Bitcoin Miners Brace for Tariff Impact as ASIC Status Undecided

Bitcoin (BTC) mining is the next sector to feel the impact of the tariff war between the US and China. Miners are looking for alternatives as the status of ASICs and mining equipment remains uncertain.

Bitcoin mining is responding to the US-China tariff war as the status of machines and their components remains uncertain. Competition in SHA-256 mining still relies on Bitmain equipment, which is either shipped to locations or uses leased capacity overseas.

The tariff wars came just as Bitmain announced new shipments of its most powerful ASIC rigs. The S21, the most powerful Bitcoin mining machine to date, will begin shipping this month.

🔔Top selling ANTMINER S21e Hyd.

Cost-effective choice for #BTC #mining✅288T

✅4896 W

✅17J/T

Total 💲12/T⏰Sales start April 15 at 9:00 AM (EST)

📦Delivery will be available from April to May pic.twitter.com/jMgq0uaeKW— BITMAIN (@BITMAINtech) April 15, 2025

The 90-day tariff grace period could lead to increased demand for ASIC supply. Miners could also increase their capacity in the US, looking to acquire as much computing power as possible before any supply bottlenecks arise.

Tariffs could cause a rush to ship ASICs to the US

The main question is whether the promised electronic devices and mining equipment will be shipped. The US tariffs affect not only China, but also Malaysia, Thailand and Vietnam, which are part of the ASIC supply chain.

Some mining startups using components from these countries are trying to ship as much goods as possible before the tariffs come into effect.

“ We have started booking cargo planes from Malaysia and Thailand to get cargo to the US ahead of schedule,” said Vishnu McEnchery, director of global logistics and services at Compass Mining.

According to the latest information, ASIC miners do not fall under the exempt electronics category and could be shipped with high tariffs if the trade war is not resolved by the end of the grace period. Compass Mining is one of the companies preparing for the possible consequences, with limited tax exemption options based on the current U.S. tariff system and classification.

🚨 Tariffs and equipment for bitcoin mining 🚨

Following up on the White House's April 11, 2025 update on tariff waivers under Executive Order 14257, let's look at the implications for ASIC miners imported into the US.

In 2018, U.S. Customs and Border Protection (CBP) classified…

— Compass Mining 🧭 (@compass_mining) April 15, 2025

Luxor Technology, another mining hardware supplier, is committed to keeping users informed, but also hinted that tariffs could be imposed on new equipment. As with other electronics, not all supply chains rely on China, with lower tariffs on some machines and components.

The US continues to lead in hashrate

Until recently, all mining ASICs from China were subject to a 25% tax when imported into the United States. Traders got around this requirement by shipping goods from other countries. Now, these regions will also suffer from mutual tariffs, forcing miners to find new potential routes for installation and shipments. Indonesia, Malaysia, and Thailand may be the most vulnerable markets.

At the moment, the US remains one of the leading countries in raw hashrate. Major mining companies like Mara Holdings are increasing their hashrate and creating new capacities.

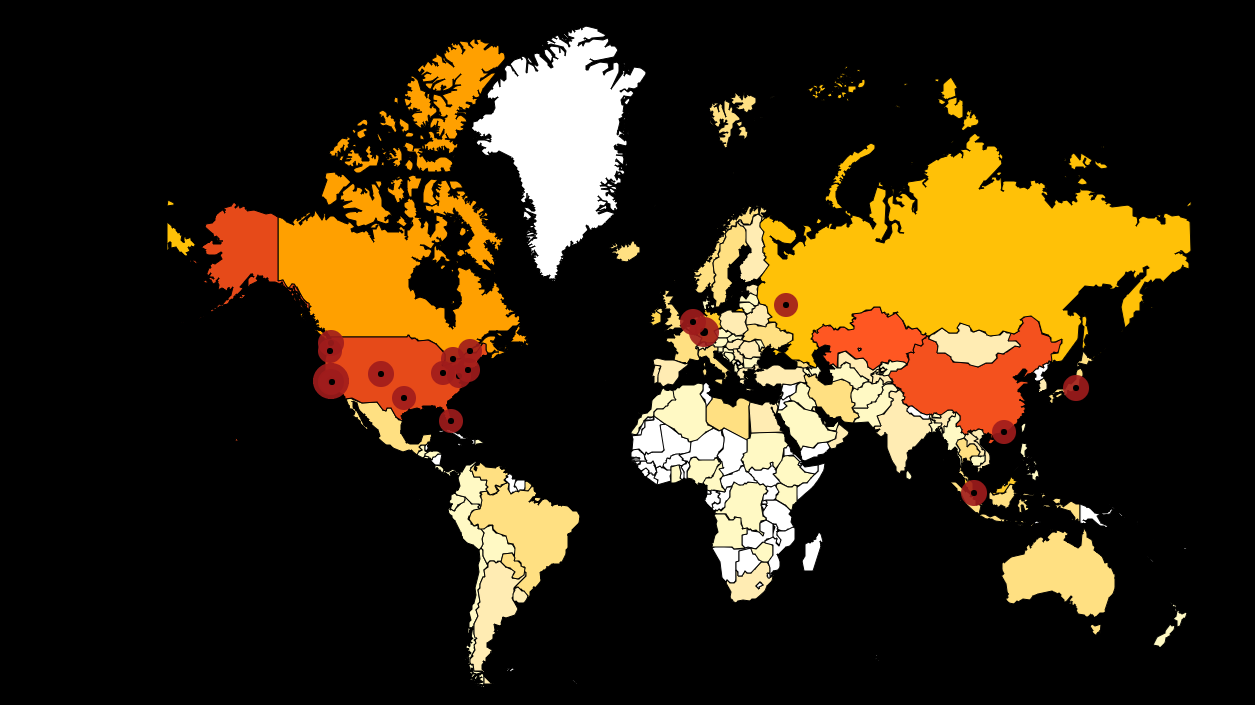

The US continues to be a leader both as a pool aggregator and in hosting local mining data centers. | Source: Chain Bulletin

The US continues to be a leader both as a pool aggregator and in hosting local mining data centers. | Source: Chain Bulletin

The threat of tariffs could have a positive impact on existing mining companies, especially those that have upgraded their equipment and recorded higher hash rates. Shares of U.S. mining companies have risen in the past 24 hours, while China-based Canaan Mining (CAN) has lost 7.2% of its value to $0.26.

FoundryUSA, the largest mining pool in the US, currently generates over 31% of blocks thanks to an influx of foreign miners, while also adding its own hashrate. The Bitcoin network still sees a peak hashrate of 890 EH/s .

Source: cryptonews.net