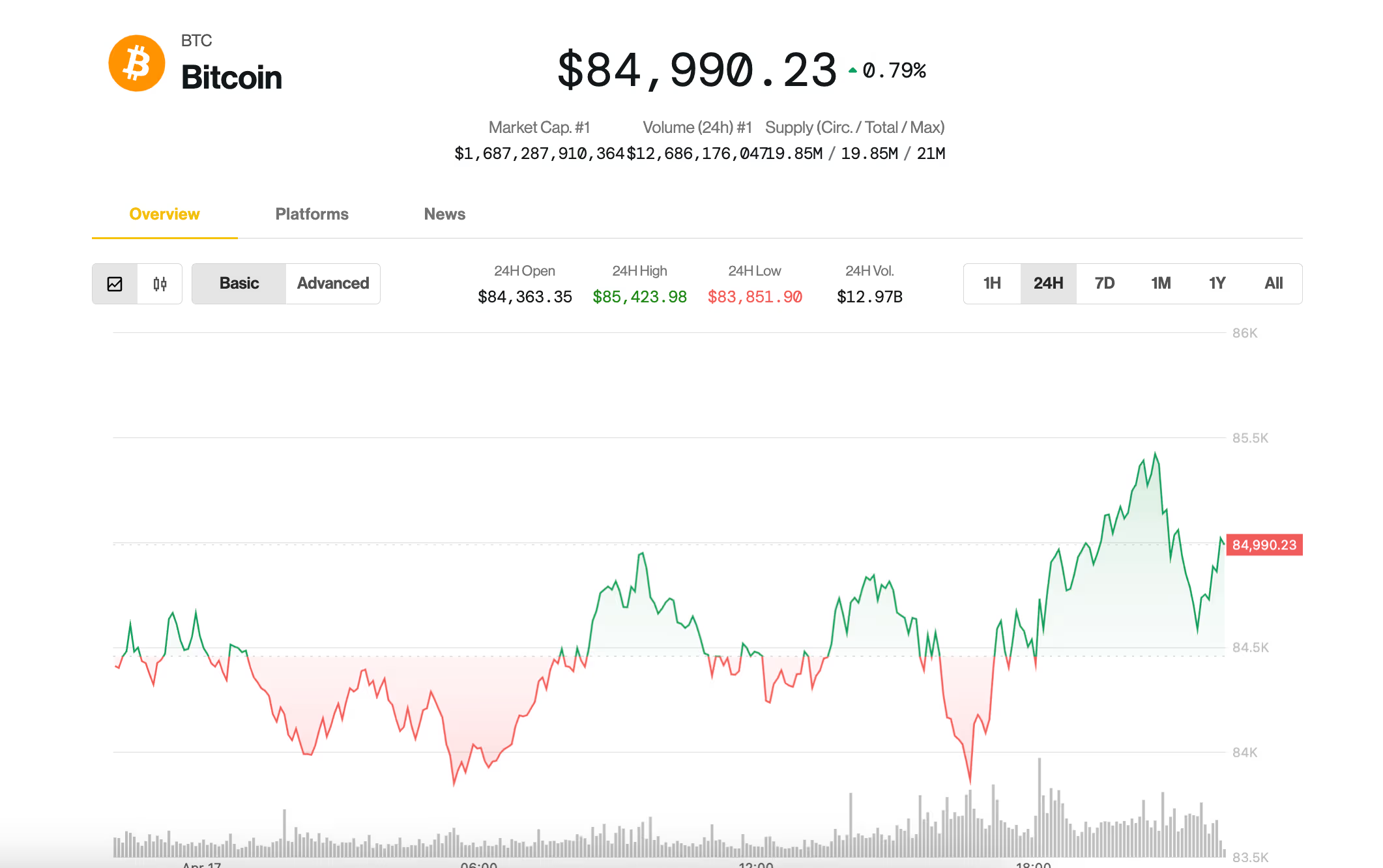

Bitcoin (BTC) Price Stuck at $85K as Trump Raises Pressure on Fed's Powell

Bitcoin Holds at $85K as Trump Raises Pressure on Fed's Powell

A sharp decline in the Philadelphia Fed's manufacturing index, coupled with rising prices, has fueled fears of stagflation in the U.S. amid the tariff war.

Christian Sandor, Helen Brown, Omkar Godbole | Edited by Stephen Alpher Updated April 18, 2025, 5:59 PM Published April 17, 2025, 8:37 PM

What you need to know:

- Bitcoin settled near $85,000 while the CoinDesk 20 Index rose thanks to gains in BCH, NEAR and AAVE.

- President Trump has reportedly privately raised the possibility of firing Powell, expressing concerns about market stability and the central bank's independence.

- According to Deribit, Bitcoin options traders are looking for bullish bets in the $90,000 to $100,000 range while also looking to hedge against a potential near-term downside.

Bitcoin (BTC) remained just below $85,000 on Thursday evening as heightened tensions between U.S. President Donald Trump and Federal Reserve Chairman Jerome Powell added uncertainty for investors.

Markets fell Wednesday after tough comments from Powell, who criticized Trump's tariff policies, arguing that they could lead to a slowing economy and higher prices — what economists call “stagflation.” In his comments, Powell made clear that he would now be more focused on prices, suggesting a tighter Fed policy than previously expected.

Trump, who nominated the former investment banker and lawyer to chair the Fed during his first term (President Biden gave Powell a second four-year term), has expressed dissatisfaction with Powell since returning to the White House. However, Powell, who is scheduled to remain at the central bank until May 2026, has repeatedly stressed his determination to complete his term and has argued that the president does not have the authority to fire him.

The WSJ reported Thursday that Trump had been privately discussing firing Powell for months, according to people familiar with the matter. Former Fed Chairman Kevin Warsh is reportedly considering being a candidate to replace Powell, but Warsh urged the president not to take action against the Fed chair, according to the report.

Warsh was joined in his warning by Treasury Secretary Scott Bessent, who noted that such a move could destabilize already fragile U.S. markets because the central bank must remain independent of political influence.

The odds that Trump will oust Powell this year on blockchain-based prediction market Polymarket have risen to 19%, the highest since the contract launched in late January.

Trump's comments came as the European Central Bank (ECB) cut its key interest rates for a seventh straight time on Thursday, warning of a worsening growth outlook.

Adding to the pressure on markets was the Philadelphia Fed's latest manufacturing index, released Thursday morning, which showed activity fell sharply this month, falling to its lowest level (-26.4) in two years. At the same time, the prices paid index rose to its highest since July 2022, fueling concerns that the Trump administration's sweeping tariff policies are pushing the U.S. economy into stagflation.

Источник