Bitcoin Hashrate Recovers: Miners Cope With Revenue Drop

Bitcoin's hashrate has made an impressive recovery from its 752 exahash per second (EH/s) drop on February 25 and is now at 819.65 EH/s, despite a significant drop in revenue in March.

Revenues are falling, hashrate is growing

The network hashrate has increased and is now over 67 EH/s compared to the low on February 25. On that day, the hashrate was 752 EH/s, but it has now stabilized at 819.65 EH/s, based on the seven-day simple moving average (SMA) according to hashrateindex.com. The hashrate is currently about 30 EH/s below its all-time high reached on February 8, 2025.

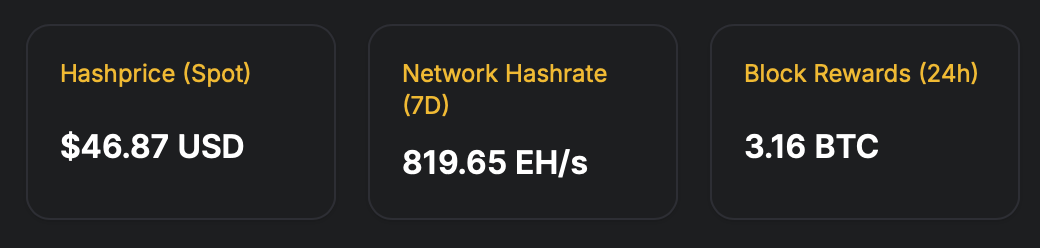

Source: Hashrateindex.com data captured at 12:30 PM ET on March 17, 2025.

Source: Hashrateindex.com data captured at 12:30 PM ET on March 17, 2025.

This growth comes at an exciting time, especially considering that revenue has fallen sharply since the hashrate’s lowest point. On February 25th, the hash price, or the amount miners receive for 1 petahash per second (PH/s) of power each day, was $53.89 per petahash. Fast forward to March 17th, and that number has dropped to $46.87 per petahash, a 13.03% drop in revenue.

Foundry currently ranks first with around 264 EH/s, making it the largest mining pool by hashrate. Antpool is in second place with 159 EH/s, and Viabtc is close behind with 115 EH/s. Combined, these three pools account for around 538 EH/s, or around 65.63% of the total of 819.65 EH/s. The data also shows that between the February 25 low and today, there have been two opposite difficulty adjustments — a 3.15% decrease followed by a 1.43% increase.

Despite the decline in revenue, the recovery of Bitcoin’s hashrate shows that miners have found ways to continue their operations. Large players like Foundry, Antpool, and Viabtc control a significant portion of the network, indicating a continuing trend toward consolidation. Despite fluctuations in difficulty and profit levels, the mining world remains active, proving that Bitcoin’s proof-of-work (PoW) system can adapt and thrive in changing conditions.

Source: cryptonews.net