Long-Term Bitcoin Holders Brace for BTC Price Rise, Stock Up as Short-Term Holders Exit

Long-term Bitcoin holders show their commitment by buying more BTC than short-term investors sell

With BTC rising above $90k, LTH continues to hold on to its assets while millions of coins are still in the red.

James Van Straten | Edited by Sheldon Rebeck Updated April 24, 2025, 2:43 PM Published April 24, 2025, 7:44 AM

Key points:

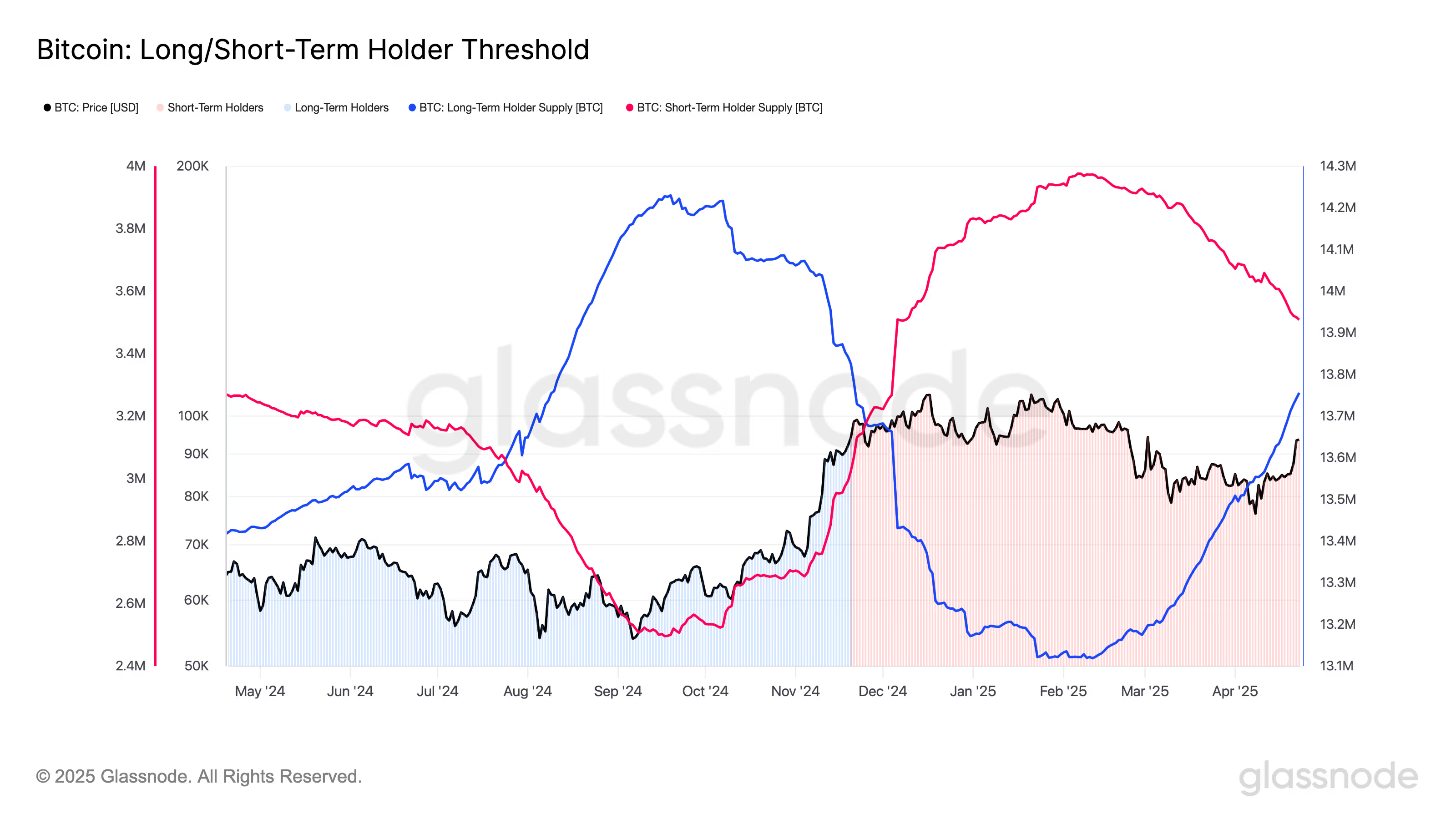

- Since January, long-term investors' holdings have increased by 635,340 BTC, outpacing the amount allocated to short-term holders with an accumulation ratio of 1.38:1.

- Despite the recovery in Bitcoin prices, 2.6 million BTC remain in the red, indicating continued resistance from investors who bought the cryptocurrency at prices above $95,000.

For every Bitcoin (BTC) sold by short-term holders, long-term holders (LTH) have accumulated 1.38 BTC, a clear sign of their dedication as the largest cryptocurrency continues to rise.

