Bitcoin ETFs Lose $1.2 Billion in a Week, But Schwab Analysts Remain Bullish

US spot Bitcoin ETFs saw weekly outflows of more than $1.2 billion, but Charles Schwab notes growing interest in the financial products.

On October 17, eleven exchange-traded funds withdrew a combined $366.6 million, ending a “red week” for the asset and related institutional vehicles.

According to SoSoValue, the largest outflow came from BlackRock's iShares Bitcoin Trust, at $268.6 million. Fidelity's product lost $67.2 million, Grayscale's GBTC lost $25 million, and a small amount was withdrawn from the Valkyrie ETF. The assets of the other funds remained unchanged on October 17.

Another bad day for ETFs pushed the weekly total to -$1.22 billion. The only exception was October 14, when funds saw a small inflow.

The outflow came as the price of Bitcoin (BTC) fell more than $10,000, from just above $115,000 at the start of the week to a four-month low below $104,000 on October 17.

Spot Bitcoin ETFs ended the week in the red. Source: SoSoValue.

Spot Bitcoin ETFs ended the week in the red. Source: SoSoValue.

Schwab sees strong interest

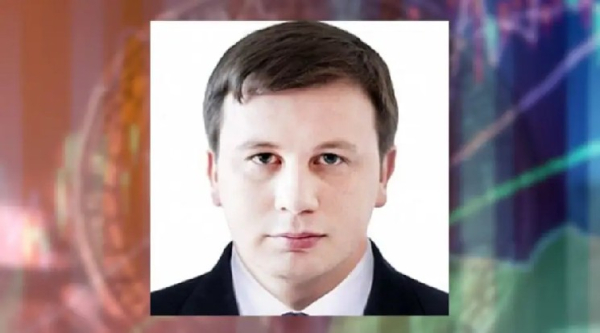

Charles Schwab CEO Rick Wurster remains optimistic about cryptocurrency exchange-traded funds (ETPs). He claims the company's clients own 20% of all such instruments in the US.

“Crypto ETPs are seeing a lot of activity,” he said on CNBC.

The top manager added that traffic to the company's cryptocurrency-focused website has grown by 90% over the past year:

“This is a high-engagement topic.”

On the topic: the shutdown did not stop the list of applications for the launch of crypto ETFs from growing.

ETF expert Nate Geraci pointed out that Charles Schwab operates one of the largest brokerage platforms in the US.

“I hope you're keeping an eye on this,” he said.

The company already offers clients exchange-traded funds and Bitcoin futures, and plans to launch spot trading of digital assets in 2026.

Schwab CEO Rick Wurster discusses crypto ETFs. Source: Nate Geraci.

Schwab CEO Rick Wurster discusses crypto ETFs. Source: Nate Geraci.

A Red October for Bitcoin

The leading cryptocurrency has shown growth in ten of the last twelve Octobers, but this month the trend was interrupted – the asset fell by 6%, according to CoinGlass.

However, analysts expect the so-called Uptober to have more to show for itself: historically, the bulk of growth has occurred in the second half of the month, and a possible Fed rate cut could become “fuel” for the rally.

Source: cryptonews.net