Glassnode analysts have assessed the Bitcoin price outlook for the near future.

Bitcoin's breakout above $126,000 points to a strong but still emerging uptrend that is becoming susceptible to profit-taking and liquidations, according to Glassnode experts.

Bitcoin's breakout above $126,000 points to a strong but still emerging uptrend that is becoming susceptible to profit-taking and liquidations, according to Glassnode experts.

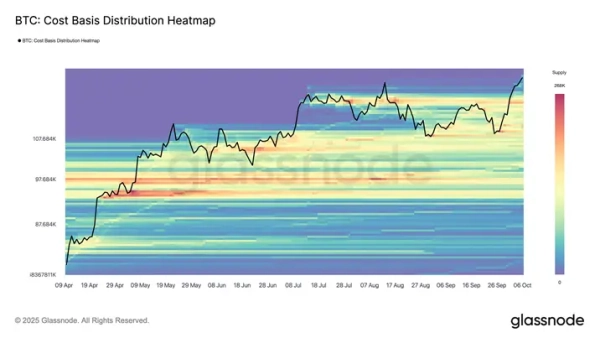

According to analysts, 97% of Bitcoin's supply has flipped, which often signals subsequent consolidation. Realized gains remain limited, suggesting an orderly rotation rather than a distribution of coins.

“Short-term volatility may remain elevated as markets digest the returned optimism,” the experts explained.

The current situation for Bitcoin looks positive, amid rising spot trading volumes, record inflows into spot exchange-traded funds (ETFs), and rising open interest in futures and funding costs for perpetual contracts.

Volatility in the options market has increased, indicating increased market activity and growing expectations for a near-term upward price movement in Bitcoin. Against this backdrop, most investors remain confident in the bullish trend, analysts noted.

An additional factor supporting positive expectations is the overall macroeconomic environment. If inflows into spot Bitcoin ETFs continue to grow and spot demand remains robust, the market could enter a phase of sustained upward momentum, punctuated by periods of short-term correction and consolidation, Glassnode concluded.

Earlier, Vetle Lunde, head of research at K33 Research, stated that the historical patterns that determine Bitcoin's price dynamics are no longer relevant.

Source: cryptonews.net