Opinion: A “crazy” wall of orders above $105,000 has been built against Bitcoin bulls.

Main:

-

The digital gold price is facing a huge overhang of sell orders above $105,000.

-

In the short term, a new wave down to $100,000 is possible due to the accumulation of bids at this level.

Bitcoin (BTC) prices continued to rebound from June lows on November 5 but found resistance near $105,000, according to Cointelegraph Markets Pro and TradingView.

BTC/USD Hourly Chart. Source: Cointelegraph/TradingView.

BTC/USD Hourly Chart. Source: Cointelegraph/TradingView.

On the topic: Why has Bitcoin broken through the key $100,000 support and is at risk of going lower?

Liquidity games

“Clearly, the price was held back by a cluster of sell orders above $105,000,” commented a trader under the nickname Skew.

The expert called the situation “unsurprising”—he noted signs of increased bearish pressure as prices attempted to recover.

“This tactic is often used to drive down prices during Asian hours,” he added.

5-minute chart of BTC/USDT with Binance order book data. Source: Skew.

5-minute chart of BTC/USDT with Binance order book data. Source: Skew.

According to Material Indicators, the essence of such actions comes down to pushing quotes into the range of $93,000 to $98,000.

“If the price reaches $105,000, some, if not all, of these orders will be cancelled. Before you panic and sell, remember that we have a rebound from the 50-week simple moving average. If it holds, it will have macroeconomic implications for the bulls,” the experts outlined the scenario.

BTC/USDT order book data. Source: Material Indicators.

BTC/USDT order book data. Source: Material Indicators.

On the topic: K33 Research estimated the average Bitcoin purchase price among BTC-ETF holders.

Is a new wave of decline ahead?

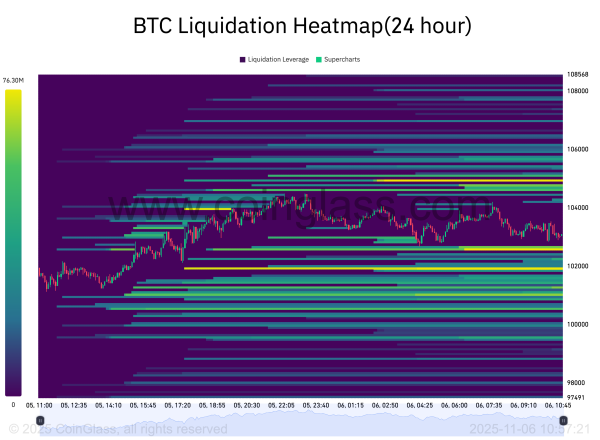

Bitcoin veteran Kyle Chasse saw potential for another price drop due to the concentration of order book liquidity below current levels, citing data from CoinGlass.

“Trust can disappear in the blink of an eye,” he warned.

Bitcoin liquidation heat map. Source: CoinGlass.

Bitcoin liquidation heat map. Source: CoinGlass.

On the topic: Wintermute names factors driving cryptocurrency market recovery

This article does not contain investment advice or recommendations. Every investment and trading decision involves risk, and readers should conduct their own research before making decisions.

Source: cryptonews.net