BTC, ADA, XRP Price News: Cardano and Ripple Fall as Bitcoin Traders Await Fed 'Coin Flip' Meeting

Cardano's ADA and XRP Drop Ahead of FOMC Meeting 'Coin Flip' Among Bitcoin Traders

Deficit tokens like Hyperliquid's HYPE have surged 70% over the past week, indicating that traders are focusing on fundamentals while capital allocators remain cautious in their investments.

Shaurya Malwa | Edited by Parikshit Mishra May 6, 2025 7:08 AM

Key points:

- Cardano's ADA and XRP have been the biggest losers among major cryptocurrencies as traders await the Federal Reserve's interest rate decision.

- Bitcoin prices remained above $94,000, while other cryptocurrencies such as Ethereum and Dogecoin declined slightly.

- Demand for DeFi tokens such as AAVE and CRV has increased, reflecting a shift in traders' interest towards projects with strong fundamentals.

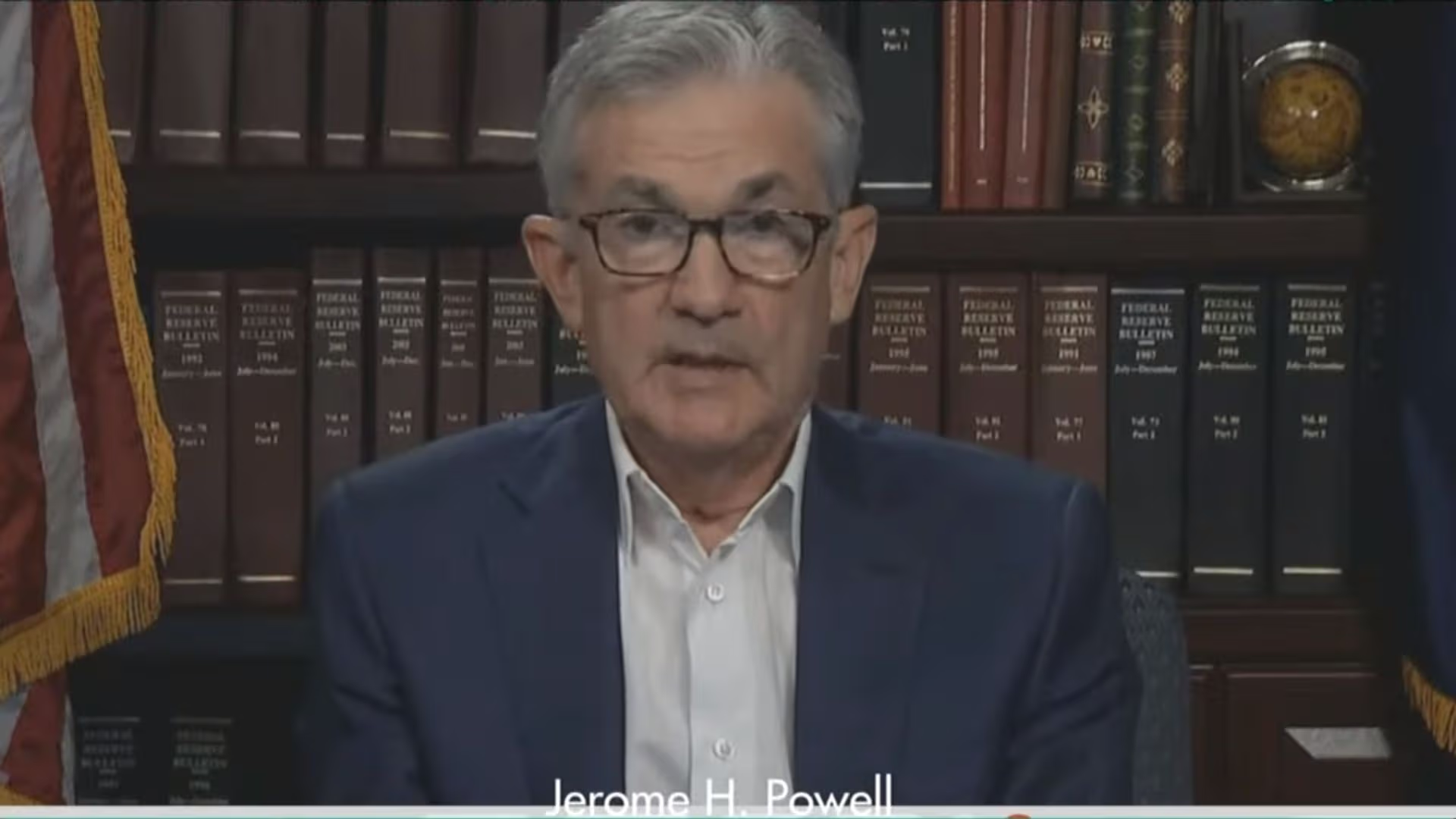

Cardano's ADA and XRP led the decline among major currencies on Tuesday as traders await the outcome of the upcoming Federal Reserve (FOMC) meeting, which is expected to leave rates unchanged, but comments from Fed Chairman Jerome Powell could provide clues about the market's direction.

Bitcoin (BTC) price is holding above $94,000 after briefly falling below that level on Sunday, continuing its recent range-bound trend.

ADA is down nearly 4%, while XRP is down about the same. Ether (ETH) is down nearly 1%, BNB BNB Chain is up 1.3%, and memecoin Dogecoin (DOGE) is down 2% in the last 24 hours.

The broad CoinDesk 20 Index (CD20), a liquid index tracking the largest tokens by market cap, was down just over 1.8%.

Elsewhere, some DeFi tokens like AAVE, Curve's CRV, and Hyperliquid's HYPE have seen a surge in demand over the past week, which some say indicates traders are becoming more interested in projects with utility and yield mechanisms.

“As memecoins lose popularity, traders are turning to projects with stronger fundamentals and token economics,” Kai Lu, CEO of HashKey Eco Labs, told CoinDesk in a Telegram message.

“DeFi ecosystems are benefiting from this change, especially as Bitcoin is showing reduced volatility and macroeconomic uncertainty remains. We expect the DeFi trend to continue as Bitcoin maintains reduced volatility and crypto acts as a hedge against economic uncertainty,” Lu added.

The top gainer among the top 100 tokens was HYPE, which increased by 72% over the past week, while AAVE and CRV rose by 40%.

Attention to Powell's comments

Traders in cryptocurrency and traditional finance markets are keeping a close eye on this week's FOMC interest rate decision, with consensus forecasts pointing to a pause in rate hikes.

Nevertheless

Источник