Bitcoin miners and AI companies compete for cheap renewable energy

Bitcoin mining companies and AI-focused data centers are increasingly competing for access to affordable and stable energy, which could lead to a resurgence of institutional investment in the mining sector over the next decade.

AI data centers with significant financial resources are starting to bid higher for energy infrastructure while many Bitcoin (BTC) miners are left “without value” or losing their mining positions, according to a research report published July 31 by Bitcoin mining infrastructure provider GoMining Institutional.

However, according to Jeremy Dreyer, managing director and chief business development officer at GoMining Institutional, the flexibility of Bitcoin miners allows them to expand into more remote and less well-connected regions, giving them a competitive advantage over AI companies.

This increasing competition for resources will lead to a new wave of institutional investment in bitcoin mining in the next decade, Dreier noted Thursday during Cointelegraph's daily Chain Reaction X Spaces show.

“Over the next five to ten years, thanks to this new fight against AI, we will see a resurgence in Bitcoin mining as real institutional capital flows into this space.”

Institutional investment has already begun to flow into U.S. Bitcoin exchange-traded funds (ETFs), and Dreier described mining investments as the “next step” for such investors.

Bitcoin Miners and the Hidden War on AI (featuring GoMining) #CHAINREACTION https://t.co/zLYMxLKZfR

— Cointelegraph (@Cointelegraph) August 13, 2025

Institutions Push for Cheaper 'Pure' Bitcoin

A logical next step could be to attract institutional capital to bitcoin mining companies as corporations investing in bitcoin ETFs and treasury institutions look to get more accessible bitcoin for their balance sheets.

Related: Bitcoin Briefly Crashes Google's Market Cap as Investors See Rally Above $124K

According to Dreier, more institutions are exploring the possibility of buying cheaper, “clean” bitcoins instead of paying market prices on exchanges. “[Institutions] want to buy genuinely new, newly minted bitcoins at lower prices than what they are selling for on the market.”

Dreier told Cointelegraph that more institutions are turning to GoMining for bitcoin mining infrastructure services in an effort to get more affordable bitcoin for their holdings.

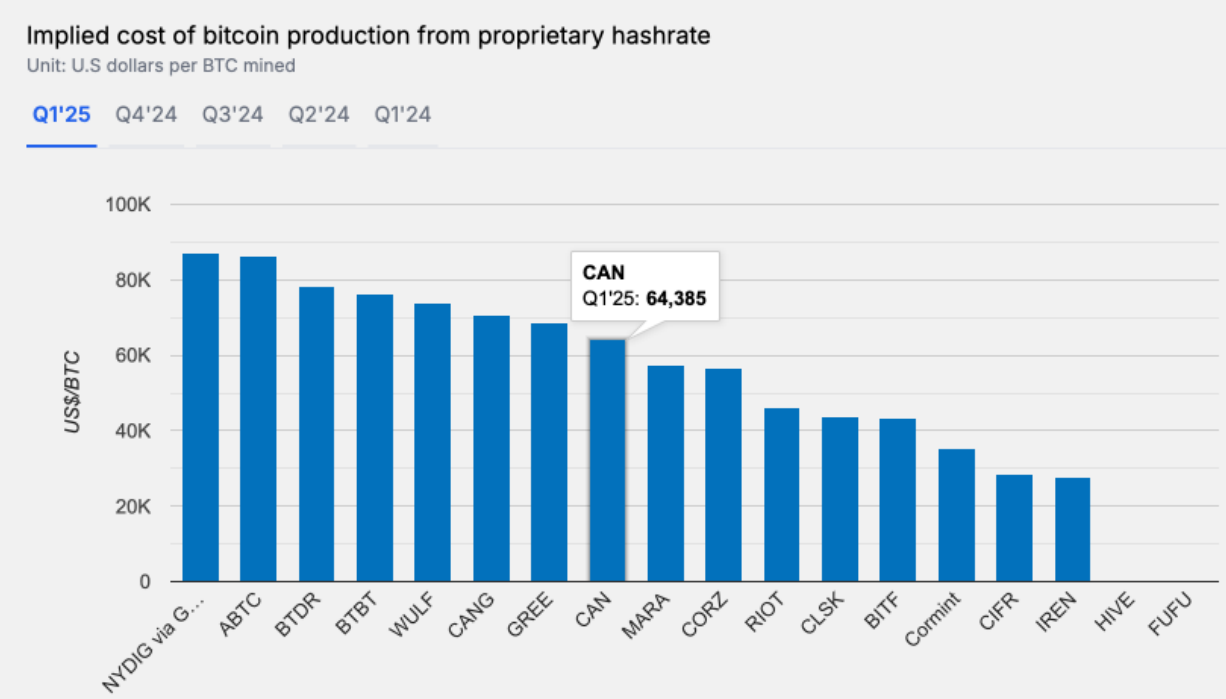

Estimated Cost of Bitcoin Mining. Source: TheMinerMag

Estimated Cost of Bitcoin Mining. Source: TheMinerMag

According to a research report by TheMinerMag, the average cost to mine one Bitcoin is $64,000 in Q1 2025 and is expected to exceed $70,000 by the end of the year. This is 70% lower than the current Bitcoin market price, which is over $119,050.

Related: BitMine Plans to Raise $24.5 Billion as SharpLink Increases Ethereum Fund

Competition for electricity between miners and AI data centers has forced many Bitcoin mining companies to diversify their operations to take advantage of this trend.

For example, Riot Platforms abandoned plans to expand its Bitcoin mining operations in Corsicana, Texas, to explore AI opportunities in the same area.

Iris Energy also announced a strategic shift toward its cloud AI business, placing a self-imposed cap on the expansion of its mining fleet, signaling a “major reprioritization,” according to a report from GoMining Institutional.

However, Dreyer predicts that many public miners “who have switched to AI” will “quickly start returning to investing in Bitcoin mining” as they see institutional capital rotate out.

Others are betting on innovations in bitcoin mining. Bitcoin-focused financial services firm Block Inc. has unveiled a new cryptocurrency mining system aimed at extending the life of mining rigs and reducing operating costs, a potential boost for miners struggling to maintain their capacity, Cointelegraph reported Thursday.

Magazine: The 2025 Altcoin Season Is Right Around the Corner… But the Rules Have Changed

Source: cryptonews.net