Bitcoin and Ethereum News: BTC Options Turn Bullish After Powell's Temporary Inflation Remarks, ETH Still Lagging on Sentiment

Bitcoin Options Show Optimism After Powell's Temporary Inflation Comments, While Ethereum Still Falls Short of That Sentiment

On Wednesday, the Fed left its forecast for two rate cuts, and Powell characterized the inflationary impact of Trump's tariffs as temporary.

Posted by: Omkar Godbole | Edited by: Parikshit Mishra Updated: March 20, 2025 17:09 UTC Published: March 20, 2025 07:18 UTC

What is important to know:

- The Bitcoin options market is once again showing bullish sentiment following the Federal Reserve meeting, indicating investor interest in betting on high-potential assets.

- On Wednesday, the Fed reiterated its forecast for two rate cuts, and Powell called the inflationary impact of Trump's tariffs temporary.

- Despite the positive developments, Ethereum options remain cautious, supporting the Fed's election sentiment, even with the upcoming Ethereum Pectra upgrade.

Bitcoin (BTC) market participants are considering topside option bets amid a bullish reversal in price expectations following the Federal Reserve (Fed) meeting, while Ethereum (ETH) continues to lag behind the sentiment.

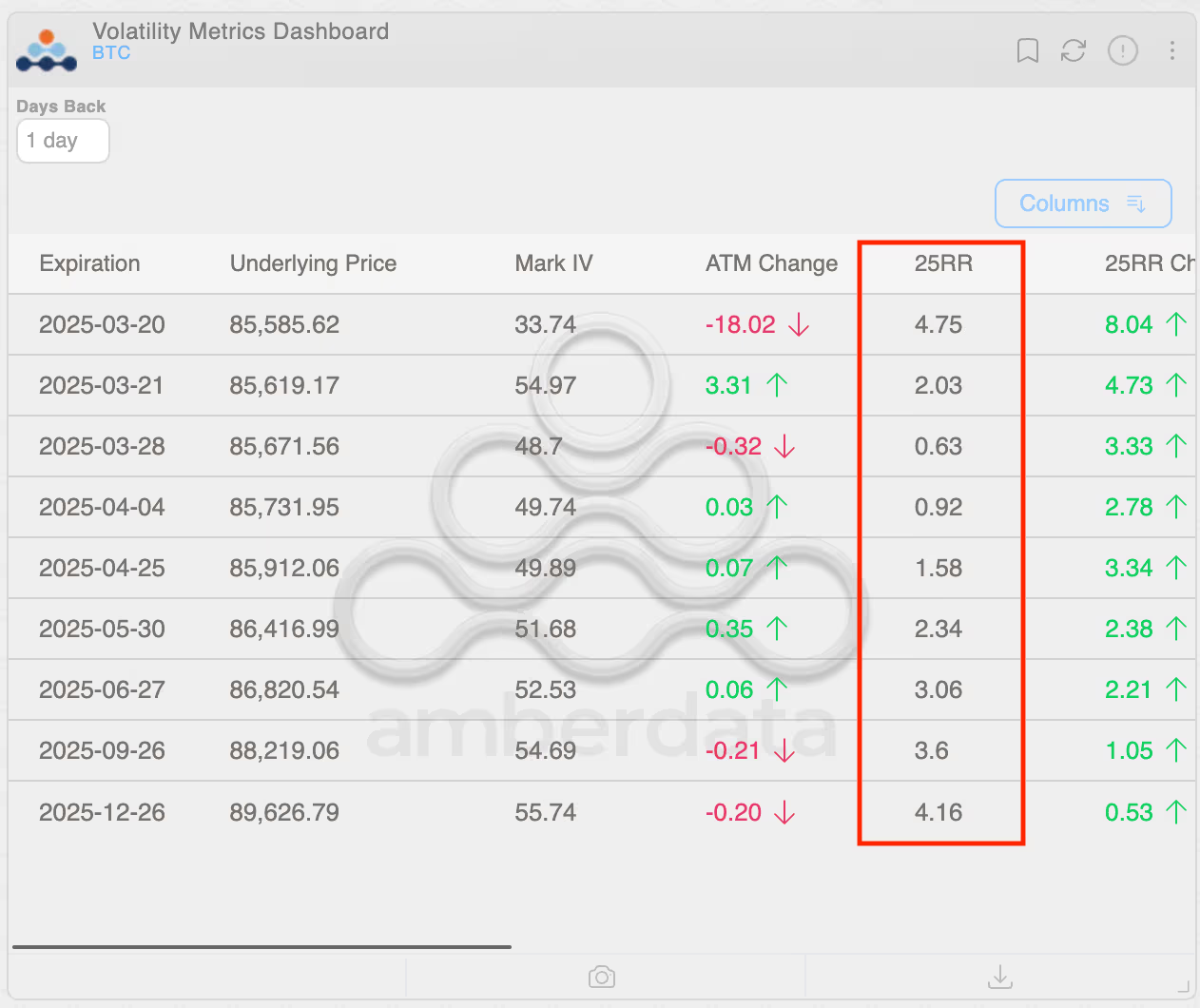

At the time of writing, BTC's short- and long-term risks, which measure the implied volatility premium (demand) for bullish bets or calls compared to puts, were positive, indicating investor appetite for higher prices for the leading cryptocurrency, according to Amberdata.

This marks a change from the bearish sentiment seen in the weeks leading up to the Fed meeting, when short and near-term put options were more expensive than call options, reflecting downside concerns.

“Frontend skew flipped calls. Flows included March 21st direct calls and bought calendars, while March 28th puts were sold,” Paradigm, an institutional-focused OTC tech platform, noted in a Telegram chat. Institutions and large traders execute block trades through OTC platforms like Paradigm, which are then listed on Deribit.

Options are derivative contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price in the future. A call option gives the right to buy, and a put option gives the right to sell.

Bullish shift in the short term and near term

Источник