BTC and ETH News: Bitcoin Falls Below $84K as Crypto Selloff Wipes Weekly Gains

Bitcoin falls below $84K after $115B selloff, erasing weekly gains

Ethereum to ETH hit its lowest price against Bitcoin in nearly five years as macroeconomic headwinds added pressure on risk assets.

Christian Sandor | Edited by Aoyon Ashraf , 28 Mar 2025 21:08 UTC

What you should know:

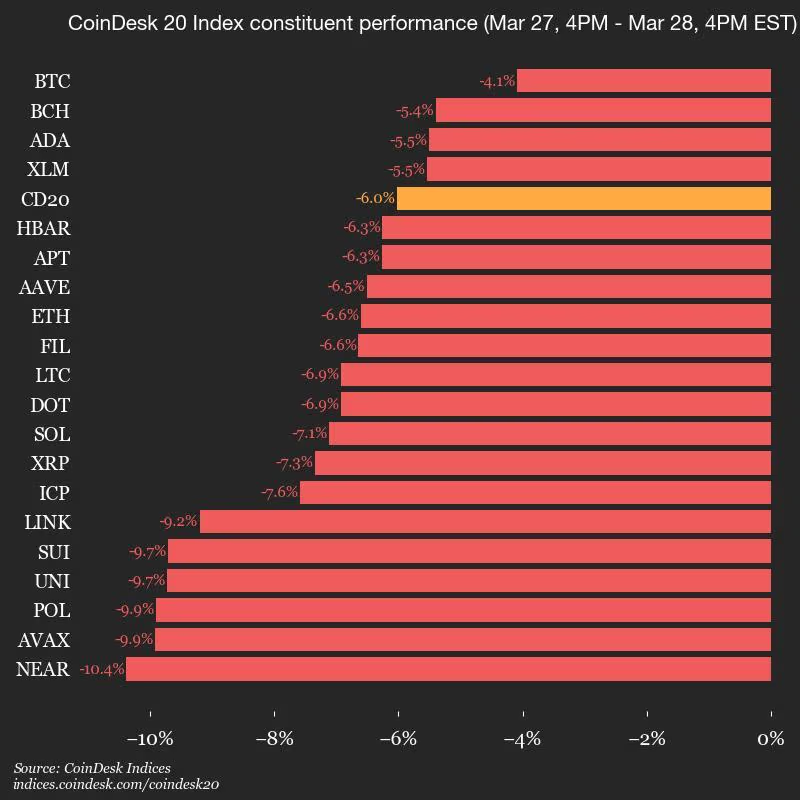

- The cryptocurrency market saw a sharp decline on Friday that erased the gains made earlier in the week. Bitcoin fell to $83,800 and the CoinDesk 20 Index fell 5.7%, with AVAX, NEAR, POL, UNI, and SUI the biggest losers.

- The fall in cryptocurrencies came as U.S. stocks sold off on unfavorable economic data, with crypto-related stocks also suffering significant losses.

- Bitcoin closed the gap on the CME on Monday with the current decline, but ongoing macroeconomic problems could have a negative impact on the entire crypto market.

Expectations for continued cryptocurrency gains were dashed on Friday as a sharp market collapse wiped out all of the gains made earlier this week.

Bitcoin (BTC), which was trading just below $88,000 the day before, recently fell to $83,800, down 3.8% in the last 24 hours. The CoinDesk 20 Index, a benchmark for the broader market, has fallen 5.7%, while cryptocurrencies like Avalanche (AVAX), Polygon (POL), Near (NEAR), and Uniswap (UNI) have all lost nearly 10% over the same period. Today’s selloff has wiped out $115 billion in total cryptocurrency market cap, according to TradingView data.

Ethereum (ETH) fell more than 6%, continuing its downward trend against BTC, falling to its lowest relative level against the largest cryptocurrency since May 2020. Underscoring the bearish trend, ETH spot ETFs have failed to attract net inflows since early March, while their BTC counterparts have received more than $1 billion in inflows over the past two weeks, according to data from Farside Investors.

The sharp move in cryptocurrency prices coincided with a sell-off in U.S. stocks during the day amid weak economic data, with the S&P 500 and tech-heavy Nasdaq falling 2% and 2.8%, respectively. Cryptocurrency-linked stocks also suffered

Источник