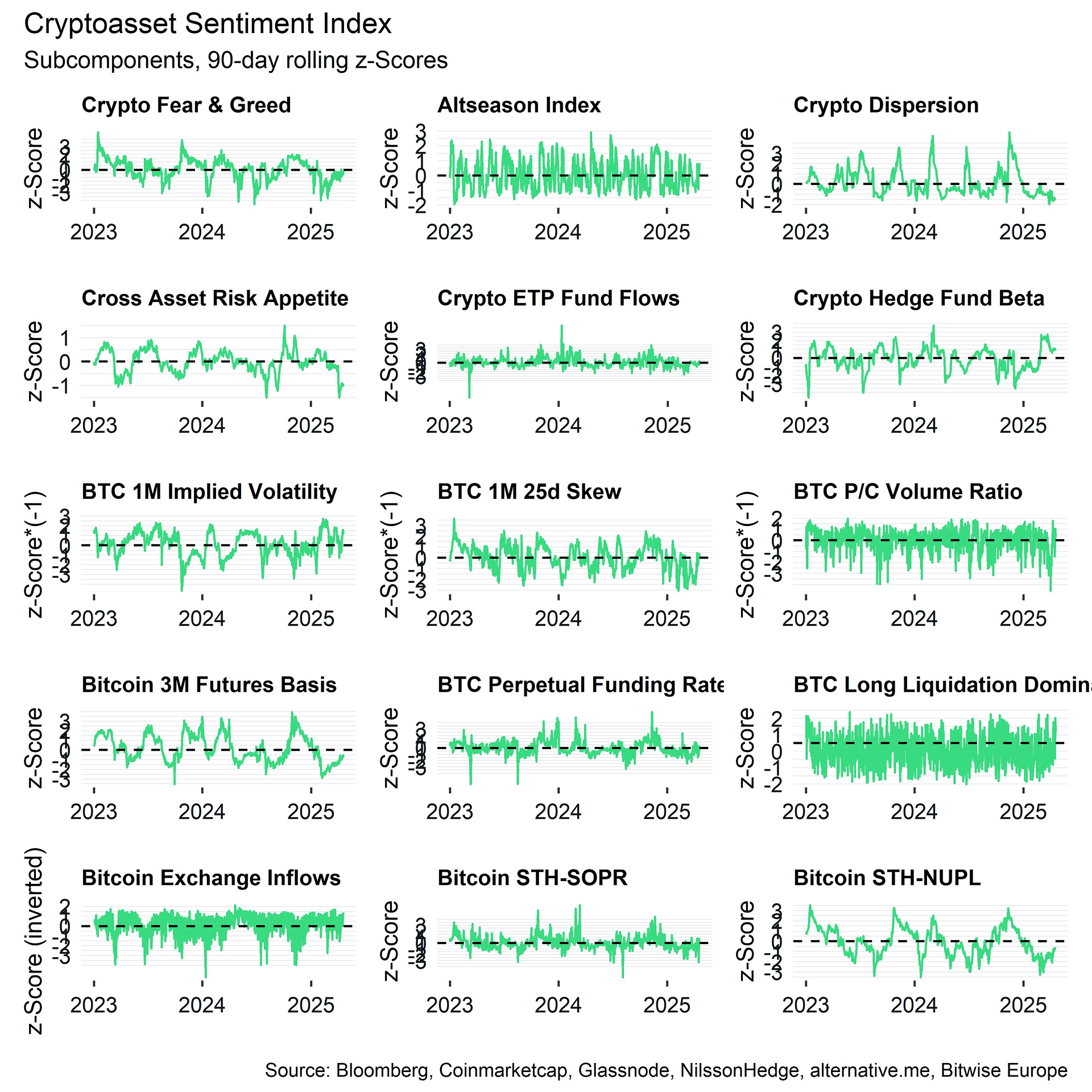

Cryptocurrency Sentiment Index | Source: Bitwise You may also like: Bitcoin Hashrate Hits Record High Amid Miner Selloff

Cryptocurrency Sentiment Index | Source: Bitwise You may also like: Bitcoin Hashrate Hits Record High Amid Miner Selloff

Investor interest is also shifting away from miners. Analysts note that spot cryptocurrency exchange-traded funds and corporate treasuries such as Strategy and Metaplanet are absorbing investor demand, and Bitcoin miners “now face fierce competition on the capital front.”

“These companies can accumulate BTC using low-cost equity or convertible debt, giving investors immediate access to price growth without the operational risks associated with mining. This displaces miners who need to fund significant upfront capital expenditures, navigate an uncertain regulatory environment, and wait months or even years for their investments to pay off.”

Bitwise

However, some companies are adapting to the new conditions. For example, Bitmain-backed crypto miner Bitfufu is considering rerouting its machines to Ethiopia, while Bitdeer is focusing on Norway and Bhutan.

Riot and CleanSpark, two U.S.-based miners, have already absorbed the initial impact of the tariffs by speeding up shipments ahead of the deadline, Bitwise notes. However, despite these efforts, the outlook remains challenging, as miners are clearly “preparing for even more severe challenges,” Bitwise concludes.

Read more: Shares of Bitcoin mining company HIVE Digital rose 2% after completing a 100 MW facility in Paraguay.

Source: cryptonews.net