'Bitcoin smells trouble' as banks stress and 'yields fall' – Strike CEO

Despite strengthening financial positions following the 2023 banking crisis, several regional banks in the US have again encountered difficulties, and Bitcoin could benefit from any subsequent liquidity crisis.

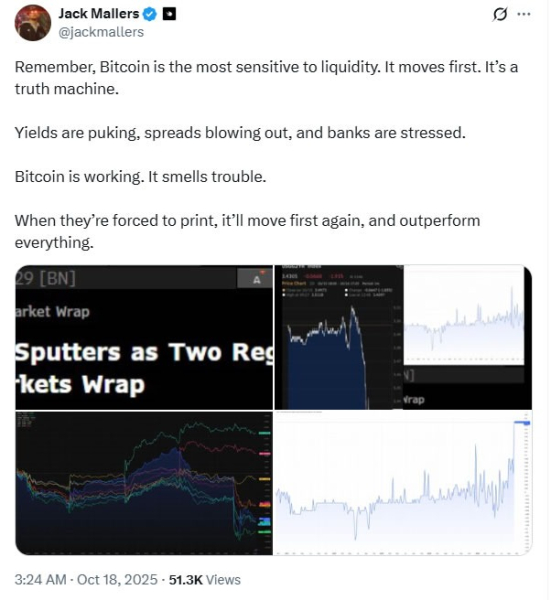

Strike CEO Jack Mallers believes the banking crisis confirms Bitcoin (BTC) is correctly assessing the looming liquidity crisis. He believes the Federal Reserve's inevitable response will lead to a rise in BTC prices.

“Bitcoin clearly smells trouble,” he said on the social media site Primal on Friday.

“The US is going to have to inject some of that sweet, sweet liquidity and print a ton of money soon, or their fiat empire will come to an end.”

Moving on to X, he said, “Bitcoin is the most liquidity-sensitive. It moves first. It's a truth machine.”

“Yields are falling, spreads are widening, banks are stressed. Bitcoin is working. Trouble is brewing. When they're forced to print money, it will rise again and outperform all other assets.”

Source: Jack Mallers

Source: Jack Mallers

The US banking crisis is worsening.

The crisis in regional banks that erupted in March 2023 was never truly resolved – it was simply masked by government subsidies and takeovers.

However, this created a moral hazard problem, as banks took excessive risks knowing that the government would back their deposits beyond Federal Deposit Insurance Corporation (FDIC) limits.

Wall Street is growing concerned about the health of the country's regional banks after the write-off of problematic commercial loans, the Associated Press reported Friday.

Shares of Zions Bank and Western Alliance plunged this week on credit problems, raising concerns in the broader market that confidence in regional banks has not been fully restored beyond 2023.

The US banking system remains vulnerable because it relies on implicit government guarantees rather than sound financial practices, Kobeissi said in the letter.

Bitcoin fell to a 4-month low

Whatever benefits this banking crisis may bring to Bitcoin are not yet clear.

On Friday, the asset's value fell to a four-month low of $103,850, losing more than $5,000 in a matter of hours.

It recovered to $107,000 in Asia on Saturday morning, but is still more than 15% off its all-time high.

“BTC is on sale. If problems in US regional banks escalate into a crisis, be prepared for a bailout like in 2023. Then go buy if you have the cash,” said BitMEX co-founder Arthur Hayes.

Source: cryptonews.net