Bitcoin Open Interest Has Fallen – Why This Could Be a Bullish Signal

Bitcoin's open interest (OI) has declined amid its price decline over the past month. Crypto experts believe this could indicate the formation of a local low.

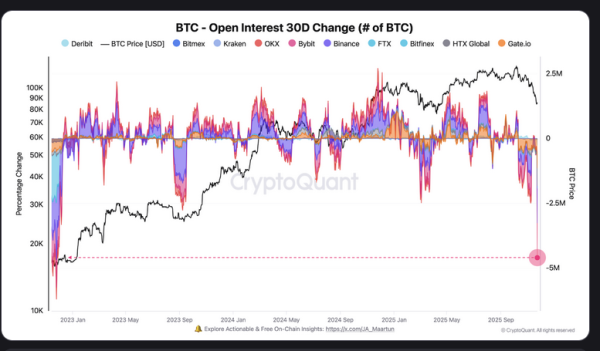

Over the course of 30 days, the indicator fell by approximately 1.3 million BTC (around $114 billion at the current exchange rate). CryptoQuant analyst Darkfost called this “the steepest monthly decline in the cycle.”

The Bitcoin (BTC) bearish trend “continues to trigger liquidations,” forcing traders to double down or adjust their strategies. Market participants are now also halting futures trading to hedge their exposure.

“Historically, these cleansing phases have often been necessary for a solid bottom to form and a subsequent rebound. Deleveraging, forced unwinding of overly optimistic positions, and a gradual reduction in speculative exposure help rebalance the market,” the expert added.

On the topic: Bitcoin's recorded losses have reached the level of the FTX crash – where is the bottom?

Change in OI to Bitcoin over the past 30 days. Source: CryptoQuant.

Change in OI to Bitcoin over the past 30 days. Source: CryptoQuant.

Darkfost also noted that the last time Bitcoin's OI fell so quickly in 30 days was “during the 2022 bear market,” which he said highlights how significant the current clearing is.

The bull market could return with a rise above $90,000.

Crypto analyst and MN Fund founder Michael van de Poppe stated that the coming week will be “decisive” for Bitcoin's price. Positive news will give the cryptocurrency a chance to reach a new all-time high in the near future.

The expert stated that if digital gold manages to firmly establish itself in the range between $90,000 and $96,000, “then the likelihood of reaching a new ATH will increase significantly.”

“Fear and panic have reached their highest levels in recent days. These are prime buying opportunities,” he concluded.

On the topic: the market needs to lose another 50% to establish a solid foundation – opinion

Source: cryptonews.net