Bitcoin Retreats From Record $125,000: Where's the Bottom?

Bitcoin reached a new all-time high above $125,000, but then corrected by more than $2,000. Traders are now wondering where the price of the leading cryptocurrency will bottom.

BTC/USD 1-day chart. Source: Bitstamp

BTC/USD 1-day chart. Source: Bitstamp

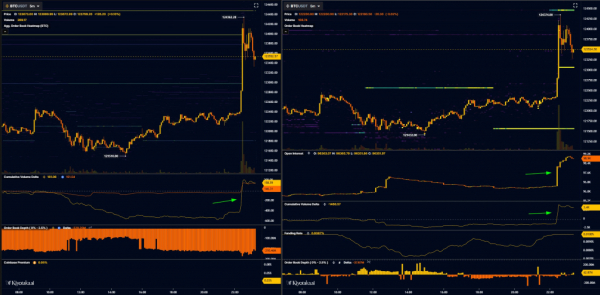

Fresh volatility gripped Bitcoin ahead of Sunday's weekly close. The BTC/USD pair retreated below $123,000 after reaching a new record above $125,000 earlier in the day. The rally was fueled by derivatives markets, which saw unusual activity over the weekend.

Correction by 4% is within normal limits

A trader nicknamed Skew warned that the entire upward momentum could be a “bait” for long positions. “Passive shorts are multiplying here,” he noted on the social network X. “Shorts are being entered on the consensus that the weekend rally is a trap.”

BTC/USD 5-minute chart. Analysis: Skew

BTC/USD 5-minute chart. Analysis: Skew

Trader CrypNuevo is keeping an eye on the 4-hour exponential moving average (EMA), which is currently just above $118,000. “I think we may see a retest of the 4-hour 50EMA next week—the price is overbought, and you can see retests of previous similar moves,” he wrote on social media. “After that, a new upward momentum should begin. Therefore, I still prefer longs to shorts from the 4-hour 50EMA.”

BTC/USD 1-Day Chart. Analysis: CrypNuevo

BTC/USD 1-Day Chart. Analysis: CrypNuevo

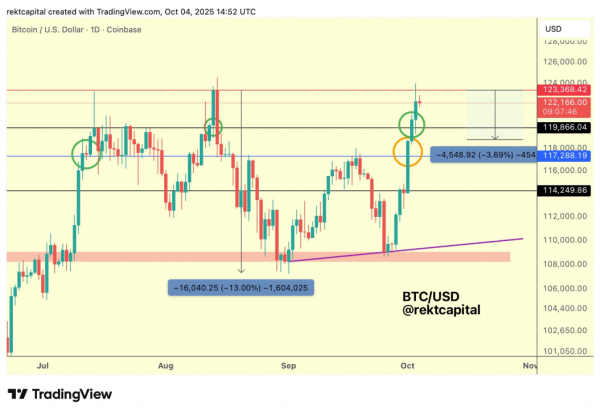

Rekt Capital analyst also relies on historical analogies to forecast BTC's future performance. He believes it may take time to confidently break above $124,000. “It's not surprising that Bitcoin bounced from ~$124,000 on its first attempt at this uptrend. After all, the last time Bitcoin pulled back from $124,000, it was followed by a 13% correction,” he reasons. “Bitcoin needs to prove that the $124,000 resistance has weakened. And any smaller drawdown or pullback here will demonstrate just that.”

BTC/USD 1-Day Chart. Analysis by Rekt Capital

BTC/USD 1-Day Chart. Analysis by Rekt Capital

Rekt Capital added that BTC/USD could fall by 4% and still maintain its weekly uptrend.

Institutions support demand

Meanwhile, bulls are taking note of the presence of institutional investors. Caleb Franzen, founder of the analytical resource Cubic Analytics, stated that the lack of significant pullbacks so far demonstrates solid demand. “When I see short-term dynamics like this, with minimal pullbacks and big spikes followed by sustained bids, I see institutional interest,” he wrote on social media.

Institutional interest is also confirmed by the numbers: Bitcoin ETFs recorded their second-best performance ever, with capital inflows totaling $3.2 billion in a single week. October, dubbed “Uptober” by investors due to the cryptocurrency's historically strong performance that month, started off with a strong momentum.

The technical picture and massive institutional interest indicate that the current correction is merely a pause before a new round of growth. It remains to be seen how deep the pullback will be.

Source: cryptonews.net