Bitcoin is above $90,000. What will it take to reach new local highs?

Main:

-

At $84,000, 400,000 BTC changed hands, but spot demand at higher price levels remains low.

-

Liquidity signals are similar to the loss-dominated weakness seen in early 2022.

-

The increase in activity in futures is mainly due to short-covering rather than an increase in long positions.

Bitcoin (BTC) has returned above $90,000, but on-chain data suggests this upward momentum is fragile. Despite a strong price cluster, demand, liquidity, and activity in the futures market remain subdued.

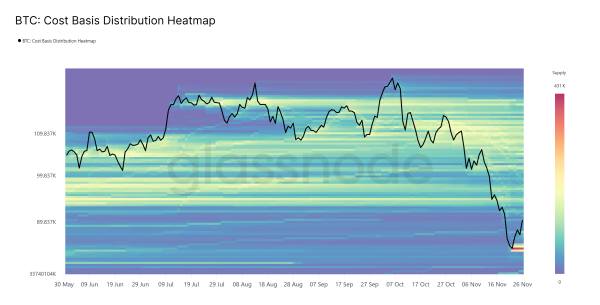

The rebound formed after reaching $84,000, where a dense value cluster was formed – transactions in the amount of 400,000 BTC took place.

Heat map of the distribution of the acquisition cost of the first cryptocurrency. Source: Glassnode.

Heat map of the distribution of the acquisition cost of the first cryptocurrency. Source: Glassnode.

Spot participation above the stated price is limited. Order flows remain small, and prices move in zones with minimal buyer presence.

To maintain the rate above $90,000, the dynamics must shift from passive accumulation to active, sustainable demand.

A healthier bullish structure requires more absorption of coins between $84,000 and $90,000, which has not yet been recorded at this point.

On the topic: Buyers regain control as Bitcoin rises above $91,000

Loss of confidence among short-term investors

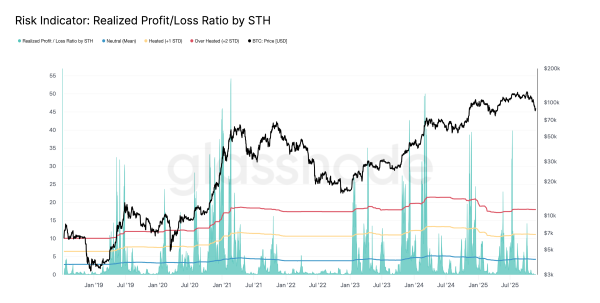

According to Glassnode, Bitcoin is trading below the speculators' “cost price” (STH) ($104,600), which is similar to a correction from the all-time high in Q1 2022.

The squeeze in the $81,000-$89,000 range, coupled with realized losses currently averaging $403 million per day, means investors are exiting the market rather than buying into the strengthening conditions.

The collapse of the STH profit/loss ratio to 0.07x confirmed that the demand momentum had “evaporated.”

STH profit-to-loss ratio. Source: Glassnode.

STH profit-to-loss ratio. Source: Glassnode.

A trend reversal requires a reduction in realized losses and a return to STH profitability above the neutral level. Without a liquidity reset, quotes will be at risk of drifting toward the True Market Mean metric near $81,000.

On the topic: Bitcoin at $87,000 – a buying opportunity or a dead cat bounce?

Futures markets need aggressive buying

The breakout to $91,000 was driven primarily by short-covering rather than long-covering. Open interest (OI) is declining, total volume delta remains unchanged, and short liquidation has led to moves to $84,000, $86,000, and $90,000.

Price, OI, and cumulative volume delta in digital gold. Source: Hyblock.

Price, OI, and cumulative volume delta in digital gold. Source: Hyblock.

Financing rates near neutral levels reflect a cautious situation in the derivatives market. Leverage is being reduced in an orderly manner, but the bulls are showing little confidence.

Thus, a change in trend will only become apparent after the OI is restored through purchases, as well as a stable transition of financing rates into the positive zone.

On the topic: Bitcoin is forming a bottom in the $84,000–$90,000 region — Glassnode

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net