Gold ETF Inflows Outpace BTC ETFs Amid Historic Rally

Gold ETF Inflows Outpace Bitcoin ETFs Amid Historic Gains

Rising gold prices and significant outflows from Bitcoin ETFs have helped push gold ETFs higher as precious metals prices reach record levels.

Francisco Rodriguez | Edited by Aoyon Ashraf Mar 15, 2025 17:26 UTC

Key points:

- Over the past three months, Bitcoin has fallen by 19%, while gold has risen by 12.5%.

- Since the end of February, there have been $3.8 billion in outflows from Bitcoin ETFs.

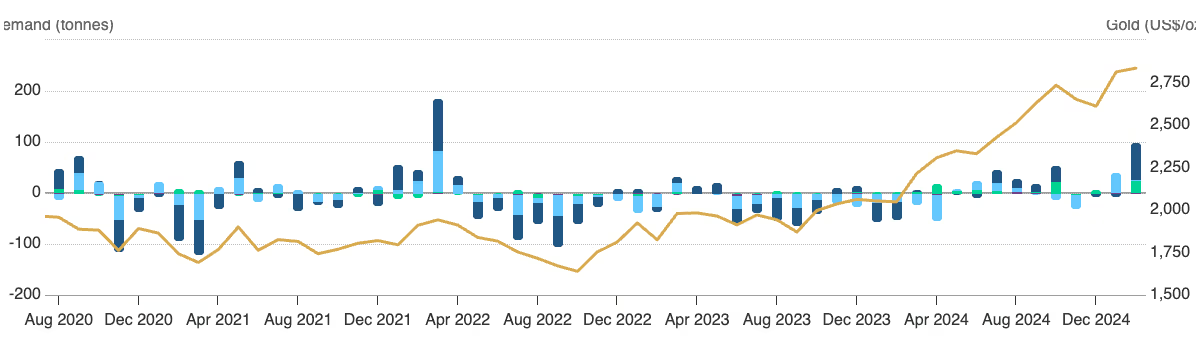

- Gold ETFs have seen their largest monthly inflows since March 2022.

Gold exchange-traded funds (ETFs) have outpaced Bitcoin ETFs in assets under management as investors turn to traditional safe havens amid a more than 19% drop in BTC over the past three months, while the precious metal has gained 12.5%.

Bitcoin ETFs, which saw significant inflows after their U.S. launch last January, have seen significant outflows, losing about $3.8 billion since Feb. 24 this year, according to Farside Investors. Meanwhile, gold ETFs saw their largest monthly inflow since March 2022 last month, according to the World Gold Council.

These flows have led to gold ETFs once again “reclaiming the asset class crown over Bitcoin ETFs,” as Bloomberg senior ETF analyst Eric Balchunas noted on social media.

The Empire Strikes Back: Gold ETFs Reclaim the Asset Crown Over Bitcoin ETFs, Up 12% This Year https://t.co/ls67z5sIs5

— Eric Balchunas (@EricBalchunas) March 14, 2025

In December 2024, US-listed Bitcoin ETFs surpassed gold ETFs in assets under management for the first time as the crypto market surged following Donald Trump's victory in the US presidential election.

Meanwhile, gold has been on a strong run, breaking through $3,000 an ounce for the first time on Friday, with futures

Источник