Since hitting its low in January, LTH has acquired 635,340 BTC, bringing its total holdings to 13,755,722 BTC, according to Glassnode data. This group, defined as holding bitcoin for at least 155 days, typically accumulates assets during market downturns and sells them during periods of growth.

In contrast, short-term holders (STH) — those who have purchased BTC in the last 155 days — have distributed 460,896 BTC, often taking profits or selling at a loss. Their holdings currently stand at 3,516,265 BTC.

The 155-day threshold dates back to around November 20, when the price of Bitcoin rose from $65,000 to $95,000. Many investors who bought during that rally are now long-term holders, confirming the strength of the conviction behind the decision. Despite a 30% decline from Bitcoin’s all-time high of $109,000 in January, LTH continues to hold on to their holdings on average.

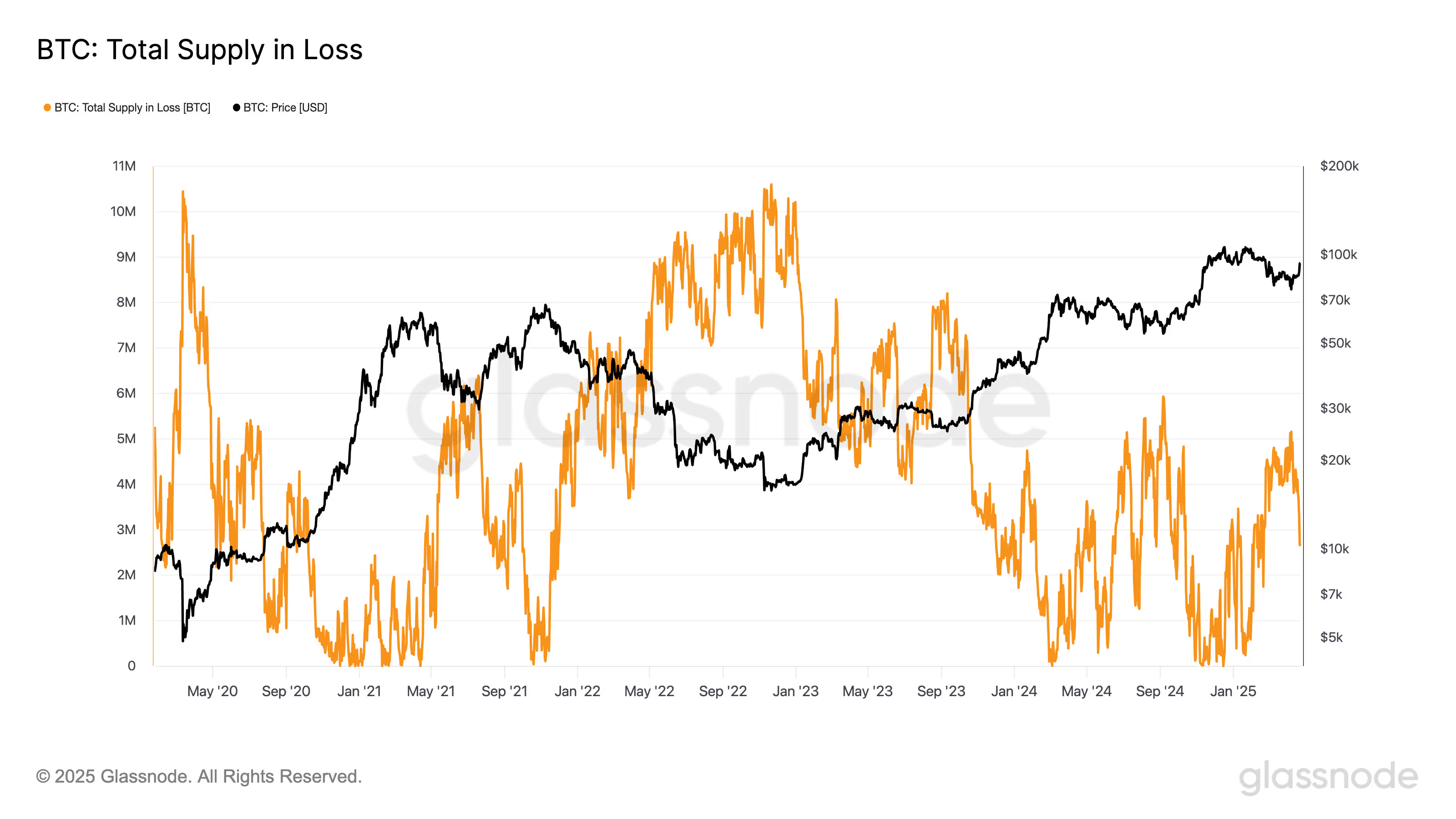

While Bitcoin has once again reached levels above $90,000 after spending a long time below that threshold since early March, a significant number of coins are still showing losses. About 2.6 million BTC are in the red, which is about half the peak of over 5 million BTC earlier this month, but still indicates significant unrealized losses. Many of these coins were purchased during the euphoria above $100,000.