APAC Bitcoin Mining Goes Green Despite China Underground Activity

Bitcoin mining continues to underpin the cryptocurrency ecosystem. Across the Asia-Pacific (APAC) area, plentiful hydropower resources, natural gas supplies, and excess energy generate both opportunities and regulatory complexities.

While the region presents potential for “green hash” solutions, it grapples with steep electricity prices and inconsistent regulations. For international investors, APAC-based bitcoin miners have become focal points in discussions about energy consumption, operational clarity, and investment pathways.

APAC Bitcoin Mining Landscape

Recent Developments – By July 2025, Bitdeer amplified its hydroelectric mining output in Bhutan to over 1,200MW, establishing the nation as a sustainable mining center. Marathon Digital and Zero Two initiated a 200MW immersion-cooled facility in Abu Dhabi, demonstrating how innovative temperature management and flare-gas utilization enable operations in harsh environments. Concurrently, Iris Energy in Australia reached 50EH/s, reflecting APAC miners’ ability to expand alongside North American and European counterparts.

Historical Context – Following China’s 2021 mining prohibition, the Cambridge Bitcoin Mining Map reveals redistributed activity across APAC nations, though clandestine operations in China endure. Data from Asia-Pacific Economic Cooperation forecasts increasing renewable energy adoption, potentially aligning bitcoin mining with emission-reduction objectives through supportive policies.

