K33 called the current Bitcoin price suitable for long-term purchases.

The leading cryptocurrency's 30% pullback from its highs offers an attractive long-term entry point as investor sentiment has shifted sharply, according to a report from K33 Research.

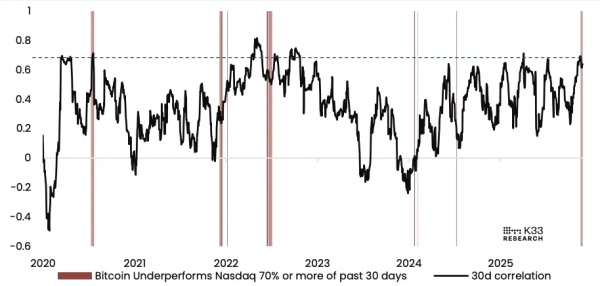

The company's head of research, Vetle Lunde, stated that Bitcoin has underperformed Nasdaq stocks in 70% of sessions over the past month. This has only been observed a few times since 2020.

Bitcoin is now about 30% weaker against the stock index than it was at the beginning of October.

BTC and Nasdaq correlation. Source: K33.

BTC and Nasdaq correlation. Source: K33.

According to Lunde, the last three notable periods of underperformance by the first cryptocurrency against the Nasdaq coincided with market shocks: the sell-off of Mt.Gox and the German government in July 2024, the significant outflow of Grayscale in January, and the “contagion effect” in June 2022.

However, the correlation between Bitcoin and the Nasdaq is now showing a different nature, the researcher added. The cryptocurrency is closely linked to stock movements, but experiences sharper declines during downturns and weaker rebounds during periods of growth. According to the analyst, this trend reflects persistent selling pressure in a generally risk-averse environment.

Lunde emphasized that today's Bitcoin market structure is significantly different from previous cycles, pointing to crypto initiatives by tier-one banks.

“The current relative price of digital gold relative to other risky assets diverges significantly from fundamentals, so we consider this position a profitable option for any long-term investor to buy at current rates,” the expert noted.

As a reminder, in November, the ratio of long to short positions for the leading cryptocurrency on Binance exceeded 3.8. This indicates traders' confidence in a Bitcoin rebound.

An expert named three signals for determining the bottom of the Bitcoin price.

Source: cryptonews.net