Bitcoin (BTC) Price Prediction: Gold Correction Could Drive BTC Higher

Gold continues its correction, which may have a positive impact on Bitcoin

ETF flows in the two assets were inversely correlated for four days last week.

Tom Carreras | Edited by Steven Alpher Updated May 2, 2025, 4:37 PM Published May 1, 2025, 7:52 PM

Key points:

- After rising sharply to record levels in recent months, gold has fallen nearly 10% in recent sessions.

- At the same time, Bitcoin also increased, approaching the $100,000 mark again.

- One analyst said Bitcoin is a more effective hedge than gold amid a shift in asset allocation strategies.

What could have been a sharp drop in gold prices last week clearly benefited Bitcoin (BTC), and this trend could continue.

Gold, already one of the world's best-performing assets in recent months, has reached new highs just weeks after President Trump imposed Emancipation Day tariffs in early April.

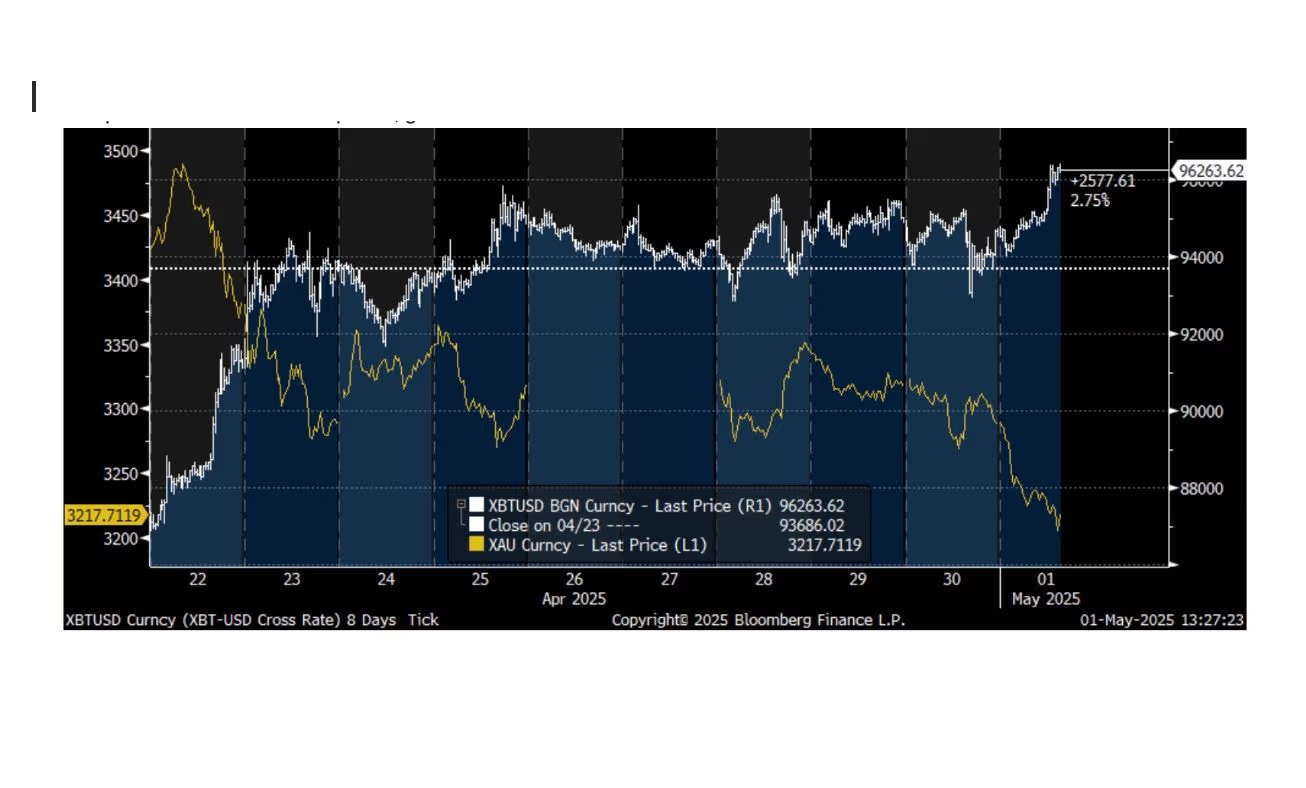

The price eventually topped $3,500 an ounce on April 21, while Bitcoin was trading at $87,000 — about the same as on Liberation Day, but about 20% below the record set in January.

Since then, however, gold has fallen nearly 10% to a current price of just over $3,200 an ounce. Meanwhile, Bitcoin has risen about 10% to a two-month high of $97,000.

“I believe Bitcoin represents a better hedge against strategic asset reallocation from the US than gold,” said Jeff Kendrick of Standard Chartered.

Kendrick pointed out that the flow of funds into ETFs has changed in line with price, with the amount of money flowing into bitcoin funds outpacing the amount of money flowing into gold funds.

Moreover, Kendrick added, the last time Bitcoin ETF inflows had such a significant gap with gold was during the week of the U.S. presidential election. Two months later, Bitcoin’s price had risen more than 40% to over $100,000.