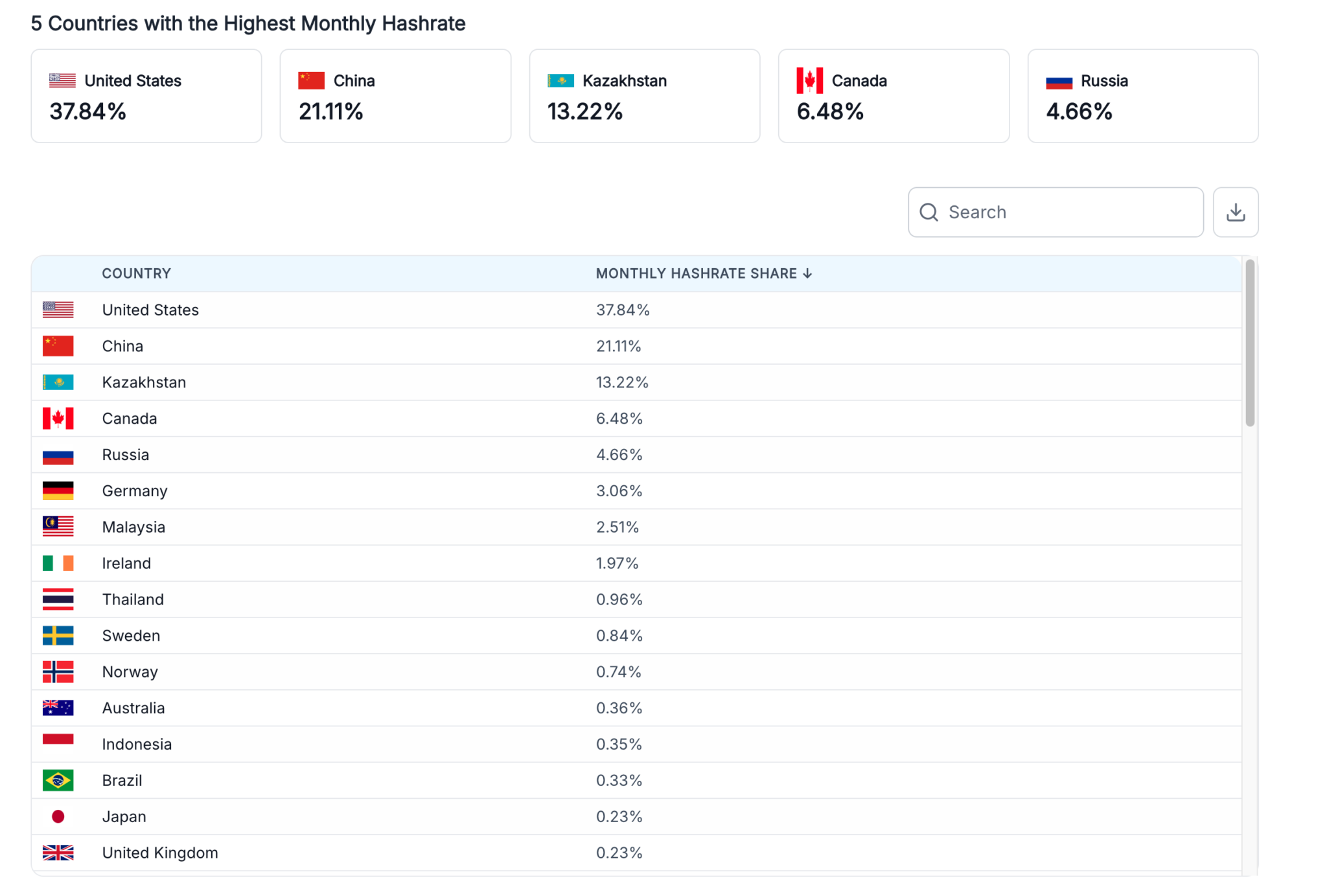

Global Bitcoin Mining Distribution 2025. Source: World Population Review

Global Bitcoin Mining Distribution 2025. Source: World Population Review

In-Depth Perspective – China’s mining landscape remains murky. Despite nationwide restrictions, seasonal hydro operations in Sichuan and small-scale concealed facilities continue. The Cambridge Digital Mining Industry Report 2025 emphasizes unreported Chinese mining activity, creating challenges for accurately evaluating global hash distribution and associated risks.

Effectively, even after the 2021 crypto-mining ban, China contributes over 21% of worldwide hashrate. This resilience stems from covert hydro plants in areas like Sichuan, decentralized operations avoiding government scrutiny, and utilities discreetly offloading excess power. While officially prohibited, Beijing appears to tacitly permit shadow mining activities, introducing substantial opacity and complicating global risk evaluations.

Japan’s expensive energy market constrains local operations. Companies like SBI Crypto and GMO instead manage overseas facilities powered by renewables. Domestically, SoftBank’s 300MW Hokkaido data center exemplifies overlapping energy demands between AI infrastructure and mining. Agreements by PTS to provide enterprise-grade hashrate services in Japan highlight consistent institutional demand.

South Korea investigates energy system synergies. A May 2025 arXiv paper proposes that bitcoin mining could help Korea Electric Power Corporation (KEPCO) reduce financial strain and enhance grid efficiency by utilizing surplus electricity, recasting mining as a stabilizing mechanism rather than an energy drain.

Sustainable Mining Innovations: Hydro, Flare Gas, and Renewables

Bhutan’s collaboration with Bitdeer exemplifies how APAC nations can position bitcoin mining as eco-friendly to attract ESG-focused investments. Abu Dhabi’s cooling technologies demonstrate adaptive strategies for extreme environments through flare-gas usage. Australia’s Iris Energy merges renewable-powered mining with AI infrastructure, operating across digital sectors. These examples illustrate APAC’s shift toward versatile, sustainability-oriented mining models.

Underlying Dynamics – Regional miners navigate domestic policies and international oversight. Japan and South Korea prioritize energy system integration over sheer expansion. Bhutan emphasizes environmental branding, while China’s covert activities fuel transparency issues. The UAE and Australia exploit energy advantages to draw institutional funding and reduce operational expenses.

Wider Implications – Institutional investors require rigorous disclosure practices. While U.S.-listed miners benefit from SEC compliance and market access, APAC operators must harmonize diverse regulatory systems. Enhanced ESG transparency could redistribute investment flows more evenly between Eastern and Western markets.

Future Projections – By 2026, APAC miners may rival Western competitors by merging operational efficiency with verifiable reporting. Success will hinge on adopting next-generation hardware, syncing with renewable grids, and developing regional standards to mitigate investor concerns.

Regulatory Challenges and Regional Vulnerabilities

Key Statistics—The CCAF 2025 report notes technological advancements and geographic shifts in mining infrastructure. Energy forecasts from regional bodies indicate how evolving power systems might alter mining economics and environmental impacts.

Potential Challenges –

- Japan: Prohibitive energy prices limit growth.

- China: Unreported operations distort risk analysis.

- South Korea: Grid integration relies on sustained policy backing.

- Bhutan/UAE: Climate fluctuations impact hydro consistency and gas availability.

- Supply chains: ASIC manufacturing faces trade barriers and geopolitical tensions.

Industry Insights –

“Regulatory uncertainty remains Asian miners’ primary challenge. Without predictable frameworks, investment costs escalate and global capital retreats.”

— Cambridge Centre for Alternative Finance, Digital Mining Industry Report 2025

“Our Abu Dhabi project proves how advanced cooling and gas utilization redefine operational viability in extreme conditions.”

— Marathon Digital Holdings, press release

“Mining-powered energy monetization could strengthen utility finances while optimizing grid performance.”

— ArXiv research, Bitcoin Mining and Grid Efficiency in Korea (May 2025)

The post APAC Bitcoin Mining Goes Green Despite China Underground Activity was originally published by BeInCrypto.

Source: cryptonews.net