Stablecoin News: Gold Tokens Hit Record Market Cap of $1.4B Amid Sharp Rise in Trading Volumes

Tokenized gold market cap hits record high of $1.4 billion as trading volumes surge in March

The total stablecoin market, including tokens linked to currencies and commodities, has surpassed $230 billion, posting 18 consecutive months of growth, according to a report from CoinDesk Data.

Christian Sandor | Edited by Steven Alpher Updated 28 Mar 2025 20:04 UTC Published 27 Mar 2025 20:11 UTC

Key points:

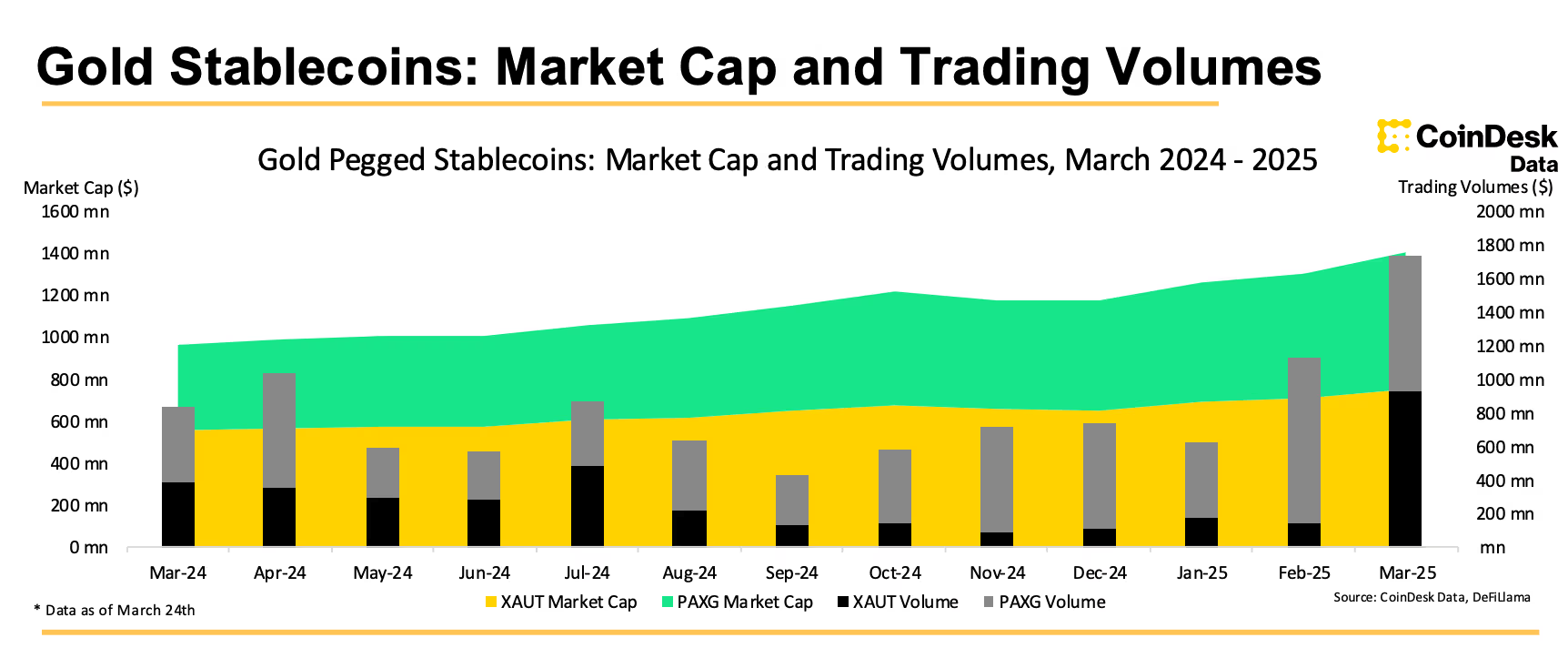

- According to CoinDesk Data's stablecoin report, the market cap of gold-backed tokens hit a record $1.4 billion in March, with Tether XAUT and Paxos PAXG leading the market.

- Tether's USDT market cap has risen to $144 billion, although its market share and leading position in trading volumes have declined.

- Regulatory changes impact euro-pegged stablecoin market: Circle EURC stablecoin surges nearly 30% to $157 million market cap

According to CoinDesk Data's monthly stablecoin report, the market cap of tokenized gold surged to a record $1.4 billion in March, with trading volumes reaching yearly highs.

The increase in market value and activity comes as physical gold prices have risen, reaching new all-time highs above $3,000 per ounce. Notable offerings include gold-backed tokens such as Tether (XAUT) and Paxos (PAXG), with market caps of $749 million and $653 million, respectively.

The report said that gold token trading volume for the month exceeded $1.6 billion, the highest in more than a year.

The report highlighted that the overall stablecoin market, including tokens that are pegged to fiat currencies and commodities, surpassed a market capitalization of $231 billion this month, posting 18 consecutive months of growth.

Tether’s USDT, the largest stablecoin on the market, also grew to a record supply of $144 billion. However, its market share fell to its lowest level (62.1%) since March 2023 as competition

Источник