BTC Price Prediction: Bitcoin Whales Are Back In Action Buying BTC Price Rally

Bitcoin Whales Return With Renewed Vigor, Invest In BTC Rally, Blockchain Data Confirms

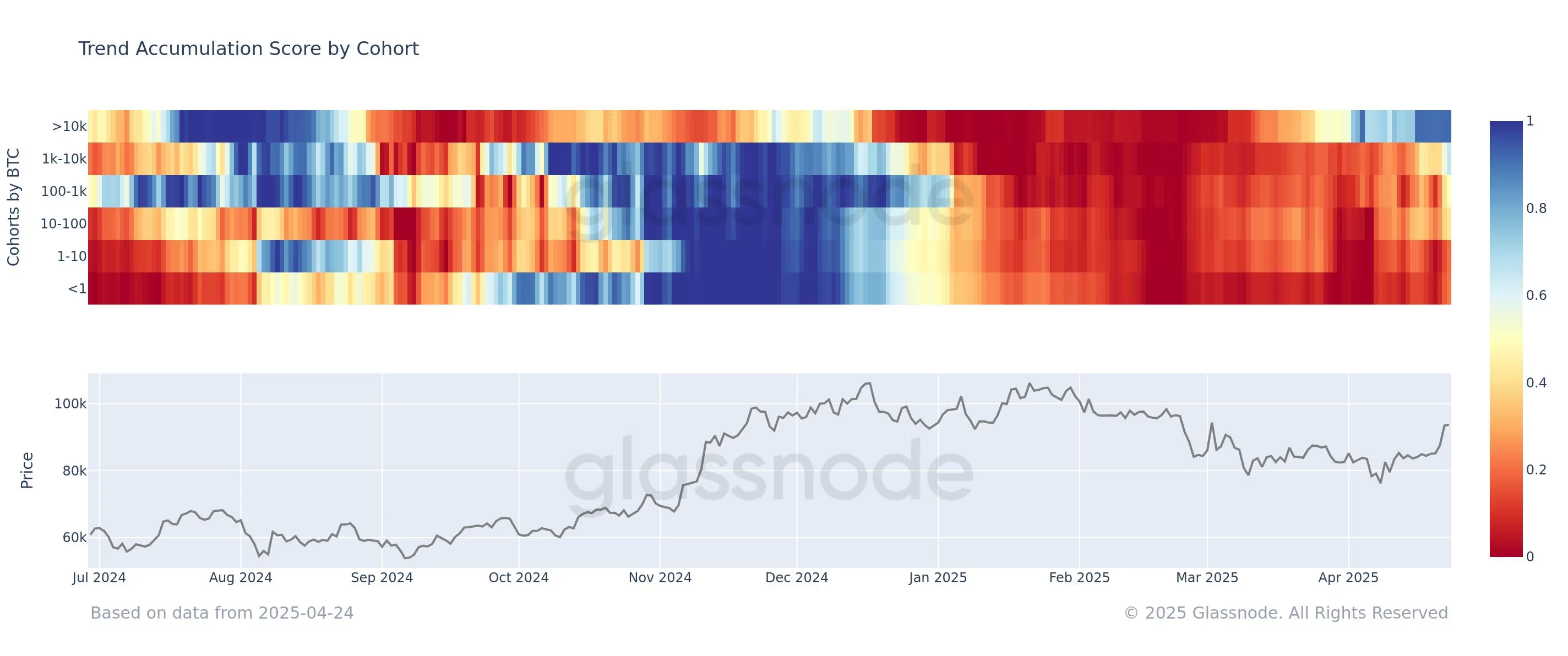

Data from Glassnode indicates active accumulation by holders of over 10,000 BTC.

Author: Omkar Godbole | Edited by: Sheldon Reback Updated: April 25, 2025 12:19 PM Published: April 25, 2025 9:30 AM

Key points:

- Glassnode data shows significant accumulation by entities holding more than 10,000 BTC.

- CryptoQuant data shows the largest outflow of BTC from exchanges in the last two years, indicating a preference for long-term storage.

The price of Bitcoin (BTC) has risen to $94,000 after falling below $75,000 earlier this month. The rise is due to the activity of crypto whales, large investors with significant capital who are actively buying up coins on the market, which is perceived as confirmation of the rally.

The return of whale interest is clearly visible in Glassnode’s unique accumulation scale, which shows the relative size of entities actively acquiring new coins on the chain. A value of 1 indicates general accumulation, while a value close to zero indicates the opposite.

As of Thursday, wallets holding more than 10,000 BTC had an accumulation score of 0.90, while those holding between 1,000 and 10,000 BTC had a score of 0.7. Smaller wallets have also started to accumulate, with a trend score of 0.5.

“The big players are actively buying into this rally at the moment,” noted Glassnode on the X platform.

At the same time, CryptoQuant data showed the highest BTC outflow from centralized exchanges in the last two years, which was analyzed using a 100-day moving average.

“Analysis of historical data suggests that this may indicate a re-accumulation of assets by investors,” CryptoQuant analysts note.

The outflow of funds from centralized exchanges is perceived as a reflection of investors' preference for directly storing their coins, indicating a long-term holding strategy.