Cryptocurrency trading volumes plunge 20% in February on global trade war fears

Cryptocurrency trading volumes plunge 20% in February amid investor concerns over import duties

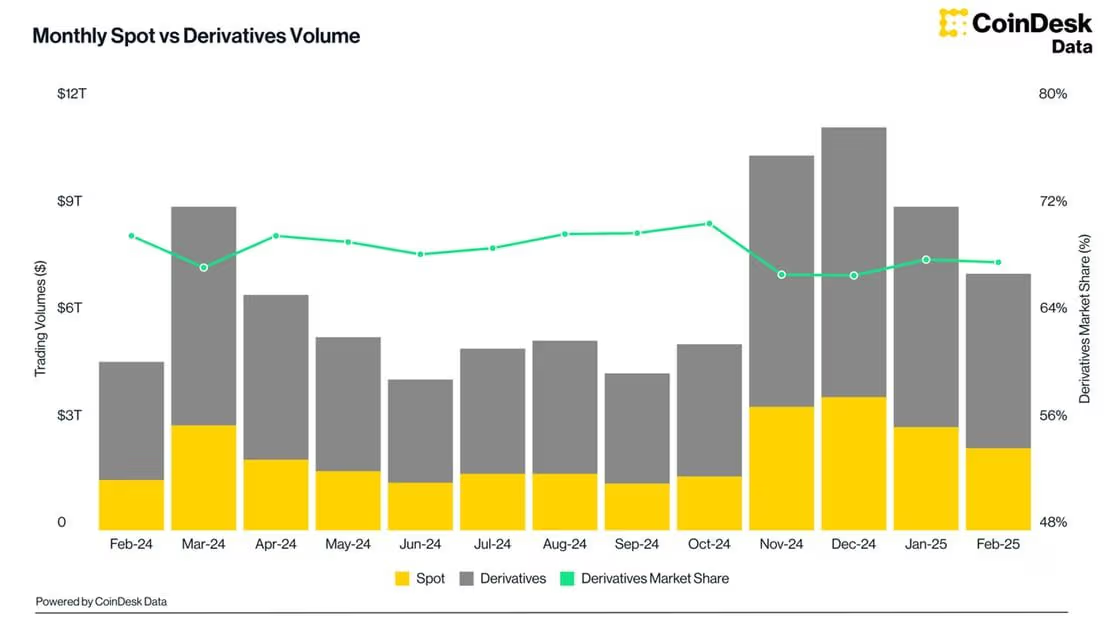

Spot and derivatives trading volumes hit a four-month low as macroeconomic factors weighed on investor sentiment.

Author: Francisco Rodriguez | Edited by: Sheldon Reback Updated: Mar 13, 2025 1:52 AM GMT Published: Mar 13, 2025 12:40 PM GMT

What you need to know:

- Trading volumes on centralized exchanges fell 21% last month to $7.2 trillion.

- Trading volumes on the CME fell for the first time in five months, even as its market share reached an all-time high.

- Open interest on centralized exchanges fell to its lowest level since November.

Cryptocurrency trading volumes fell sharply in February as concerns over President Donald Trump's tariffs on Mexico, Canada and other countries dampened investor appetite for riskier assets.

According to the latest report from CoinDesk Data, total spot and derivatives trading on centralized exchanges fell 21% to $7.2 trillion, the lowest level since October.

Since November, the Trump administration has threatened tariffs on trading partners, including China and the European Union, in response to what it sees as unfair trade practices against the United States in various sectors.

Among centralized exchanges, Binance continues to be the leading spot trading platform with a market share of 27%. It is followed by Crypto.com (8.1%) and Bybit (7.4%), while Coinbase (COIN) and MEXC Global round out the top five.

Derivatives trading also fell significantly, with CME, the largest institutional venue for cryptocurrency trading, recording its first decline in volume in five months. CME trading volume fell 20% to $229 billion, with Bitcoin futures activity down 20% to $175 billion and Ethereum futures activity down 13% to $35.9 billion.

The drop in trading volumes coincided with a decline in CME's annualized BTC rate, which fell to 4.08%, the lowest since March 2023. However, CME's market share among derivatives exchanges rose to a record 4.67%.

This increase indicates that

Источник