Why January 15th Could Be Strategy's (MicroStrategy's) Funeral Day

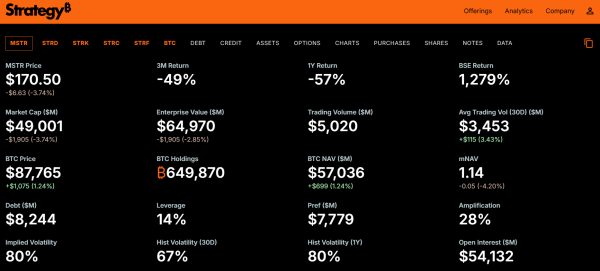

Strategy Inc. has disclosed data that casts doubt on its ability to survive the next quarter. It holds 649,870 bitcoins, representing 3.26% of the supply. The total amount spent on these coins reached $48.37 billion.

The scale of assets appears impressive, but the published data shows a serious gap between the company's capabilities and its current liabilities.

How to buy Bitcoin with a card: instructions

A financial structure that has stopped working

Strategy Inc. has $54 million in available cash but is obligated to pay $700 million in preferred stock dividends annually. The company's core business is enterprise software development, a segment that is unprofitable. Its cash flow is negative, so the company must raise $700 million annually to meet its dividend obligations.

In the first nine months of 2025, Strategy raised $19.5 billion. These funds were used not to purchase new Bitcoin, but to service debt accumulated from previous bond and equity issues. Maintaining operations requires continually raising new capital to cover existing liabilities.

Previously, the model worked thanks to the high share price. When securities traded at roughly double the balance sheet value of Bitcoin, issuing new shares increased the amount of Bitcoin per share held by existing investors. In the fall of 2025, this premium disappeared. Each new issue now dilutes shareholders' stakes, and the Bitcoin accumulation mechanism ceased to be effective.

Dividend burden growth and the risk of a Bitcoin sell-off

Preferred shares are increasing pressure. In the summer of 2025, the dividend rate was 9%; by November, it had risen to 10.5%. Every drop in the share price below $100 forces the rate to be raised to attract buyers. This pressure has no upper limit. The loss of confidence creates the risk that Strategy will have to sell bitcoin to meet its obligations, which completely undermines its own investment logic.

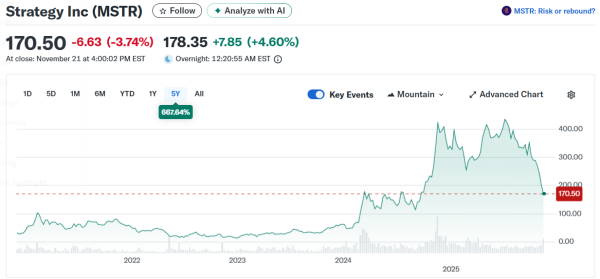

Strategy stock information. Source: finance.yahoo.

Strategy stock information. Source: finance.yahoo.

January 15, 2026

MSCI is one of the largest providers of stock indices. A large number of passive funds are required to mechanically follow the structure of these indices. Deleting a company from the index forces these funds to sell its shares automatically.

On January 15, 2026, MSCI will announce its decision on companies with more than 50% of their assets in digital currencies. Strategy holds approximately 77% of its assets in Bitcoin, so inclusion on the delist is virtually guaranteed. JPMorgan estimates the required divestment volume at $2.8 billion. Total capital outflows could reach $8.8 billion.

MSCI data for Strategy. Source: strategy.com

MSCI data for Strategy. Source: strategy.com

The market has already shown weak liquidity

On October 10, Bitcoin's 17% drop led to a sharp reduction in liquidity. Order book depth dropped by approximately 90%, and liquidations exceeded $19 billion in 14 hours. Strategy owns 3.26% of the entire Bitcoin supply. Selling even 100,000 coins under stress could cause a significant price drop due to a lack of sufficient liquidity.

False expectations and incorrect calculations

Strategy claims to have a dividend cover of approximately 71 years. This conclusion is based on the assumption that $1 billion in Bitcoin can be sold annually without affecting the price. The events of October 10th disproved this assumption. The market is unable to sustainably absorb such volumes during periods of high volatility.

Strategy's story demonstrates the clash between corporate logic and the nature of a long-lived asset. Corporations operate within short financial cycles with regular payouts and constant refinancing. Bitcoin requires a long holding horizon. Strategy's model proved unsustainable because it relied on constant capital inflows and high stock prices.

By March 2026, the market will make its final decision. Strategy could undergo downsizing and restructuring, or it could become an example of how the corporate model of holding large amounts of Bitcoin cannot withstand the pressure of regular financial obligations.

What's the bottom line?

Strategy Inc.'s model is collapsing due to a combination of high debt, the erosion of its share price premium, and the potential delisting from MSCI. These factors make the company's continued existence in its current form impossible.

The company relied on continuous capital inflows and high stock prices. With the disappearance of the premium, the Bitcoin accumulation mechanism has stalled. The risk of being delisted from MSCI is creating pressure from mechanical sell-offs by index funds. These processes are creating a situation in which Strategy faces insurmountable financial constraints.

Source: cryptonews.net