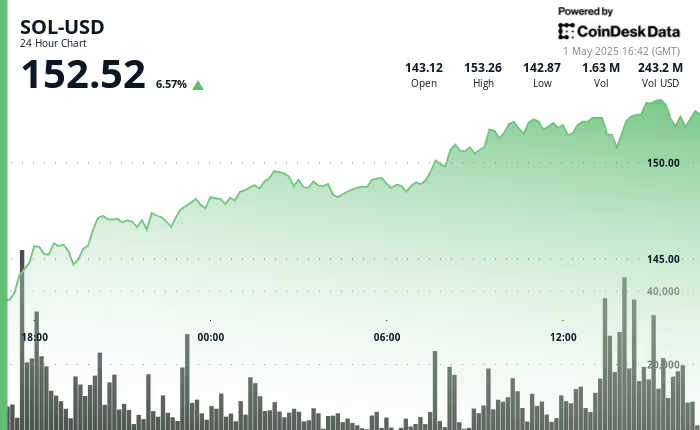

Solana jumps 8% despite global macroeconomic tensions. Could it hit $155 in the short term?

Solana up 8% despite global macroeconomic tensions, could it hit $155 in the near future?

Despite the overall uncertainty in the market, SOL has shown remarkable resilience, recovering from April lows and establishing new support levels above $150.

Author: AI Boost | Edited by: Aoyon Ashraf May 1, 2025, 5:09 PM

What you should know:

- Trade tensions between the US and China are heating up as new tariffs threaten global supply chains, creating market uncertainty that is affecting crypto assets including SOL.

- Solana has shown remarkable resilience, recovering from a 7.4% drop to reach new period highs of $152.69 despite overall market volatility.

- According to CoinDesk Research's technical analysis model, bullish momentum appears stable with higher lows forming, indicating a possible extension towards the psychological 155.00 level.

Geopolitical tensions and changing trade policies continue to impact cryptocurrency markets, with Solana taking center stage amid global economic uncertainty.

SOL has shown impressive resilience, rising 8% from its April 30 low of $140 to around $152, with daily trading volume up 35% in 24 hours. This resilience comes as trade relations between the US and China deteriorate, creating ripple effects across both traditional and digital asset markets.

The gains came as the broader CoinDesk 20 Index gained about 4% on Thursday.

Key Points of Technical Analysis

- SOL recovered from a significant 7.4% correction on April 30, falling from 148.03 to 140.63 before reaching a new period high of 152.69.

- The overall trading range of 12.04 points (8.3%) shows volatility, with strong support established at 140.65.

- Volume analysis shows increased trading activity during the correction (volume over 2.4 million), followed by sustained buying interest during the recovery.

- According to technical analysis data from CoinDesk Research, recent price action is forming an ascending channel with resistance at 152.50, while the 148.50-149.50 zone serves as a key support level.

- Bullish momentum appears stable with higher lows forming, suggesting a possible continuation of the move towards the psychological level of 155.00.

- SOL has shown significant volatility over the last 100 minutes, falling sharply from 152.38 to a low of 150.74 before showing a V-shaped recovery to 152.49.

- Key support was established at 151.10, where significant buying volume was observed (more than 44 thousand).

- The mid-session rise from 151.22 to 152.60 coincided with the highest volume spike (126k at 2pm), indicating strong institutional interest.

- A short-term ascending channel has been formed with resistance at 152.68 and support at 152.32.

- The 152.45-152.50 zone now acts as the immediate resistance that could determine the short-term direction.

Disclaimer: This article was generated by AI tools and reviewed by our editorial team to ensure accuracy and adhere to our standards. For more information, see CoinDesk's full AI policy. This article may include

Источник