RWA News: Tokenized Real Estate Market to Reach $4 Trillion by 2035, Deloitte Predicts

Deloitte predicts the global tokenized real estate market could grow to $4 trillion by 2035

The report says that moving loans, funds and land rights to blockchain could transform the private real estate market.

Author: Christian Sandor | Edited by: Cheyenne Ligon Updated: April 25, 2025, 5:46 PM Published: April 24, 2025, 8:16 PM

What you need to know:

- According to a report from the Deloitte Center for Financial Services, real estate tokenization is expected to become a mainstream way to finance, own, and trade real estate, and the market could reach $4 trillion by 2035.

- Tokenization offers benefits such as increased operational efficiency, faster settlements, and expanded access for investors.

- Despite its potential, the industry continues to face challenges, including asset custody issues, regulatory uncertainty and default risks.

Once a niche experiment, real estate tokenization could soon become a fundamental principle of how real estate is financed, owned and traded, according to a report released Thursday by the Deloitte Center for Financial Services.

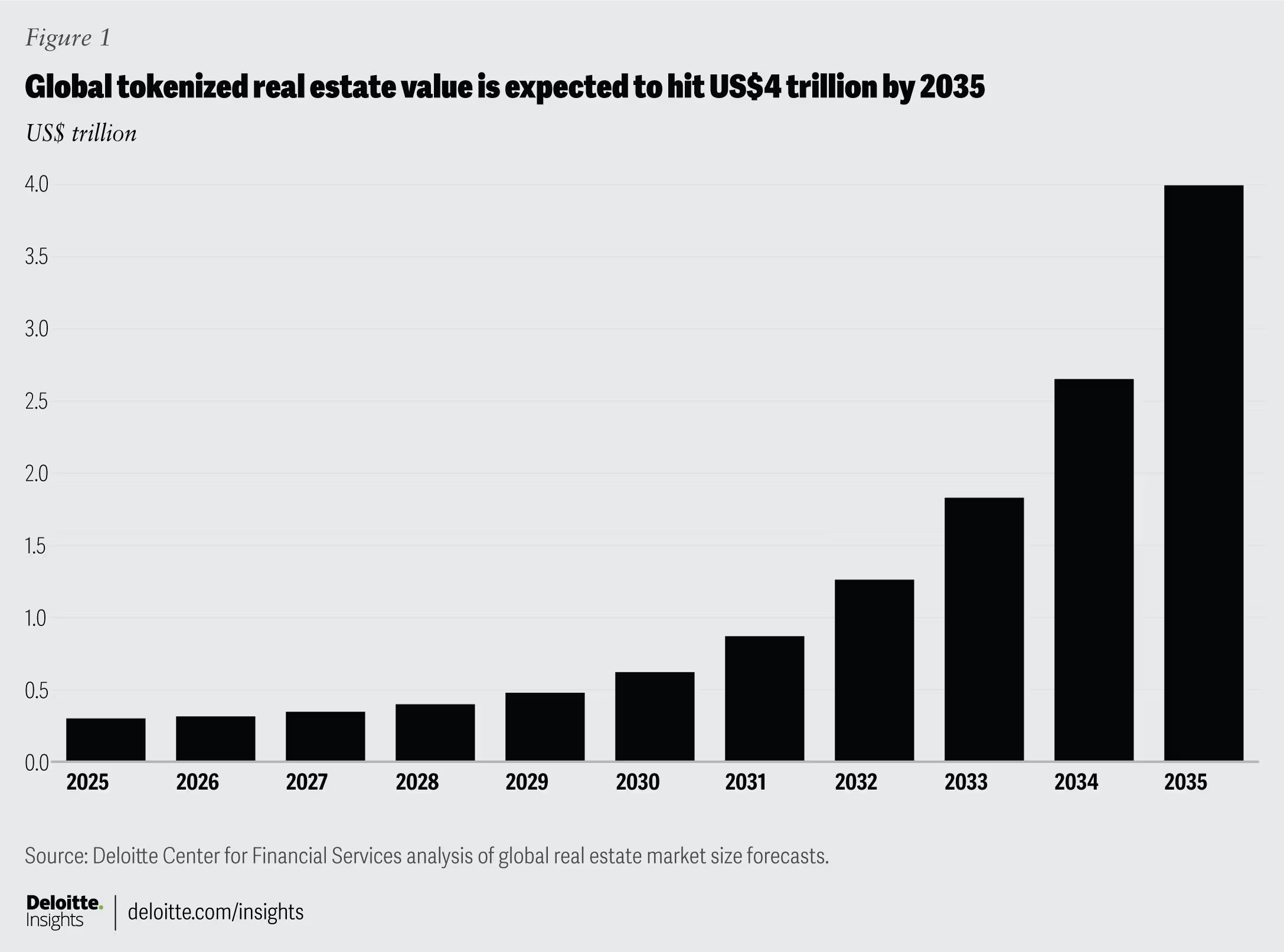

The company predicts that the tokenized real estate market could reach $4 trillion by 2035, growing at an average annual rate of 27% from its current level of less than $300 billion.

Real-world asset tokenization (RWA) is a rapidly growing field at the intersection of crypto and traditional finance. It involves creating digital analogues of assets such as bonds, funds, and real estate that represent property rights on blockchain technology.

This process provides operational efficiency, more cost-effective and faster settlements, and expanded access for investors.

For the real estate sector, the appeal of tokenization lies in its ability to automate and simplify complex financial agreements, the report noted, such as launching a real estate fund on a blockchain with coded rules that handle property transfers and cash flows. As an example, Deloitte cited Kin Capital’s $100 million Chintai real estate debt fund tokenization platform, which uses trust deed-based lending.

The report outlines a three-stage evolution of tokenized property: private real estate funds, securitized credit holdings, and land development or construction projects. Tokenized debt securities are expected to dominate, reaching $2.39 trillion by 2035, according to the report’s forecast. Private funds could account for about $1 trillion, while land development assets could reach approximately $500 billion.

Источник