Bitcoin News: BTC Bulls, Don't Forget That Stock Bear Markets Often Involve Sharp Price Rallies

New Bull Run or Bear Market Rally? Only Time Will Tell

Wednesday's rally in stocks and cryptocurrencies could signal the start of a new bullish trend, or it could be just a short-lived blip in a prolonged decline.

Author: Omkar Godbole | Edited by: Sheldon Reback Updated: April 10, 2025, 5:07 PM Published: April 10, 2025, 9:16 AM

What you need to know:

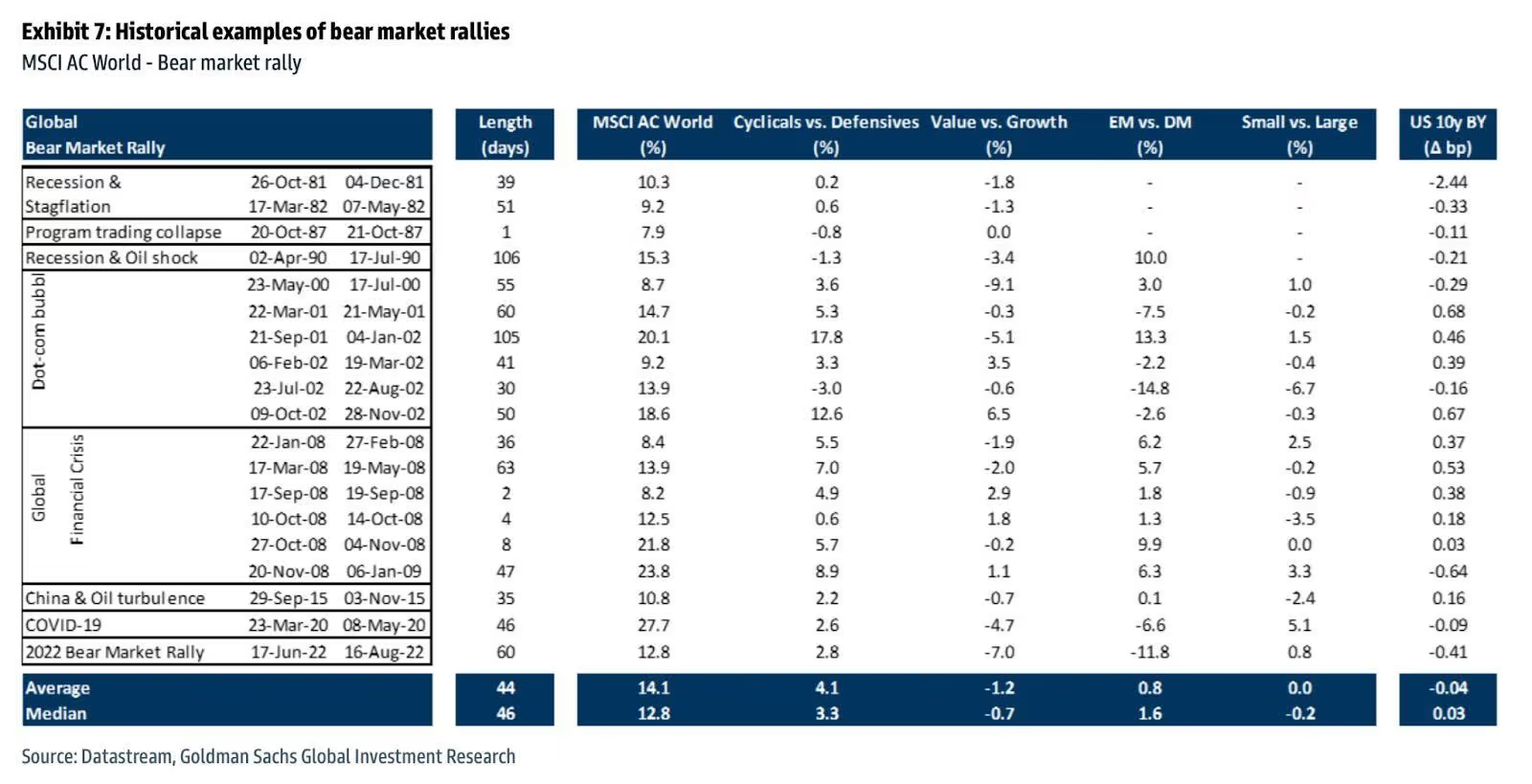

- According to research from Goldman Sachs and others, bear markets in stocks are often followed by multiple double-digit rallies.

- The data cautioned against over-optimism despite a rise in prices on Wednesday.

Don't be fooled by the dramatic turnaround in the market on Wednesday, when the S&P 500 stock index posted its biggest gain since 2008 and there was also a big rise in Bitcoin (BTC) and the broader crypto market, as reflected by the CoinDesk 20 Index (CD20).

The rally sparked by President Donald Trump’s announcement of a 90-day tariff suspension has fueled optimism on social media about a supposedly long bull run in both stocks and cryptocurrencies. But that may be over-optimism, according to analysts at Goldman Sachs and others, as multi-week double-digit stock price rallies are fairly common even during severe bear markets.

“In most bear markets, given the light positioning, even small changes in these variables can have a magnified impact on markets. Bear market rallies are therefore fairly common,” Goldman’s strategy team led by Peter Oppenheimer wrote in a note on Tuesday titled “Bear Market Anatomy – The Path and Shape of a Bear Market.”

Since the 1980s, there have been 19 bearish rally periods in the global market, and on average “they lasted 44 days, and the MSCI AC World Index recorded a yield of 10-15%,” the note says.

“One of the most severe bear markets in history saw about half a dozen major double-digit rallies before it all came to an end,” commented Callum Thomas, founder of

Источник